Finanscape offers comprehensive financial analysis and forecasting tools designed to optimize your investment strategies and enhance decision-making processes. Leveraging advanced data analytics, it provides real-time insights and customizable dashboards to track market trends effectively. Explore the full article to discover how Finanscape can transform your financial planning and elevate your portfolio management.

Table of Comparison

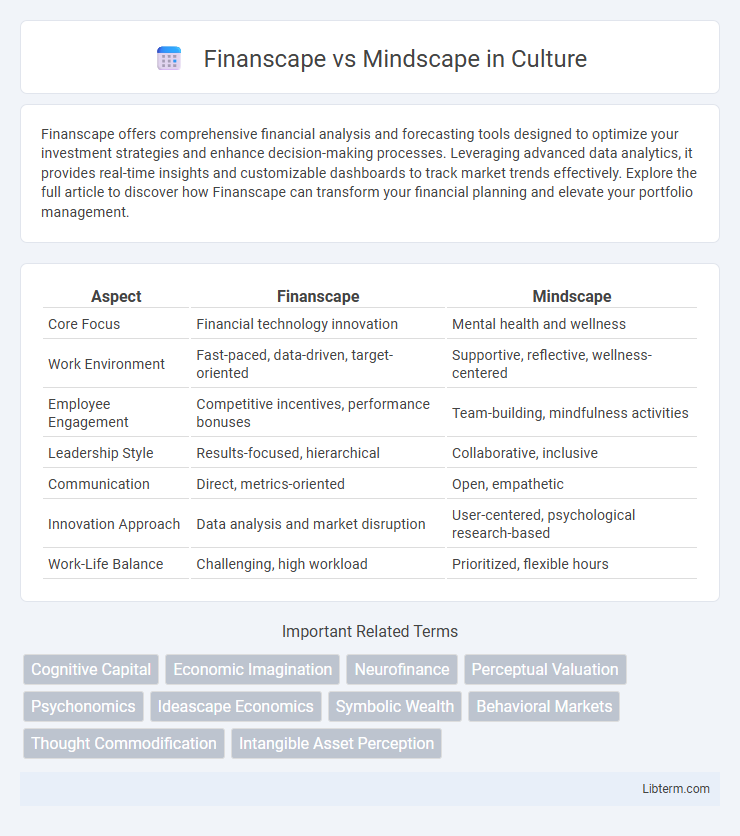

| Aspect | Finanscape | Mindscape |

|---|---|---|

| Core Focus | Financial technology innovation | Mental health and wellness |

| Work Environment | Fast-paced, data-driven, target-oriented | Supportive, reflective, wellness-centered |

| Employee Engagement | Competitive incentives, performance bonuses | Team-building, mindfulness activities |

| Leadership Style | Results-focused, hierarchical | Collaborative, inclusive |

| Communication | Direct, metrics-oriented | Open, empathetic |

| Innovation Approach | Data analysis and market disruption | User-centered, psychological research-based |

| Work-Life Balance | Challenging, high workload | Prioritized, flexible hours |

Introduction to Finanscape and Mindscape

Finanscape is a comprehensive financial analytics platform designed to streamline data visualization and enhance decision-making for investment professionals. Mindscape focuses on cognitive computing solutions that integrate AI-driven insights to optimize business strategies and operational efficiencies. Both platforms offer specialized tools catering to distinct sectors, with Finanscape emphasizing financial intelligence and Mindscape targeting advanced AI applications.

Defining Finanscape: The Financial Landscape

Finanscape represents the comprehensive financial landscape, encompassing global markets, investment opportunities, and economic policies that shape wealth management and capital allocation. It integrates data on stock exchanges, banking systems, regulatory frameworks, and emerging fintech innovations to provide a dynamic view of financial ecosystems. Mindscape, by contrast, centers on cognitive frameworks and decision-making processes, offering insights into investor behavior and strategic financial planning.

Exploring Mindscape: The Psychological Terrain

Mindscape delves deeply into the psychological terrain by mapping cognitive and emotional patterns that influence decision-making. It leverages advanced neuroanalytics to provide insights into mental states, contrastable with Finanscape's financial data-centric approach. This psychological exploration enhances understanding of behaviorally-driven risks and opportunities, enriching strategic planning beyond traditional financial metrics.

Key Differences Between Finanscape and Mindscape

Finanscape specializes in financial data analytics, offering advanced tools for investment strategies and market trend analysis, while Mindscape focuses on cognitive behavioral applications and mental wellness solutions. Finanscape integrates real-time economic indicators and portfolio management features, contrasting with Mindscape's emphasis on psychological assessments and personalized therapy plans. The key difference lies in Finanscape's financial market orientation versus Mindscape's mental health and cognitive development approach.

The Interplay of Finance and Mindset

Finanscape leverages behavioral finance principles to highlight how cognitive biases impact investment decisions, while Mindscape emphasizes psychological resilience and mindset shifts crucial for financial success. The interplay of finance and mindset in these frameworks reveals that cultivating emotional intelligence and adaptive thinking enhances risk management and long-term wealth growth. Integrating Finanscape's data-driven insights with Mindscape's focus on mental habits fosters a holistic approach to personal finance optimization.

How Finanscape Influences Financial Decisions

Finanscape leverages advanced data analytics and real-time market insights to shape smarter financial decisions, offering personalized investment strategies based on individual risk profiles. Its integration of AI-driven forecasting tools enhances portfolio optimization by predicting market trends more accurately than traditional methods. This targeted approach empowers users to manage assets efficiently, improving long-term financial outcomes compared to Mindscape's broader, less data-intensive financial planning solutions.

The Role of Mindscape in Personal and Business Success

Mindscape plays a crucial role in achieving personal and business success by enhancing cognitive functions such as creativity, focus, and problem-solving, which are essential for strategic decision-making and innovation. Unlike Finanscape, which primarily focuses on financial data analytics and investment strategies, Mindscape emphasizes mental frameworks and psychological insights that drive motivation and effective leadership. Integrating Mindscape's cognitive tools with Finanscape's financial metrics can lead to a holistic approach, optimizing both mental agility and economic outcomes.

Integrating Finanscape and Mindscape for Growth

Integrating Finanscape and Mindscape enhances financial analytics with advanced cognitive insights, driving strategic growth through comprehensive data interpretation. The synergy between Finanscape's robust financial modeling and Mindscape's AI-driven behavioral analysis enables businesses to optimize decision-making and forecast market trends more accurately. Leveraging combined dashboards and real-time data integration fosters agility and scalability, positioning organizations for accelerated growth.

Challenges in Aligning Finanscape with Mindscape

Aligning Finanscape with Mindscape presents significant challenges due to differing data architectures and integration protocols, which complicate seamless data flow and real-time analytics synchronization. Inconsistent taxonomies and metadata standards between Finanscape's financial datasets and Mindscape's cognitive frameworks hinder accurate semantic mapping and unified reporting. Overcoming these obstacles requires advanced API development and robust middleware solutions to ensure interoperability and maintain data integrity across platforms.

Strategies for Harmonizing Finanscape and Mindscape

Strategies for harmonizing Finanscape and Mindscape involve aligning financial data analytics with cognitive frameworks to enhance decision-making accuracy. Integrating Finanscape's quantitative insights with Mindscape's qualitative understanding promotes a holistic view of business dynamics, fostering adaptive strategies in volatile markets. Leveraging AI-driven tools to synchronize financial modeling and cognitive behavior patterns optimizes resource allocation and risk management.

Finanscape Infographic

libterm.com

libterm.com