Effective tax planning minimizes your tax liability while maximizing savings through strategic use of deductions, credits, and retirement contributions. Understanding the latest tax laws and carefully timing income and expenses can significantly impact your overall financial health. Explore the rest of this article to discover practical tax planning tips tailored to your unique financial situation.

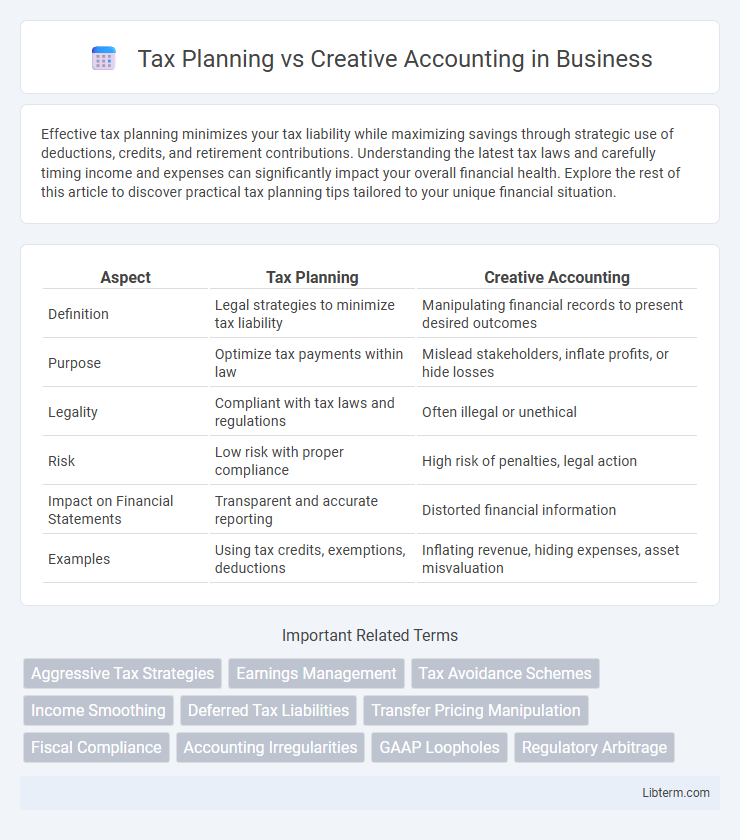

Table of Comparison

| Aspect | Tax Planning | Creative Accounting |

|---|---|---|

| Definition | Legal strategies to minimize tax liability | Manipulating financial records to present desired outcomes |

| Purpose | Optimize tax payments within law | Mislead stakeholders, inflate profits, or hide losses |

| Legality | Compliant with tax laws and regulations | Often illegal or unethical |

| Risk | Low risk with proper compliance | High risk of penalties, legal action |

| Impact on Financial Statements | Transparent and accurate reporting | Distorted financial information |

| Examples | Using tax credits, exemptions, deductions | Inflating revenue, hiding expenses, asset misvaluation |

Introduction to Tax Planning and Creative Accounting

Tax planning involves legally structuring financial affairs to minimize tax liability through deductions, credits, and exemptions allowed by law. Creative accounting manipulates financial records and reports, often bending regulations to present a more favorable financial position without outright illegal activity. Understanding the distinction is crucial, as tax planning enhances compliance while creative accounting risks legal scrutiny and misrepresentation.

Key Definitions: Tax Planning vs Creative Accounting

Tax planning involves legally analyzing financial situations to minimize tax liability through authorized methods such as deductions, credits, and deferrals. Creative accounting refers to manipulating financial records within legal boundaries to present a desired financial position, often pushing ethical limits without directly breaking laws. Key distinctions include tax planning's focus on compliance and optimization, whereas creative accounting emphasizes exploiting loopholes or ambiguities to alter financial reporting.

Legal Framework: What’s Allowed and What Isn’t

Tax planning involves legally optimizing financial affairs within the boundaries set by tax laws and regulations to minimize tax liabilities, ensuring compliance with the legal framework defined by authorities like the IRS or HMRC. Creative accounting manipulates financial statements and transactions to present a desired image, often exploiting loopholes or ambiguous regulations, which can cross into illegal territory such as tax evasion or fraud. The key distinction lies in adherence to statutory tax codes: tax planning aligns with legal allowances, while creative accounting risks violating laws through deceitful practices.

Objectives: Minimizing Tax vs Manipulating Profit

Tax planning aims to minimize tax liability by leveraging legal deductions, exemptions, and incentives to optimize financial outcomes. Creative accounting focuses on manipulating profit figures through unconventional or aggressive accounting methods to present a desired financial position. The primary objective of tax planning is compliance and efficiency, while creative accounting seeks to distort financial reality for strategic advantage.

Techniques Used in Tax Planning

Tax planning techniques involve legal strategies such as income deferral, tax credits utilization, and investment in tax-efficient instruments like municipal bonds. These approaches aim to minimize tax liability by optimizing deductions, exemptions, and allowances while adhering to statutory regulations. Unlike creative accounting, which may manipulate financial statements, tax planning strictly complies with tax laws to achieve financial efficiency.

Methods Commonly Seen in Creative Accounting

Creative accounting often involves methods such as income smoothing, where companies manipulate revenues and expenses to present a steadier financial performance, and off-balance-sheet financing, allowing firms to keep liabilities hidden from the balance sheet. Channel stuffing is another tactic, accelerating revenue recognition by pushing excess products to distributors before period-end. These techniques blur the line between legitimate tax planning and aggressive financial manipulation, potentially misleading stakeholders and regulators.

Risks and Consequences of Creative Accounting

Creative accounting involves manipulating financial statements to present a misleading view of a company's economic position, which carries significant risks including legal penalties, loss of investor trust, and damage to corporate reputation. Unlike tax planning, which legally optimizes tax liabilities within regulatory frameworks, creative accounting often breaches accounting standards and tax laws, resulting in audits, fines, and potential criminal charges. Companies practicing creative accounting may face severe consequences such as restatement of financials, decline in stock prices, and long-term harm to stakeholder relationships.

Ethical Considerations in Tax Strategies

Tax planning involves legally optimizing financial decisions to minimize tax liabilities within the boundaries of tax laws, whereas creative accounting manipulates financial records to present a misleadingly favorable tax position. Ethical considerations in tax strategies emphasize transparency, compliance, and integrity, ensuring that actions align with both legal standards and moral responsibility. Employing ethical tax planning fosters trust with tax authorities and supports sustainable business practices without resorting to deceptive or aggressive tactics.

Case Studies: Real-World Examples

Case studies highlight stark differences between tax planning and creative accounting: Royal Dutch Shell's tax planning strategies enabled the company to legally minimize its global tax burden through profit shifting and use of tax treaties, demonstrating effective compliance with tax laws. In contrast, the Lehman Brothers scandal exposed creative accounting practices, such as the "Repo 105" transactions, which misrepresented the company's financial health and led to severe legal consequences for deceptive financial reporting. These real-world examples illustrate how strategic tax planning aligns with regulatory frameworks, while creative accounting often crosses ethical and legal boundaries.

Best Practices for Ethical Tax Planning

Ethical tax planning involves legally leveraging available deductions, credits, and incentives to minimize tax liabilities without misrepresenting financial information. Best practices include maintaining transparent documentation, adhering strictly to tax laws and regulations, and consulting qualified tax professionals to ensure compliance. Differentiating ethical tax planning from creative accounting lies in the commitment to transparency and avoidance of aggressive schemes that manipulate financial statements or obscure taxable income.

Tax Planning Infographic

libterm.com

libterm.com