Asset-intensive businesses require significant investment in physical assets such as machinery, equipment, or infrastructure to operate effectively. Managing these assets efficiently is crucial to maximizing productivity and minimizing costs, impacting overall profitability. Explore the rest of the article to understand how optimizing asset utilization can enhance your business performance.

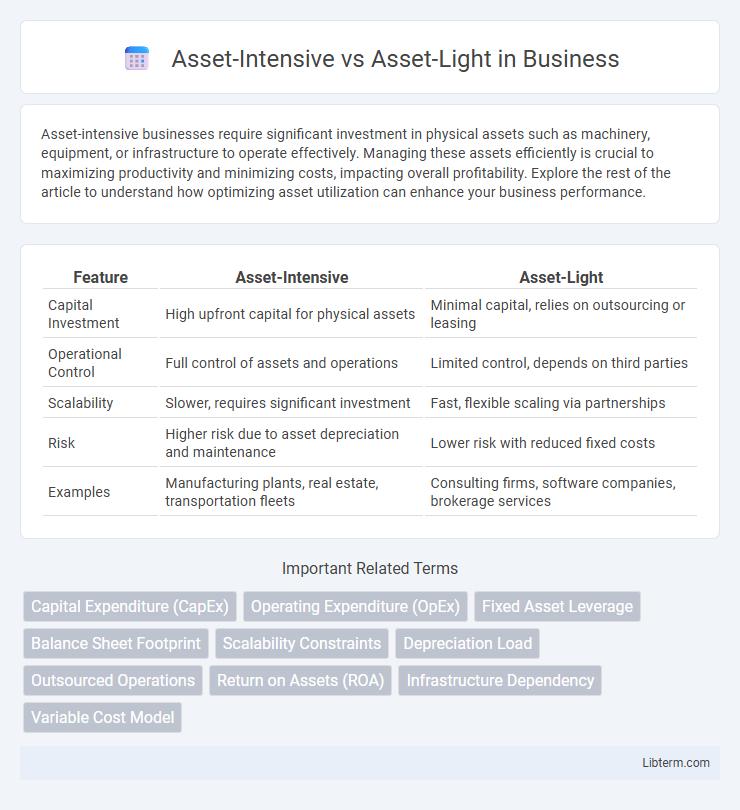

Table of Comparison

| Feature | Asset-Intensive | Asset-Light |

|---|---|---|

| Capital Investment | High upfront capital for physical assets | Minimal capital, relies on outsourcing or leasing |

| Operational Control | Full control of assets and operations | Limited control, depends on third parties |

| Scalability | Slower, requires significant investment | Fast, flexible scaling via partnerships |

| Risk | Higher risk due to asset depreciation and maintenance | Lower risk with reduced fixed costs |

| Examples | Manufacturing plants, real estate, transportation fleets | Consulting firms, software companies, brokerage services |

Understanding Asset-Intensive and Asset-Light Models

Asset-intensive models require significant investment in physical assets like machinery, infrastructure, and real estate, driving higher capital expenditure and maintenance costs but often resulting in greater control over production and quality. Asset-light models focus on minimizing ownership of fixed assets by leveraging outsourcing, partnerships, and technology, enabling lower operational risks and increased flexibility in scaling. Understanding the balance between these models helps businesses optimize resource allocation, improve agility, and align their strategies with industry demands and financial goals.

Key Characteristics of Asset-Intensive Businesses

Asset-intensive businesses require significant capital investment in physical assets such as machinery, equipment, and infrastructure to operate effectively. These enterprises typically face high fixed costs, long depreciation cycles, and rely heavily on efficient asset management to maximize operational uptime and return on investment. Industries like manufacturing, utilities, and transportation exemplify asset-intensive models where asset utilization directly impacts profitability and competitive advantage.

Defining Features of Asset-Light Companies

Asset-light companies prioritize minimal ownership of physical assets, relying heavily on outsourcing, partnerships, and technology to drive operations and growth. These firms emphasize agility, reduced capital expenditure, and scalability by leveraging external resources rather than investing in warehouses, manufacturing plants, or heavy machinery. Typical features include high asset turnover ratios, a focus on intellectual property and brand management, and reliance on service-oriented business models.

Capital Requirements: Asset-Intensive vs Asset-Light

Asset-intensive businesses require significant capital investment in physical assets such as machinery, buildings, and infrastructure, leading to higher fixed costs and longer depreciation periods. In contrast, asset-light models minimize capital expenditure by focusing on intangible assets, outsourcing, or renting resources, resulting in greater operational flexibility and lower financial risk. This fundamental difference impacts cash flow management, scalability, and overall financial strategy for companies within each model.

Risk Profiles in Asset-Intensive and Asset-Light Approaches

Asset-intensive approaches carry higher operational and capital expenditure risks due to heavy investments in physical assets such as manufacturing plants, equipment, and infrastructure, which are subject to depreciation, maintenance costs, and market fluctuations. In contrast, asset-light models reduce financial risk by leveraging outsourcing, partnerships, or digital platforms, minimizing fixed costs and allowing greater scalability and flexibility in responding to market demand changes. The asset-light strategy often faces increased dependency on third-party providers, introducing supply chain and vendor reliability risks.

Profitability and ROI: A Comparative Analysis

Asset-intensive businesses typically require significant capital investment in physical assets, leading to higher depreciation costs but often generating stable cash flows and higher long-term ROI through asset utilization. Asset-light companies minimize fixed assets, resulting in lower operating costs and enhanced profitability margins, yet may face greater volatility in cash flow and rely heavily on outsourcing or intangible assets. Comparing profitability, asset-light models often achieve higher return on equity (ROE) amid market fluctuations, whereas asset-intensive firms exhibit stronger return on invested capital (ROIC) when leveraging asset expertise and scale efficiencies.

Scalability and Flexibility in Both Models

Asset-intensive models require significant capital investment in physical infrastructure, limiting rapid scalability and reducing operational flexibility due to fixed assets. Asset-light models leverage third-party resources or digital platforms, enabling faster scalability and greater adaptability to market changes with lower upfront costs. Businesses aiming for quick expansion and agility often prefer asset-light strategies while asset-intensive approaches suit industries demanding control over their physical assets.

Industry Examples: Asset-Intensive vs Asset-Light

Asset-Intensive industries like manufacturing, oil and gas, and utilities require significant capital investment in physical assets such as machinery, plants, and infrastructure to operate efficiently. In contrast, asset-light industries such as software development, consulting, and digital media emphasize intellectual property, technology, and human capital, minimizing reliance on large physical assets. The manufacturing sector exemplifies asset-intensive business models with high fixed costs and depreciation, whereas tech firms like SaaS providers illustrate asset-light models focusing on scalable services and intellectual property.

Choosing the Right Model for Your Business Strategy

Selecting between an asset-intensive and asset-light model hinges on your business's capital availability, operational control needs, and scalability goals. Asset-intensive models require substantial investment in physical resources, ensuring direct control and quality but often limiting flexibility and increasing fixed costs. Asset-light strategies leverage outsourced assets and partnerships to reduce capital expenditure, enhance agility, and facilitate rapid market entry, ideal for businesses prioritizing innovation and scalability over ownership.

Future Trends Shaping Asset-Intensive and Asset-Light Models

Future trends shaping asset-intensive and asset-light models highlight digital transformation, sustainability, and IoT integration as critical drivers. Asset-intensive industries adopt predictive maintenance and automation to enhance operational efficiency, while asset-light companies leverage cloud computing and flexible supply chains for scalability. Increasing emphasis on circular economy practices and data-driven decision-making further differentiates the strategic evolution of both models.

Asset-Intensive Infographic

libterm.com

libterm.com