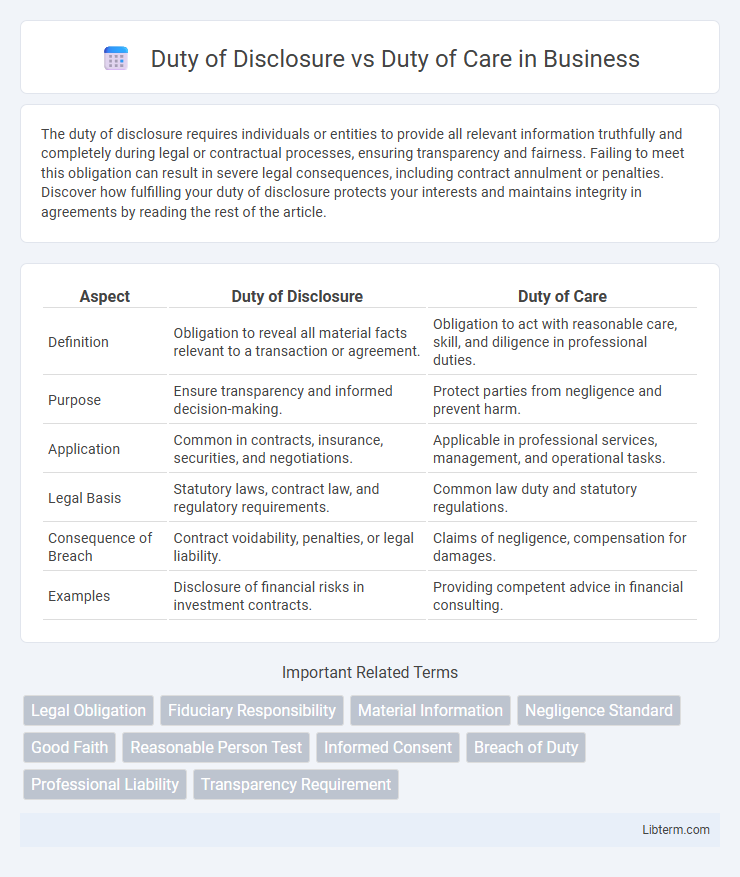

The duty of disclosure requires individuals or entities to provide all relevant information truthfully and completely during legal or contractual processes, ensuring transparency and fairness. Failing to meet this obligation can result in severe legal consequences, including contract annulment or penalties. Discover how fulfilling your duty of disclosure protects your interests and maintains integrity in agreements by reading the rest of the article.

Table of Comparison

| Aspect | Duty of Disclosure | Duty of Care |

|---|---|---|

| Definition | Obligation to reveal all material facts relevant to a transaction or agreement. | Obligation to act with reasonable care, skill, and diligence in professional duties. |

| Purpose | Ensure transparency and informed decision-making. | Protect parties from negligence and prevent harm. |

| Application | Common in contracts, insurance, securities, and negotiations. | Applicable in professional services, management, and operational tasks. |

| Legal Basis | Statutory laws, contract law, and regulatory requirements. | Common law duty and statutory regulations. |

| Consequence of Breach | Contract voidability, penalties, or legal liability. | Claims of negligence, compensation for damages. |

| Examples | Disclosure of financial risks in investment contracts. | Providing competent advice in financial consulting. |

Understanding Duty of Disclosure

Duty of Disclosure requires parties to provide all material information relevant to a contract or agreement, ensuring transparency and preventing misleading omissions. This duty is crucial in insurance contracts, where the insured must reveal risks or facts that could influence the insurer's decision. Understanding Duty of Disclosure helps identify the boundaries of legal obligations and protects parties from claims of fraud or misrepresentation.

Defining Duty of Care

Duty of Care refers to the legal obligation to act with a standard of reasonable care while performing any acts that could foreseeably harm others, primarily in professional and contractual contexts. It requires individuals or entities to anticipate potential risks and take appropriate precautions to prevent injury or loss. This contrasts with Duty of Disclosure, which mandates the sharing of all relevant information during contractual negotiations or fiduciary relationships.

Key Differences Between Duty of Disclosure and Duty of Care

Duty of Disclosure requires parties in a contractual or insurance context to reveal all material facts that could influence decision-making, ensuring transparency and preventing fraud. Duty of Care involves the obligation to act with reasonable caution and prudence to avoid causing harm or loss to others, primarily in tort law and professional settings. Key differences include Duty of Disclosure's emphasis on information sharing before contract formation versus Duty of Care's focus on behavior and actions to prevent damage during the contract or professional engagement.

Legal Foundations of Duty of Disclosure

The legal foundations of the Duty of Disclosure primarily stem from contract law and insurance law, requiring parties to reveal all material facts that could influence the other party's decision-making. This duty is enforceable to prevent misrepresentation and ensure fairness, particularly in insurance contracts where nondisclosure can void coverage. Courts interpret the scope of this duty based on statutory regulations and case precedents emphasizing transparency and good faith in contractual relationships.

Legal Foundations of Duty of Care

The legal foundations of Duty of Care are primarily established through common law principles, particularly in negligence cases where individuals must act reasonably to avoid foreseeable harm to others. Landmark cases such as Donoghue v Stevenson (1932) have shaped the standard, insisting that a person owes a duty to those who could be directly affected by their actions. Unlike the Duty of Disclosure, which is rooted in contract and regulatory law requiring full transparency, the Duty of Care centers on preventing harm through prudent and responsible behavior.

Importance in Professional and Commercial Contexts

Duty of Disclosure requires professionals and businesses to provide all relevant information honestly and transparently, ensuring informed decisions in contracts and negotiations. Duty of Care mandates that individuals and companies act with a reasonable level of competence and diligence to prevent harm or loss, protecting stakeholders and maintaining trust. Both duties are fundamental in upholding ethical standards, minimizing legal risks, and fostering accountability in professional and commercial environments.

Consequences of Breaching Duty of Disclosure

Breaching the Duty of Disclosure can lead to void or voidable contracts, financial penalties, and legal disputes, impacting the claimant's ability to enforce agreements. Insurers may deny claims or reduce payouts if material information is withheld or misrepresented, causing significant economic loss. Courts often scrutinize nondisclosure cases, potentially awarding damages or rescinding contracts to protect affected parties.

Consequences of Breaching Duty of Care

Breaching the Duty of Care can result in legal liabilities such as negligence claims, financial damages, and reputational harm for professionals and organizations. Failure to uphold this duty often leads to compensation payouts, regulatory penalties, and loss of client trust. Courts assess the extent of the breach based on the harm caused and the standard of care expected in the relevant industry.

Case Law Comparing Duty of Disclosure vs Duty of Care

Case law differentiates Duty of Disclosure as an obligation to reveal all material facts relevant to a contract or transaction, exemplified by *Derry v Peek* (1889) emphasizing no fraudulent misrepresentation, from Duty of Care which requires individuals to exercise reasonable caution to avoid foreseeable harm, as established in *Donoghue v Stevenson* (1932). Courts analyze Duty of Disclosure under contract and insurance law contexts, focusing on full transparency, while Duty of Care is central to tort law, mandating prudent behavior to prevent negligence claims. Comparative judgments illustrate Duty of Disclosure's preventive role in contractual fairness, opposed to Duty of Care's protective function in personal safety and liability.

Best Practices for Complying with Both Duties

Maintaining transparency by promptly sharing all material information fulfills the Duty of Disclosure, while conducting thorough evaluations and prudent decision-making aligns with the Duty of Care. Implementing standardized protocols for information sharing and risk assessment ensures compliance with both duties, minimizing legal exposure and enhancing stakeholder trust. Regular training on disclosure obligations and careful review processes further embed these best practices in organizational culture.

Duty of Disclosure Infographic

libterm.com

libterm.com