Time preference reflects how individuals value present benefits over future gains, influencing decision-making in economics and personal finance. Understanding your time preference helps optimize savings, investments, and consumption choices by balancing immediate satisfaction with long-term rewards. Explore the full article to learn how mastering time preference can improve your financial well-being.

Table of Comparison

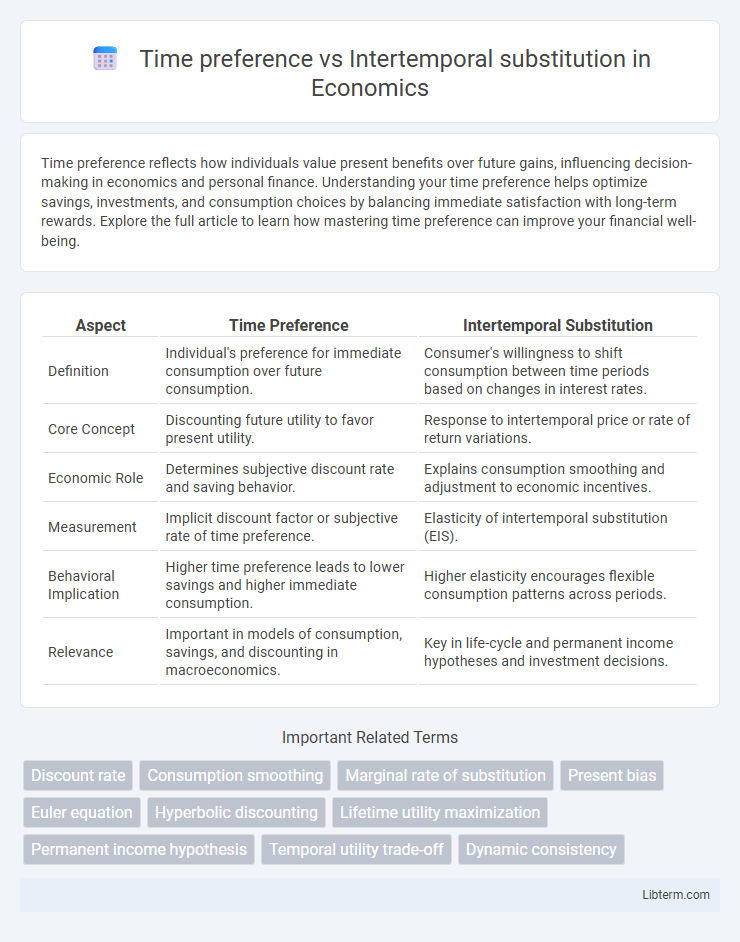

| Aspect | Time Preference | Intertemporal Substitution |

|---|---|---|

| Definition | Individual's preference for immediate consumption over future consumption. | Consumer's willingness to shift consumption between time periods based on changes in interest rates. |

| Core Concept | Discounting future utility to favor present utility. | Response to intertemporal price or rate of return variations. |

| Economic Role | Determines subjective discount rate and saving behavior. | Explains consumption smoothing and adjustment to economic incentives. |

| Measurement | Implicit discount factor or subjective rate of time preference. | Elasticity of intertemporal substitution (EIS). |

| Behavioral Implication | Higher time preference leads to lower savings and higher immediate consumption. | Higher elasticity encourages flexible consumption patterns across periods. |

| Relevance | Important in models of consumption, savings, and discounting in macroeconomics. | Key in life-cycle and permanent income hypotheses and investment decisions. |

Introduction to Time Preference and Intertemporal Substitution

Time preference refers to an individual's preference for immediate rewards over future gains, influencing choices across different time periods. Intertemporal substitution describes how individuals adjust their consumption or labor supply in response to changes in the relative returns of consuming at various times. Understanding these concepts is crucial for modeling decision-making in economics, particularly in saving behavior and investment over time.

Defining Time Preference: Core Concepts

Time preference refers to the degree to which individuals value present consumption over future consumption, reflecting their tendency to favor immediate rewards instead of delayed ones. It is a crucial factor in economic decision-making, influencing saving, investment, and consumption behaviors by determining the subjective discount rate applied to future utility. Understanding time preference helps explain why people might prefer smaller, sooner rewards rather than larger, later benefits, playing a vital role in intertemporal choice models and behavioral economics.

Understanding Intertemporal Substitution

Intertemporal substitution refers to how individuals adjust their consumption and labor decisions over time in response to changes in the relative price of current versus future consumption, typically influenced by interest rates. It highlights the trade-off between consuming today and saving for consumption tomorrow, emphasizing the elasticity of consumption with respect to the real interest rate. Understanding intertemporal substitution is crucial for analyzing consumer behavior, savings patterns, and the impact of fiscal and monetary policy on economic growth.

Key Differences Between Time Preference and Intertemporal Substitution

Time preference refers to an individual's intrinsic valuation of present consumption over future consumption, reflecting impatience or preference for immediacy. Intertemporal substitution captures how consumers adjust their consumption patterns over time in response to changes in the rate of return or interest rates, emphasizing flexibility rather than inherent preference. The key difference lies in time preference being a psychological bias towards present utility, while intertemporal substitution represents a responsive behavioral adjustment to economic incentives across different time periods.

How Economists Measure Time Preference

Economists measure time preference primarily through discount rates, which reflect individuals' willingness to trade off present consumption for future benefits. Experimental methods like time preference surveys and choice tasks assess how people value immediate versus delayed rewards, revealing their subjective discounting behavior. Intertemporal substitution elasticity is estimated by analyzing consumption patterns over time, showing how changes in interest rates influence the timing of consumption decisions.

The Role of Intertemporal Substitution in Economic Modeling

Intertemporal substitution plays a crucial role in economic modeling by capturing how individuals adjust their consumption over time in response to changes in the real interest rate, reflecting preferences for current versus future consumption. Unlike time preference, which represents an inherent rate of impatience or discounting of future utility, intertemporal substitution measures the elasticity of consumption growth relative to the intertemporal rate of substitution. Incorporating intertemporal substitution into models allows economists to better predict household behavior under varying economic conditions and to analyze policy impacts on savings and consumption dynamics.

Factors Influencing Individual Time Preferences

Individual time preferences are influenced by factors such as age, income levels, and psychological traits like impulsivity and self-control. Economic conditions, including interest rates and inflation, affect how individuals weigh present versus future consumption. Cultural norms and education also shape the degree to which individuals engage in intertemporal substitution by valuing immediate rewards against future benefits.

Applications in Personal Finance and Investment Decisions

Time preference reflects an individual's inclination to favor immediate rewards over future gains, impacting savings behavior and consumption patterns. Intertemporal substitution describes how changes in interest rates influence the timing of consumption and investment, prompting shifts between present and future financial decisions. Understanding these concepts aids in optimizing personal finance strategies by balancing current spending with long-term investment growth and retirement planning.

Impacts on Macroeconomic Policy and Social Planning

Time preference, reflecting individuals' valuation of present consumption over future consumption, directly influences saving rates and investment, shaping macroeconomic policy decisions on fiscal stimulus and interest rate adjustments. Intertemporal substitution, the responsiveness of labor supply and consumption choices to changes in intertemporal prices, affects the effectiveness of policies targeting labor market flexibility and consumption smoothing. Understanding the interaction between these concepts enables policymakers to design social planning initiatives that balance short-term welfare with long-term economic growth and stability.

Future Research Directions and Contemporary Debates

Future research directions in time preference versus intertemporal substitution emphasize refining behavioral models that capture individual heterogeneity in discount rates and consumption smoothing. Contemporary debates revolve around integrating neuroeconomic findings with macroeconomic frameworks to better understand decision-making under uncertainty and the role of cognitive biases. Advancements in experimental economics and longitudinal data analysis are expected to enhance policy implications related to savings, investment, and sustainable consumption.

Time preference Infographic

libterm.com

libterm.com