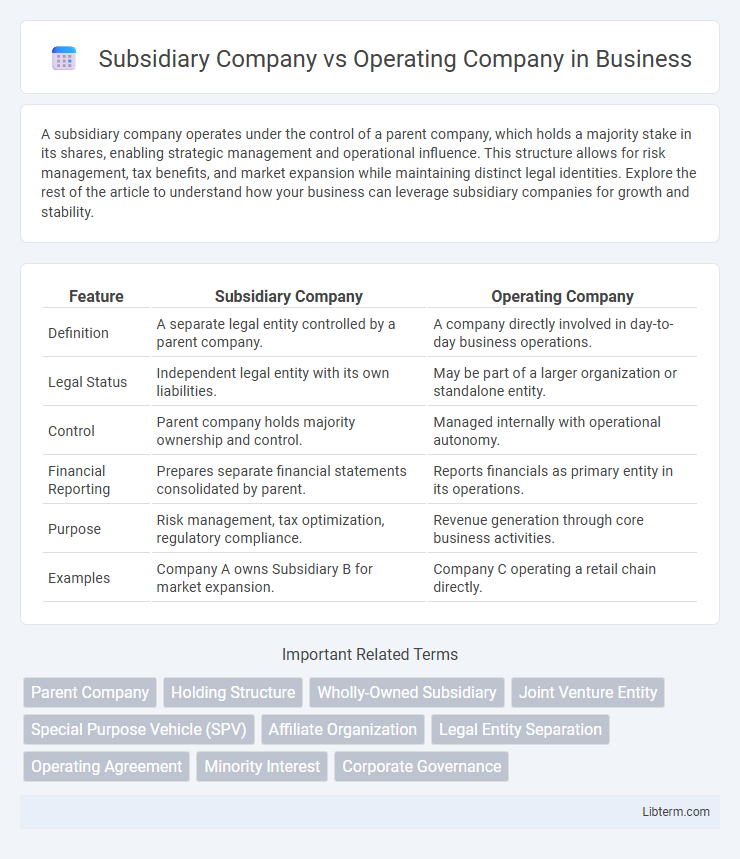

A subsidiary company operates under the control of a parent company, which holds a majority stake in its shares, enabling strategic management and operational influence. This structure allows for risk management, tax benefits, and market expansion while maintaining distinct legal identities. Explore the rest of the article to understand how your business can leverage subsidiary companies for growth and stability.

Table of Comparison

| Feature | Subsidiary Company | Operating Company |

|---|---|---|

| Definition | A separate legal entity controlled by a parent company. | A company directly involved in day-to-day business operations. |

| Legal Status | Independent legal entity with its own liabilities. | May be part of a larger organization or standalone entity. |

| Control | Parent company holds majority ownership and control. | Managed internally with operational autonomy. |

| Financial Reporting | Prepares separate financial statements consolidated by parent. | Reports financials as primary entity in its operations. |

| Purpose | Risk management, tax optimization, regulatory compliance. | Revenue generation through core business activities. |

| Examples | Company A owns Subsidiary B for market expansion. | Company C operating a retail chain directly. |

Definition of Subsidiary Company

A subsidiary company is a legal entity controlled by another company, known as the parent company, through ownership of more than 50% of its voting shares. It operates as a separate business entity with its own management and financial statements but remains dependent on the parent company for strategic decisions and funding. This structure differentiates it from an operating company, which primarily focuses on day-to-day business operations without the hierarchical control inherent in a subsidiary relationship.

Definition of Operating Company

An operating company is a business entity actively engaged in producing goods or providing services, maintaining day-to-day operational control and management. It contrasts with a subsidiary company, which is a legally separate entity owned or controlled by a parent company but may not directly conduct core operational activities. Operating companies are typically responsible for revenue generation, operational decisions, and executing strategic business functions.

Key Differences Between Subsidiary and Operating Companies

A subsidiary company is a distinct legal entity controlled by a parent corporation, whereas an operating company directly manages business operations and day-to-day activities. Key differences include legal independence, financial consolidation where subsidiaries have separate financial statements but contribute to the parent's consolidated reports, and decision-making autonomy with subsidiaries often having their own management teams compared to operating companies that are directly involved in executing core business functions. Understanding these distinctions is crucial for corporate governance, tax implications, and regulatory compliance.

Legal Structure and Ownership

A subsidiary company is a separate legal entity owned or controlled by a parent company, allowing for limited liability and distinct financial reporting. An operating company directly manages daily business operations and may either be standalone or function as a subsidiary under a larger corporate group. The legal structure of a subsidiary ensures ownership control through shareholding, while an operating company's structure emphasizes operational efficiency and regulatory compliance.

Roles and Functions in Business

A subsidiary company functions under the control of a parent company, primarily managing specific business segments or regional operations to streamline organizational efficiency and risk management. An operating company, on the other hand, is actively engaged in the day-to-day production of goods or services, driving revenue generation and customer engagement within its defined market. The subsidiary typically focuses on strategic alignment and compliance with parent company directives, while the operating company centers on operational execution and business growth initiatives.

Financial Reporting and Accountability

A subsidiary company prepares separate financial statements while consolidating them with the parent company's accounts to ensure transparent financial reporting and accountability. Operating companies focus on day-to-day business activities, generating primary financial data used in the consolidated reports. The distinction impacts how liabilities, assets, and profits are reported, influencing the accuracy and compliance of financial disclosures.

Advantages of Operating Through a Subsidiary

Operating through a subsidiary company offers significant advantages, including limited liability protection that shields the parent company from direct legal and financial risks. It enables better tax planning through distinct legal entities and facilitates targeted management control over diverse business operations. Furthermore, subsidiaries can enhance brand positioning by allowing localized market strategies while maintaining overall corporate governance.

Risks and Challenges Associated with Subsidiaries

Subsidiary companies often face risks such as limited autonomy, financial dependence on the parent company, and exposure to regulatory complexities across different jurisdictions. Challenges include managing intercompany transactions, ensuring compliance with diverse legal frameworks, and mitigating potential reputational damage from the parent company's actions. Operating companies must also address risks related to cultural integration, operational control, and aligning strategic objectives with the broader corporate group.

Regulatory and Compliance Considerations

Subsidiary companies must adhere to regulatory requirements specific to their jurisdiction, including separate financial reporting, tax filings, and corporate governance standards distinct from the parent company. Operating companies face strict compliance obligations related to industry-specific regulations, licensing, and operational permits that directly impact daily business functions, ensuring adherence to environmental, safety, and labor laws. Both entities require robust internal controls and audit mechanisms to meet statutory compliance and mitigate legal risks effectively.

Choosing the Right Structure for Your Business

Choosing between a subsidiary company and an operating company hinges on factors like liability protection, tax implications, and operational control. A subsidiary company, legally distinct yet controlled by a parent company, offers risk isolation and potential tax advantages, making it ideal for diverse business ventures or geographic expansion. An operating company directly manages day-to-day activities and holds full accountability, suited for businesses seeking straightforward management and cohesive brand identity.

Subsidiary Company Infographic

libterm.com

libterm.com