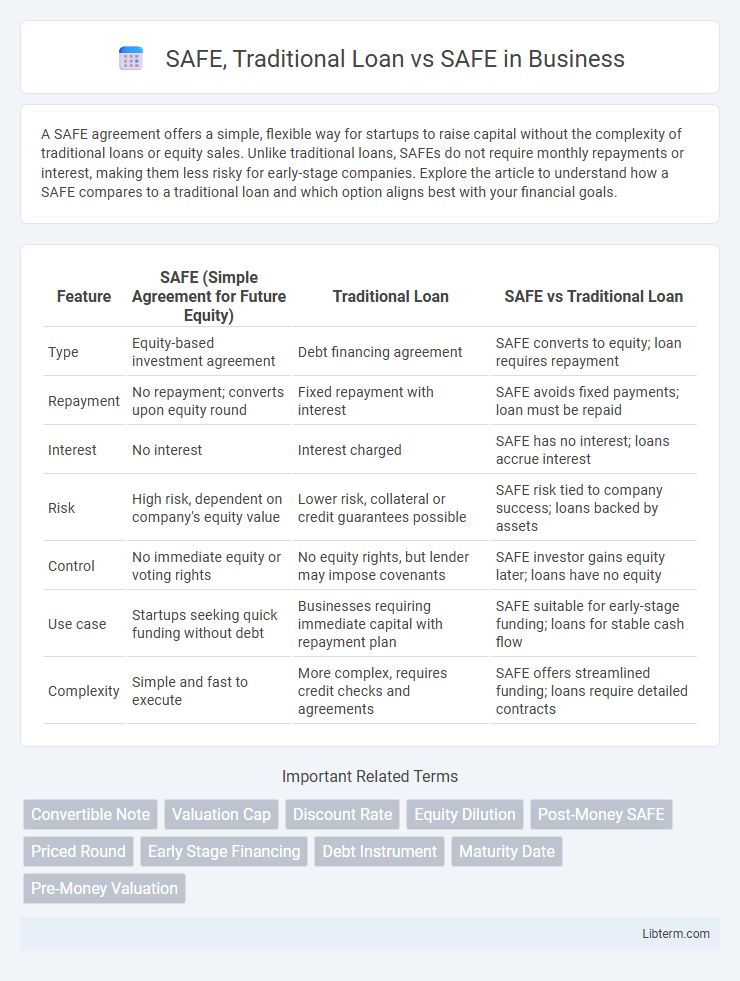

A SAFE agreement offers a simple, flexible way for startups to raise capital without the complexity of traditional loans or equity sales. Unlike traditional loans, SAFEs do not require monthly repayments or interest, making them less risky for early-stage companies. Explore the article to understand how a SAFE compares to a traditional loan and which option aligns best with your financial goals.

Table of Comparison

| Feature | SAFE (Simple Agreement for Future Equity) | Traditional Loan | SAFE vs Traditional Loan |

|---|---|---|---|

| Type | Equity-based investment agreement | Debt financing agreement | SAFE converts to equity; loan requires repayment |

| Repayment | No repayment; converts upon equity round | Fixed repayment with interest | SAFE avoids fixed payments; loan must be repaid |

| Interest | No interest | Interest charged | SAFE has no interest; loans accrue interest |

| Risk | High risk, dependent on company's equity value | Lower risk, collateral or credit guarantees possible | SAFE risk tied to company success; loans backed by assets |

| Control | No immediate equity or voting rights | No equity rights, but lender may impose covenants | SAFE investor gains equity later; loans have no equity |

| Use case | Startups seeking quick funding without debt | Businesses requiring immediate capital with repayment plan | SAFE suitable for early-stage funding; loans for stable cash flow |

| Complexity | Simple and fast to execute | More complex, requires credit checks and agreements | SAFE offers streamlined funding; loans require detailed contracts |

Introduction to SAFE and Traditional Loans

SAFE (Simple Agreement for Future Equity) is an investment contract allowing startups to raise capital without immediate valuation or equity dilution, providing investors rights to future equity upon a triggering event. Traditional loans involve borrowing a fixed amount with scheduled repayments and interest, posing immediate financial obligations on the borrower. Unlike loans, SAFEs prioritize long-term equity conversion over short-term debt repayment, balancing risk and potential growth for startups and investors.

What is SAFE (Simple Agreement for Future Equity)?

SAFE (Simple Agreement for Future Equity) is an investment contract allowing investors to convert their investment into equity at a future financing round, commonly used by startups for early-stage funding. Unlike traditional loans that require scheduled repayments with interest, SAFEs do not accrue interest or have fixed maturity dates, reducing immediate financial pressure on startups. This structure provides investors potential equity upside without the obligation of debt repayment, aligning with high-growth business models seeking flexible capital.

How Traditional Loans Work

Traditional loans require borrowers to repay principal and interest over a fixed term, with structured monthly payments. These loans are typically secured by collateral, such as property or assets, which the lender can claim if the borrower defaults. Lenders evaluate creditworthiness, income, and debt-to-income ratio before approval to mitigate financial risk.

Key Differences Between SAFE and Traditional Loans

SAFE (Simple Agreement for Future Equity) offers startup investors equity in the company without immediate repayment obligations, unlike traditional loans that require fixed interest payments and principal repayment. Traditional loans carry defined deadlines, interest rates, and collateral requirements, while SAFEs convert into equity based on future financing rounds without debt-related risk. SAFEs provide flexibility for early-stage startups by delaying valuation negotiations, contrasting with loans' immediate financial liability and impact on cash flow.

Advantages of Using SAFE Agreements

SAFE agreements provide startups with faster and simpler funding processes compared to traditional loans, eliminating the need for repayment schedules and interest rates. They allow investors to convert their investment into equity during future financing rounds, aligning interests without immediate financial burden on the company. By avoiding debt accumulation, SAFEs minimize financial risk and support agility in early-stage business growth.

Benefits of Traditional Loans for Startups

Traditional loans offer startups predictable repayment schedules and clear interest rates, providing financial stability crucial for early business planning. They enable founders to retain full ownership without diluting equity, preserving control over company decisions. Access to traditional loans can also help establish credit history, facilitating future financing opportunities.

Risks and Drawbacks of SAFE vs Traditional Loans

SAFE agreements carry higher risk compared to traditional loans due to their equity-based nature, where investors may receive little or no return if the startup fails or never reaches a triggering event. Unlike traditional loans with fixed repayment schedules and collateral, SAFEs lack guaranteed repayment, exposing investors to potential total loss of capital. Additionally, SAFEs can lead to significant dilution for founders during future financing rounds, whereas traditional loans do not affect equity ownership.

Decision Factors: When to Choose SAFE or Loan

Choosing between a SAFE and a traditional loan depends on factors such as company stage, risk tolerance, and funding goals. SAFE agreements are ideal for startups seeking flexible, equity-linked financing without immediate repayment obligations, whereas traditional loans suit businesses with steady cash flow aiming for fixed repayment terms. Consider the impact on ownership dilution, interest costs, and repayment timeline when deciding the optimal funding method.

Investor Perspectives: SAFE vs Loan Agreements

SAFE agreements offer investors equity-like upside without debt obligations or interest, providing a simplified entry into early-stage startups. Traditional loans require fixed repayments and accrue interest, prioritizing creditor rights and limiting investor potential gains. Investors often prefer SAFEs for their high-risk, high-reward profile aligned with startup growth, while loans cater to conservative, income-focused investors.

Conclusion: Selecting the Right Funding Option

Choosing between a SAFE (Simple Agreement for Future Equity) and a traditional loan depends on the startup's growth stage, risk tolerance, and repayment ability. SAFEs offer flexible, equity-based funding without immediate debt obligations, making them ideal for early-stage startups seeking future financing rounds. Traditional loans require fixed repayments and collateral, better suited for businesses with steady cash flow and lower risk profiles.

SAFE, Traditional Loan Infographic

libterm.com

libterm.com