Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. This key financial ratio helps investors assess a firm's operational effectiveness and compare performance across industries. Explore the rest of the article to understand how improving ROA can enhance your investment decisions.

Table of Comparison

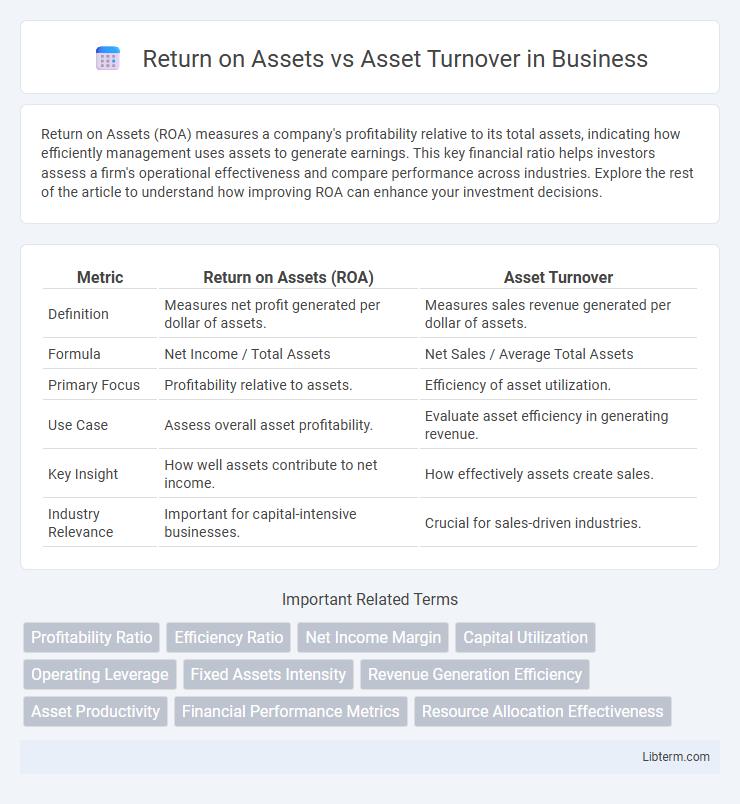

| Metric | Return on Assets (ROA) | Asset Turnover |

|---|---|---|

| Definition | Measures net profit generated per dollar of assets. | Measures sales revenue generated per dollar of assets. |

| Formula | Net Income / Total Assets | Net Sales / Average Total Assets |

| Primary Focus | Profitability relative to assets. | Efficiency of asset utilization. |

| Use Case | Assess overall asset profitability. | Evaluate asset efficiency in generating revenue. |

| Key Insight | How well assets contribute to net income. | How effectively assets create sales. |

| Industry Relevance | Important for capital-intensive businesses. | Crucial for sales-driven industries. |

Understanding Return on Assets (ROA)

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. It is calculated by dividing net income by average total assets, helping investors assess operational performance. Understanding ROA is crucial for comparing companies within asset-intensive industries, where effective asset utilization directly drives profitability.

Defining Asset Turnover

Asset Turnover measures a company's efficiency in using its assets to generate sales by dividing total revenue by average total assets. This ratio highlights how effectively management utilizes asset investments to produce revenue, distinguishing it from Return on Assets (ROA), which evaluates profitability relative to assets by incorporating net income. Understanding Asset Turnover is crucial for assessing operational performance without the influence of profit margins or financing decisions.

The Core Differences Between ROA and Asset Turnover

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently assets generate net income, while Asset Turnover focuses on the efficiency of asset use by calculating sales revenue per unit of asset value. ROA incorporates net profit margin, combining operational efficiency and profitability, whereas Asset Turnover solely evaluates the ability to generate revenue from assets without factoring in profit margins. The core difference lies in ROA's profit-driven insight versus Asset Turnover's emphasis on revenue generation efficiency from total assets.

How to Calculate Return on Assets

Return on Assets (ROA) is calculated by dividing net income by average total assets, measuring how efficiently a company generates profit from its assets. Asset Turnover, on the other hand, is calculated by dividing total sales or revenue by average total assets, indicating how well a company uses its assets to produce sales. ROA provides insights into profitability relative to assets, while Asset Turnover focuses on operational efficiency in asset utilization.

Asset Turnover Ratio Formula Explained

Asset Turnover Ratio measures how efficiently a company uses its assets to generate sales, calculated as Net Sales divided by Average Total Assets. This ratio highlights operational efficiency by showing the revenue earned per dollar of assets, distinguishing it from Return on Assets (ROA), which includes net income in its formula. By focusing on sales relative to assets, the Asset Turnover Ratio provides insight into asset utilization without the influence of profit margin variations.

Interpreting ROA in Financial Analysis

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. Asset Turnover, on the other hand, quantifies the efficiency of asset utilization by showing the amount of revenue produced per dollar of assets. Interpreting ROA involves analyzing both profit margins and asset turnover to assess operational effectiveness and asset management quality in financial analysis.

Importance of Asset Turnover for Business Efficiency

Asset Turnover measures how effectively a company uses its assets to generate sales, making it a critical indicator of business efficiency. Higher Asset Turnover ratios signify that the company is maximizing asset productivity, leading to better operational performance and competitive advantage. While Return on Assets (ROA) combines profitability with asset use, Asset Turnover specifically highlights efficiency in asset utilization, essential for optimizing resource allocation and driving sustainable growth.

ROA vs Asset Turnover: Which Metric to Use?

Return on Assets (ROA) measures a company's profitability relative to its total assets, highlighting efficiency in generating profit from investments, while Asset Turnover focuses solely on how effectively assets generate sales. ROA integrates profit margins and asset utilization, making it a comprehensive indicator of overall financial performance, whereas Asset Turnover emphasizes operational efficiency. Choosing between ROA and Asset Turnover depends on whether profitability or sales efficiency is the primary focus for analyzing asset performance.

Practical Examples Comparing ROA and Asset Turnover

Return on Assets (ROA) measures a company's profitability relative to its total assets, calculated as net income divided by total assets, indicating how efficiently assets generate profit. Asset Turnover, defined as sales revenue divided by total assets, evaluates how effectively a company uses assets to generate sales. For example, a retail company with $1 million in sales and $500,000 in assets has an Asset Turnover of 2, while a manufacturing firm with $1 million in net income and $10 million in assets has an ROA of 10%, highlighting practical differences in operational efficiency versus profitability.

Enhancing Business Performance with ROA and Asset Turnover

Enhancing business performance through Return on Assets (ROA) and Asset Turnover requires understanding their distinct but complementary roles in financial efficiency. ROA measures net income generated per dollar of assets, reflecting overall profitability, while Asset Turnover gauges sales revenue relative to asset investment, indicating operational efficiency. Combining a high ROA with a strong Asset Turnover ratio drives superior asset utilization and profit margins, optimizing capital deployment and boosting shareholder value.

Return on Assets Infographic

libterm.com

libterm.com