Book value represents the net asset value of a company calculated by subtracting its total liabilities from total assets, providing a snapshot of its intrinsic worth. This metric is essential for investors to assess the underlying financial health and potential undervaluation of a stock compared to its market price. Explore the rest of the article to understand how book value impacts investment strategies and company analysis.

Table of Comparison

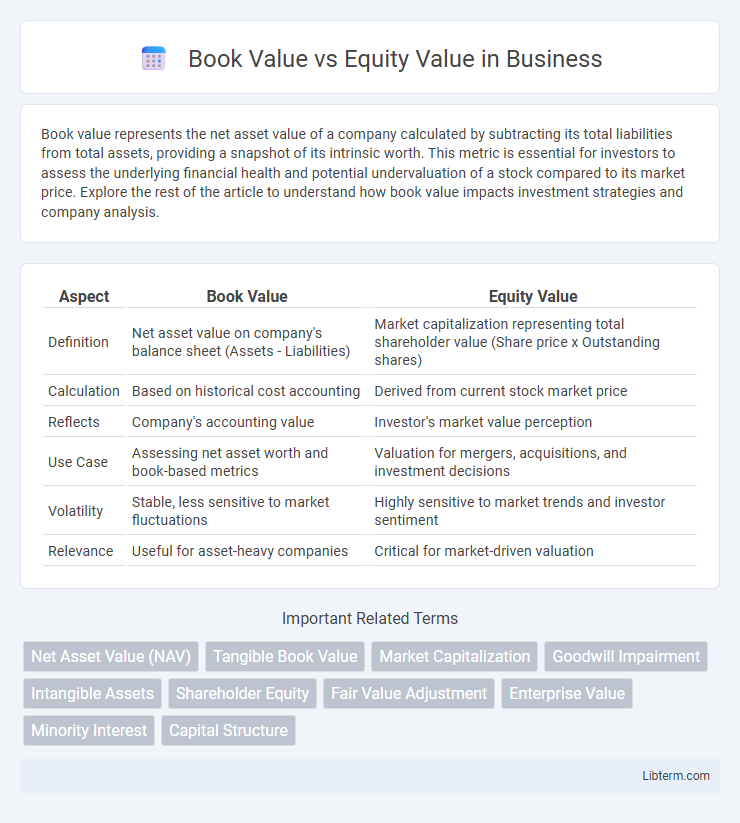

| Aspect | Book Value | Equity Value |

|---|---|---|

| Definition | Net asset value on company's balance sheet (Assets - Liabilities) | Market capitalization representing total shareholder value (Share price x Outstanding shares) |

| Calculation | Based on historical cost accounting | Derived from current stock market price |

| Reflects | Company's accounting value | Investor's market value perception |

| Use Case | Assessing net asset worth and book-based metrics | Valuation for mergers, acquisitions, and investment decisions |

| Volatility | Stable, less sensitive to market fluctuations | Highly sensitive to market trends and investor sentiment |

| Relevance | Useful for asset-heavy companies | Critical for market-driven valuation |

Introduction to Book Value and Equity Value

Book Value represents a company's net asset value calculated as total assets minus total liabilities, reflecting the accounting value on the balance sheet. Equity Value, often referred to as market capitalization, is the company's total market value of outstanding shares, capturing investor sentiment and future growth expectations. Understanding the distinction between Book Value and Equity Value is essential for evaluating a firm's financial health and market price alignment.

Defining Book Value: What It Means

Book Value represents the net asset value of a company, calculated as total assets minus total liabilities, reflecting the accounting value recorded on the balance sheet. It indicates the intrinsic worth of the company from an accounting perspective, not influenced by market fluctuations or investor sentiment. Book Value serves as a baseline for assessing the company's financial health and comparing it to the market-driven Equity Value, which accounts for the current stock price and outstanding shares.

Understanding Equity Value in Finance

Equity value represents the total market value of a company's outstanding shares and reflects investor perception of the company's future growth and profitability. It is calculated by multiplying the current stock price by the number of outstanding shares, providing insight into the company's market capitalization rather than its accounting worth. Unlike book value, which is based on historical costs recorded on the balance sheet, equity value incorporates market dynamics and intangible assets, making it a crucial metric for investors assessing a company's true market worth.

Key Differences Between Book Value and Equity Value

Book value represents the net asset value of a company as recorded on its balance sheet, calculated by subtracting total liabilities from total assets. Equity value, also known as market capitalization, reflects the total market value of a company's outstanding shares and fluctuates with stock price changes. Key differences include book value's reliance on historical financial data, while equity value incorporates market perceptions and future growth potential.

How Book Value Is Calculated

Book value is calculated by subtracting a company's total liabilities from its total assets, representing the net asset value on the balance sheet. This figure reflects the historical cost of assets minus accumulated depreciation and amortization, providing a baseline valuation. Book value differs from equity value, which accounts for market perceptions and includes elements such as market capitalization and intangible assets.

Calculating Equity Value: Methods and Metrics

Calculating equity value involves methods such as the market capitalization approach, which multiplies a company's share price by total outstanding shares to reflect the current market perception of ownership. Another key metric is the enterprise value minus net debt, which adjusts for a company's capital structure by subtracting liabilities like debt from total enterprise value. These methods provide insights into the company's worth from investor and accounting perspectives, essential for valuation and investment decisions.

Importance in Valuation: When to Use Each Metric

Book value represents a company's net asset value based on its balance sheet, making it crucial for assessing liquidation scenarios and accounting-based valuations. Equity value reflects the market capitalization, capturing investor sentiment and growth expectations, thus essential for market-based valuations and merger analyses. Understanding when to use book value versus equity value ensures accurate financial assessments aligned with the context of asset liquidation or market performance.

Implications for Investors and Analysts

Book value represents a company's net asset value based on its balance sheet, offering investors a conservative estimate of intrinsic value while equity value reflects the market capitalization, capturing current market perceptions and growth expectations. Investors use book value to assess undervaluation or asset quality, especially in asset-heavy industries, while equity value provides insight into market sentiment, investor confidence, and potential for future growth. Analysts integrate both metrics to evaluate financial health, make informed investment decisions, and identify discrepancies between market price and fundamental worth.

Real-World Examples: Book Value vs. Equity Value

Book value represents a company's net asset value calculated by total assets minus total liabilities, often reflecting historical costs on the balance sheet. Equity value, or market capitalization, captures the market's perception of a company's worth by multiplying the current share price by the total number of outstanding shares. For example, in tech firms like Apple, equity value far exceeds book value due to strong growth prospects and intangible assets, whereas in manufacturing companies, book value and equity value tend to align more closely because of substantial physical assets.

Conclusion: Choosing the Right Metric for Your Analysis

Book value represents a company's net asset value based on accounting records, reflecting historical costs, while equity value captures the market's perception of a company's worth by incorporating future growth prospects and investor sentiment. Selecting the right metric depends on the analysis purpose: book value suits asset-intensive industries or liquidation scenarios, whereas equity value is preferred for valuation in mergers, acquisitions, or market-based comparisons. Analysts should align their choice with the specific financial context and objectives to ensure accurate and meaningful conclusions.

Book Value Infographic

libterm.com

libterm.com