A joint venture is a strategic partnership where two or more parties collaborate to achieve a specific business goal by sharing resources, risks, and profits. It allows companies to enter new markets, combine expertise, and increase competitive advantage without full mergers or acquisitions. Discover how forming a joint venture can transform your business strategy by exploring the key benefits and challenges in the rest of this article.

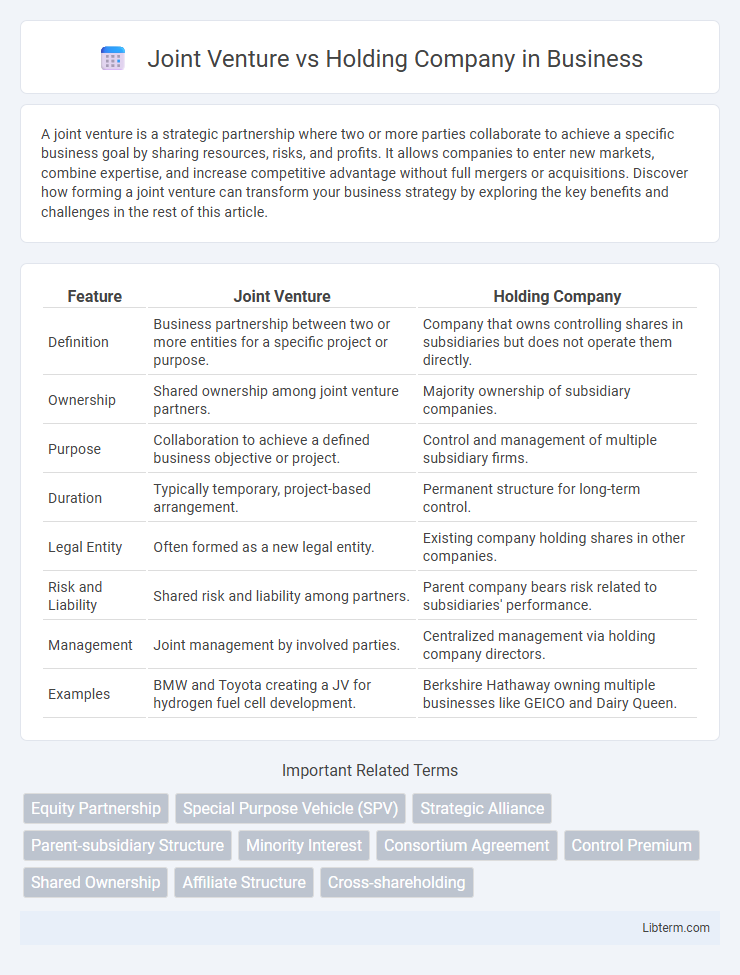

Table of Comparison

| Feature | Joint Venture | Holding Company |

|---|---|---|

| Definition | Business partnership between two or more entities for a specific project or purpose. | Company that owns controlling shares in subsidiaries but does not operate them directly. |

| Ownership | Shared ownership among joint venture partners. | Majority ownership of subsidiary companies. |

| Purpose | Collaboration to achieve a defined business objective or project. | Control and management of multiple subsidiary firms. |

| Duration | Typically temporary, project-based arrangement. | Permanent structure for long-term control. |

| Legal Entity | Often formed as a new legal entity. | Existing company holding shares in other companies. |

| Risk and Liability | Shared risk and liability among partners. | Parent company bears risk related to subsidiaries' performance. |

| Management | Joint management by involved parties. | Centralized management via holding company directors. |

| Examples | BMW and Toyota creating a JV for hydrogen fuel cell development. | Berkshire Hathaway owning multiple businesses like GEICO and Dairy Queen. |

Introduction: Understanding Business Structures

Joint ventures involve two or more companies collaborating on a specific project or business activity while maintaining their separate legal identities, enabling shared resources and risks. Holding companies own controlling interests in one or multiple subsidiary businesses without engaging in day-to-day operations, providing centralized management and strategic oversight. Understanding these distinct structures is crucial for optimizing investment strategies, risk management, and operational control in complex business environments.

What is a Joint Venture?

A joint venture is a business arrangement where two or more parties pool resources to achieve a specific project or goal while remaining independent entities. Each participant shares ownership, risks, profits, and management responsibilities according to their agreed terms. Joint ventures are commonly used to enter new markets, combine expertise, or leverage complementary assets for strategic growth.

What is a Holding Company?

A holding company is a firm that owns a controlling interest in one or more subsidiary companies, enabling centralized management and control without directly engaging in their daily operations. It primarily exists to hold assets, reduce risk, and facilitate strategic decisions across diverse business units. Unlike a joint venture that involves partnership and shared operations between entities, a holding company maintains ownership stakes to influence or dictate corporate policies.

Formation Process: Joint Venture vs Holding Company

The formation process of a joint venture typically involves a contractual agreement between two or more companies to collaborate on a specific project while maintaining separate legal identities, often requiring a joint management structure and shared resources. In contrast, a holding company is established by creating a new parent corporation that acquires controlling stakes in subsidiary businesses, with legal registration as a separate entity solely for ownership and control purposes. Registering a holding company demands compliance with corporate laws specific to parent companies, whereas joint ventures may involve more complex negotiations regarding profit sharing, contribution, and operational governance.

Ownership and Control Differences

A joint venture involves two or more parties sharing ownership, resources, and control over a specific business project or entity, typically with defined percentage stakes and decision-making rights based on their contributions. In contrast, a holding company owns controlling shares in subsidiary companies, exercising indirect control through ownership of stock rather than day-to-day management. The control in a joint venture is collaborative and project-specific, while in a holding company, control is centralized and exercised through board decisions and ownership majority.

Legal and Regulatory Considerations

Legal and regulatory considerations for joint ventures require compliance with contractual agreements, antitrust laws, and joint control mechanisms, ensuring shared liabilities and obligations are clearly defined. Holding companies face regulatory scrutiny around ownership concentration, financial disclosures, and subsidiary control under corporate governance laws. Jurisdiction-specific regulations impact the structure and operation of both entities, influencing tax treatment, liability exposure, and reporting requirements.

Financial Implications and Liabilities

In a joint venture, partners share profits, losses, and liabilities according to their agreement, often resulting in direct financial exposure tied to the project's performance. Holding companies typically hold controlling interests in subsidiaries, insulating parent company finances as liabilities remain with individual subsidiaries. Understanding tax treatment is vital; joint ventures may be taxed directly on earnings, while holding companies benefit from consolidated tax strategies and potential dividend exemptions.

Strategic Advantages: Joint Venture vs Holding Company

Joint ventures enable companies to pool resources and expertise for specific projects, fostering innovation and market entry without full mergers or acquisitions. Holding companies offer strategic control over multiple subsidiaries, optimizing tax benefits, risk management, and centralized governance. Joint ventures prioritize collaboration and shared risk in targeted ventures, while holding companies focus on long-term asset management and corporate structure flexibility.

Risks and Challenges

Joint ventures face risks such as cultural clashes, unequal resource contributions, and profit-sharing disputes, which can affect operational efficiency. Holding companies encounter challenges including complex regulatory compliance, potential double taxation, and difficulties in managing diverse subsidiaries under a unified strategy. Both structures demand careful risk management and clear contractual agreements to mitigate financial and operational uncertainties.

Choosing the Right Structure for Your Business

Selecting the appropriate structure between a joint venture and a holding company depends on your business goals and operational needs. A joint venture is ideal for collaboration on a specific project or market entry, allowing shared risks and resources without full integration. A holding company, on the other hand, provides centralized ownership and control over multiple subsidiaries, optimizing asset management and tax benefits.

Joint Venture Infographic

libterm.com

libterm.com