Preferred stock offers investors fixed dividends and priority over common stockholders during company liquidations, making it a more secure investment option. It blends characteristics of both equity and debt, providing steady income without relinquishing voting rights typically associated with common stock. Explore the rest of the article to understand how preferred stock can fit into your investment portfolio and the risks involved.

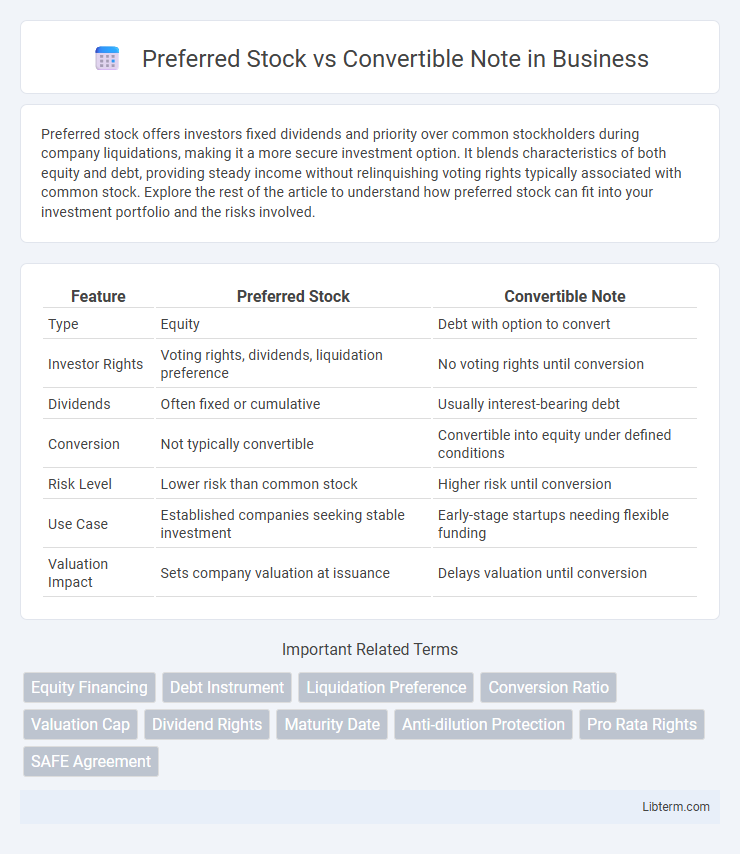

Table of Comparison

| Feature | Preferred Stock | Convertible Note |

|---|---|---|

| Type | Equity | Debt with option to convert |

| Investor Rights | Voting rights, dividends, liquidation preference | No voting rights until conversion |

| Dividends | Often fixed or cumulative | Usually interest-bearing debt |

| Conversion | Not typically convertible | Convertible into equity under defined conditions |

| Risk Level | Lower risk than common stock | Higher risk until conversion |

| Use Case | Established companies seeking stable investment | Early-stage startups needing flexible funding |

| Valuation Impact | Sets company valuation at issuance | Delays valuation until conversion |

Introduction to Preferred Stock and Convertible Notes

Preferred stock represents equity ownership with priority over common stock in dividends and asset liquidation, often featuring fixed dividend payments and voting rights. Convertible notes are debt instruments that convert into equity, typically common stock, upon specified events like a funding round, combining elements of debt and equity financing. Both are crucial in startup financing, with preferred stock offering investor protections and convertible notes providing flexible, temporary funding solutions.

Key Differences Between Preferred Stock and Convertible Notes

Preferred stock represents an equity investment with voting rights and fixed dividends, providing shareholders priority over common stockholders in asset liquidation. Convertible notes are debt instruments that accrue interest and convert into equity at a future financing round, often at a discount or with valuation caps. The primary difference lies in ownership--preferred stock grants immediate equity, while convertible notes delay equity conversion until triggering events occur.

Structure and Features of Preferred Stock

Preferred stock features a fixed dividend, liquidation preference, and potential voting rights, providing investors with priority over common shareholders during dividend payments and asset distribution. Its structure includes various classes with differing rights, such as cumulative dividends and anti-dilution provisions, enhancing investor protection. Convertible notes lack these equity characteristics and instead function as debt instruments that may convert into equity under specific conditions.

Structure and Features of Convertible Notes

Convertible notes are structured as debt instruments that convert into equity at a later financing round, typically featuring a maturity date, interest rate, and conversion discount or valuation cap. Unlike preferred stock, convertible notes do not grant immediate ownership or voting rights but provide investors protection through debt seniority and potential equity upside. These notes streamline early-stage fundraising by delaying valuation negotiations and offering a flexible path to equity.

Pros and Cons of Preferred Stock

Preferred stock provides investors with fixed dividends and priority over common shareholders during liquidation, offering a more secure income stream and downside protection. However, it typically lacks the potential upside of common stock appreciation and may come with restrictive covenants limiting company control. Compared to convertible notes, preferred stock does not convert into equity easily, which can limit flexibility but ensures a stable claim on assets and earnings.

Advantages and Disadvantages of Convertible Notes

Convertible notes offer advantages such as deferred valuation, allowing startups to raise capital without immediate equity dilution and typically include a discount or valuation cap that benefits early investors. However, disadvantages include potential complications during conversion events, the risk of debt accumulation if notes do not convert, and uncertainty for founders regarding future ownership percentages. Investors may face ambiguity in valuation and timing of conversion, which can impact investment returns and negotiation leverage.

Investor Perspectives: Preferred Stock vs Convertible Notes

Preferred stock offers investors equity ownership with dividend preferences and liquidation priority, enhancing downside protection and potential upside through voting rights and fixed dividends. Convertible notes provide a debt instrument that converts to equity upon triggering events, allowing investors to delay valuation discussions and benefit from conversion discounts during future funding rounds. Investors often favor preferred stock for immediate equity participation and protective rights, while convertible notes are attractive for early-stage deals seeking flexible, lower-risk entry with potential equity upside.

Company Considerations: Choosing the Right Financing Option

When evaluating Preferred Stock versus Convertible Notes, companies must weigh factors such as control dilution, valuation clarity, and investor preferences. Preferred Stock provides immediate equity stakes with defined rights, which can attract long-term investors but may dilute founder control. Convertible Notes delay valuation until a future financing round, offering flexibility and faster funding but introduce potential uncertainty in ownership distribution and future investor negotiations.

Impact on Valuation and Dilution

Preferred stock often provides investors with liquidation preferences, dividends, and voting rights, which can significantly affect company valuation by increasing investor confidence and perceived value. Convertible notes initially act as debt but convert into equity at a discount or valuation cap during a future financing round, potentially leading to unexpected dilution for founders if the company's valuation surpasses expectations. The timing and terms of conversion impact the dilution effect, with convertible notes generally causing less immediate dilution than issuing preferred stock but creating uncertainty around future equity stakes.

Which Is Best: Preferred Stock or Convertible Notes?

Preferred stock offers investors equity with preferential dividends and liquidation rights, making it attractive for those seeking stable returns and ownership influence. Convertible notes provide debt that can convert into equity at a later valuation, appealing to early-stage investors desiring flexibility and reduced risk upfront. The best choice depends on a startup's funding stage, investor risk tolerance, and the need for immediate capital versus growth potential.

Preferred Stock Infographic

libterm.com

libterm.com