Economic recessions cause widespread job losses and reduced consumer spending, impacting various industries and financial markets. Understanding the signs and preparing your finances can help mitigate the challenges during these downturns. Explore this article to learn effective strategies for navigating a recession successfully.

Table of Comparison

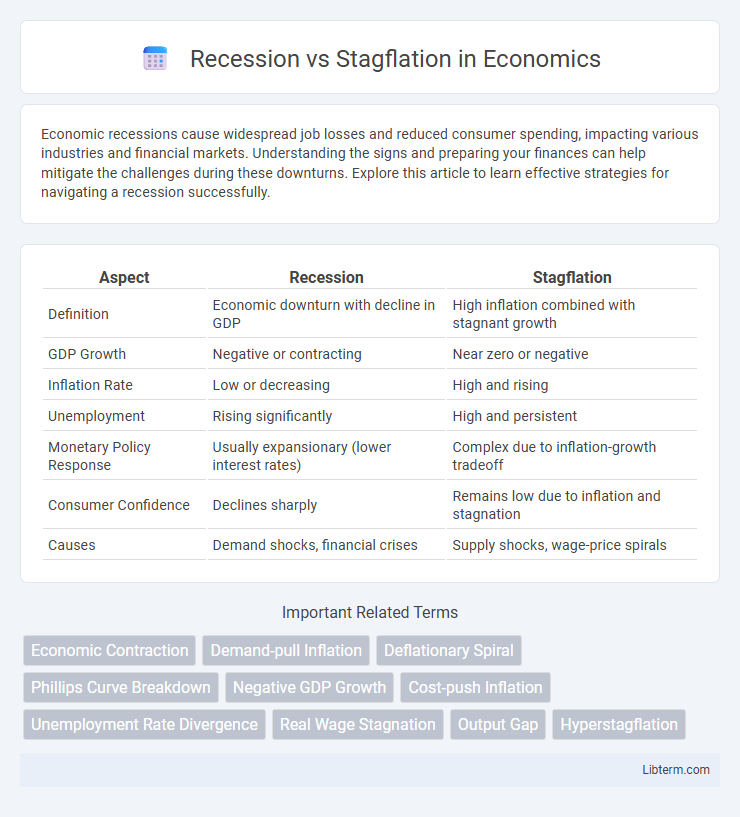

| Aspect | Recession | Stagflation |

|---|---|---|

| Definition | Economic downturn with decline in GDP | High inflation combined with stagnant growth |

| GDP Growth | Negative or contracting | Near zero or negative |

| Inflation Rate | Low or decreasing | High and rising |

| Unemployment | Rising significantly | High and persistent |

| Monetary Policy Response | Usually expansionary (lower interest rates) | Complex due to inflation-growth tradeoff |

| Consumer Confidence | Declines sharply | Remains low due to inflation and stagnation |

| Causes | Demand shocks, financial crises | Supply shocks, wage-price spirals |

Understanding Recession: Definition and Causes

Recession is defined as a significant decline in economic activity across the economy lasting more than a few months, typically visible in GDP, income, employment, industrial production, and retail sales. It is primarily caused by factors such as reduced consumer demand, high-interest rates, decreased investment, or external shocks like financial crises. Understanding these causes helps in distinguishing recession from stagflation, where inflation rises alongside stagnant economic growth.

What Is Stagflation? Key Characteristics

Stagflation is an economic condition characterized by stagnant growth, high unemployment, and persistent inflation occurring simultaneously. Unlike a typical recession marked by declining economic output and rising unemployment without inflation, stagflation combines economic stagnation with soaring prices, creating a challenging environment for policymakers. Key characteristics include slow GDP growth, rising consumer prices, and increased joblessness, often driven by supply shocks or poor monetary policies.

Historical Examples: Recession vs Stagflation

The Great Depression of the 1930s exemplifies a severe global recession with massive unemployment and economic contraction, while the 1970s oil crisis triggered stagflation, characterized by stagnant economic growth, high inflation, and rising unemployment simultaneously. During the 1970s stagflation, economies struggled as traditional Keynesian policies failed to address the inflation-unemployment trade-off, contrasting sharply with the recovery-focused measures during typical recessions like the 2008 financial crisis. Historical data highlights that recessions involve primarily output decline and job losses, whereas stagflation combines economic stagnation with inflationary pressures, complicating policy responses.

Economic Indicators: How to Identify Each

Recession is identified by a prolonged decline in GDP, rising unemployment rates, and decreased consumer spending, signaling a slowdown in economic activity. Stagflation combines stagnant economic growth with high inflation rates and persistent unemployment, marked by rising consumer price indices alongside flat or negative GDP growth. Monitoring inflation rates, GDP data, and labor market statistics helps differentiate between recession and stagflation conditions effectively.

Causes Behind Recessions and Stagflation

Recessions are primarily caused by a significant decline in consumer demand, tightening of monetary policy, or external shocks like financial crises, leading to reduced economic output and rising unemployment. Stagflation occurs when an economy experiences stagnant growth coupled with high inflation, often triggered by supply-side shocks such as rising oil prices or disrupted supply chains while monetary policy fails to contain inflation without worsening unemployment. Understanding these distinct causes is crucial for policymakers to tailor interventions that address either demand-side contractions or supply-side constraints effectively.

Impacts on Employment and Wages

Recession typically leads to rising unemployment as businesses reduce hiring or lay off workers due to decreased demand, causing wages to stagnate or decline. Stagflation combines high inflation with stagnant economic growth, resulting in both rising unemployment and eroding real wages as price increases outpace wage growth. The dual pressures in stagflation make job market recovery slower and wage improvements more difficult compared to a standard recession.

Inflation Trends: Contrasts and Comparisons

Inflation trends during a recession typically show a decline or stabilization as consumer demand and spending slow down, leading to reduced price pressures. In contrast, stagflation combines stagnant economic growth with persistent, high inflation rates, creating a unique environment where inflation rises despite low demand and high unemployment. These divergent inflation patterns highlight the fundamental economic differences between recessionary periods and stagflation scenarios.

Policy Responses: Government and Central Bank Actions

Government and central bank actions during recession and stagflation differ significantly due to their distinct economic challenges; recessions typically prompt expansionary fiscal policies and monetary easing, including interest rate cuts and increased government spending to stimulate demand. In contrast, stagflation requires a delicate balance of tightening monetary policy to control inflation while avoiding deepening unemployment, often involving targeted fiscal measures aimed at structural reforms and supply-side improvements. Central banks may face a policy dilemma under stagflation, as traditional tools to curb inflation can exacerbate economic contraction, necessitating coordinated approaches between monetary and fiscal authorities.

Investor Strategies During Recession vs Stagflation

Investor strategies during a recession prioritize capital preservation and liquidity by increasing allocation to defensive sectors such as utilities and consumer staples while reducing exposure to cyclical stocks. In contrast, during stagflation, characterized by rising inflation and stagnant growth, investors seek assets that hedge against inflation, including commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). Diversification across inflation-resistant asset classes and maintaining some cash reserves are critical tactics to navigate the unique challenges posed by both economic conditions.

Long-Term Economic Consequences and Recovery Paths

Recession typically leads to short-term economic contraction with potential for swift recovery through monetary stimulus and increased consumer spending, while stagflation combines slow growth, high inflation, and unemployment, creating prolonged economic stagnation and challenging traditional recovery methods. Long-term consequences of stagflation include diminished investment, eroded purchasing power, and persistent labor market inefficiencies, complicating policy responses and delaying economic stabilization. Recovery paths from stagflation require balanced fiscal discipline and structural reforms to address inflationary pressures without deepening unemployment, unlike recession strategies that prioritize demand stimulation.

Recession Infographic

libterm.com

libterm.com