Structural policy focuses on long-term changes to improve economic efficiency and competitiveness by adjusting the organization of markets, industries, and public institutions. It targets labor market reforms, innovation incentives, and infrastructure investments to foster sustainable growth and reduce regional disparities. Explore the article to understand how structural policy can shape your economic environment and future opportunities.

Table of Comparison

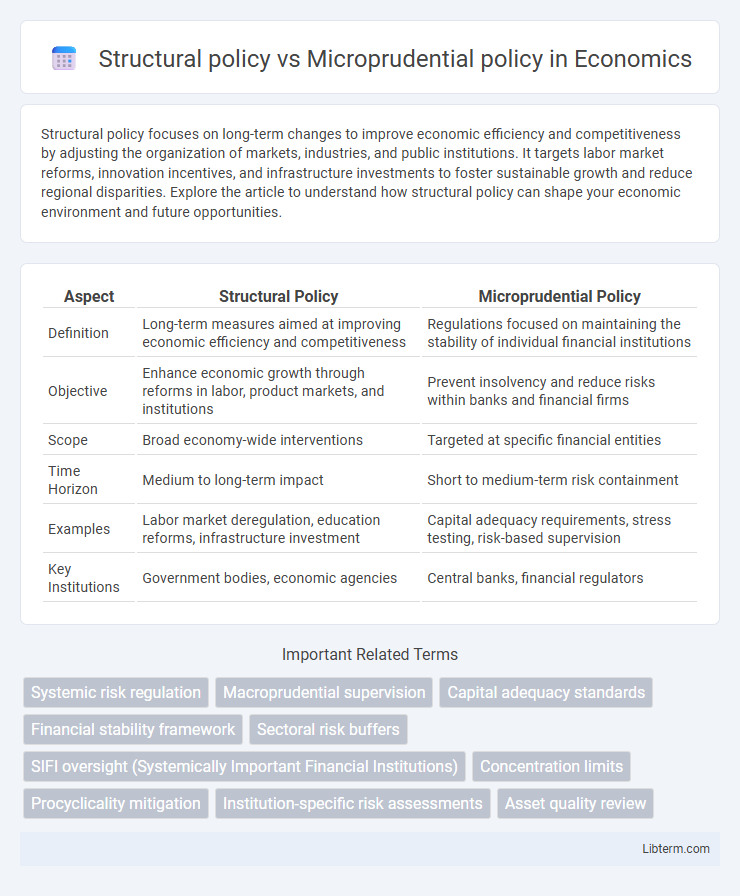

| Aspect | Structural Policy | Microprudential Policy |

|---|---|---|

| Definition | Long-term measures aimed at improving economic efficiency and competitiveness | Regulations focused on maintaining the stability of individual financial institutions |

| Objective | Enhance economic growth through reforms in labor, product markets, and institutions | Prevent insolvency and reduce risks within banks and financial firms |

| Scope | Broad economy-wide interventions | Targeted at specific financial entities |

| Time Horizon | Medium to long-term impact | Short to medium-term risk containment |

| Examples | Labor market deregulation, education reforms, infrastructure investment | Capital adequacy requirements, stress testing, risk-based supervision |

| Key Institutions | Government bodies, economic agencies | Central banks, financial regulators |

Understanding Structural Policy: A Macroprudential Perspective

Structural policy in the context of macroprudential regulation addresses systemic risks by enhancing the resilience of the entire financial system through measures such as capital buffers, countercyclical capital requirements, and sectoral risk controls. Unlike microprudential policy, which targets the stability of individual financial institutions by enforcing standards like minimum capital ratios and liquidity requirements, structural policy focuses on mitigating interconnected risks that can trigger widespread financial instability. Effective macroprudential structural policies involve monitoring systemic vulnerabilities and implementing macro-level interventions to prevent the amplification of shocks across the financial network.

What is Microprudential Policy? Key Principles and Goals

Microprudential policy concentrates on the stability and soundness of individual financial institutions to prevent their failure and protect depositors. Key principles include risk-based supervision, capital adequacy, and early intervention to manage institution-specific risks effectively. The primary goal is to safeguard consumer confidence and ensure the resilience of each entity within the financial system.

Main Objectives: Structural vs. Microprudential Policies

Structural policy primarily aims to enhance the overall stability and efficiency of the financial system by addressing systemic risks and promoting long-term economic growth. Microprudential policy focuses on the soundness and resilience of individual financial institutions to prevent failures and protect depositors. While structural policy targets broad market and macroeconomic factors, microprudential policy deals with institution-specific risk management and regulatory compliance.

Core Differences Between Structural and Microprudential Approaches

Structural policy targets systemic risks and aims to enhance the resilience of the entire financial system through macro-level regulations and reforms, such as capital adequacy frameworks and macroprudential buffers. Microprudential policy focuses on the soundness of individual financial institutions by enforcing risk management practices, supervision, and compliance to prevent insolvency or failure. The core difference lies in their scope: structural policies address aggregate financial stability, while microprudential policies ensure the robustness of each entity within the financial system.

Regulatory Tools Used in Structural Policy

Structural policy employs regulatory tools such as capital adequacy requirements, liquidity ratios, and macroprudential buffers to enhance systemic stability and reduce financial vulnerabilities. It emphasizes broad, economy-wide measures like countercyclical capital buffers and sectoral capital requirements to address systemic risks and promote long-term resilience. These tools differ from microprudential policies, which focus on the health and risk management of individual financial institutions.

Microprudential Instruments and Their Applications

Microprudential policy centers on safeguarding the stability of individual financial institutions through instruments such as capital adequacy requirements, loan loss provisioning, and stress testing. These tools are applied to monitor and mitigate risks like credit risk, market risk, and operational risk at the institution level, ensuring solvency and resilience against economic shocks. Effective microprudential regulation prevents contagion effects and supports the soundness of the financial system by promoting prudent risk management and regulatory compliance.

Risk Management: Systemic vs. Institution-Specific Focus

Structural policy targets systemic risk by enhancing the resilience of the entire financial system through macroprudential tools, addressing vulnerabilities that could trigger widespread instability. Microprudential policy concentrates on institution-specific risk management, ensuring individual financial entities maintain adequate capital and risk controls to prevent failure. Effective risk management requires a balanced integration of both approaches to mitigate contagion and safeguard overall economic stability.

Impacts on Financial Stability: Comparative Analysis

Structural policy influences financial stability by shaping the broader economic framework, including market regulations, institutional arrangements, and systemic risk management, leading to long-term resilience against crises. Microprudential policy targets individual financial institutions' risk exposures and capital adequacy, aiming to prevent insolvency and maintain soundness at the firm level. The comparative impact reveals structural policy mitigates systemic vulnerabilities, while microprudential policy confines risks within entities, both essential for an integrated financial stability strategy.

Challenges in Coordinating Structural and Microprudential Policies

Coordinating structural and microprudential policies presents challenges due to differing objectives; structural policy aims to enhance overall financial stability by addressing systemic risks, while microprudential policy focuses on the soundness of individual institutions. Divergent time horizons and regulatory scopes complicate the alignment of measures, potentially causing regulatory gaps or overlaps that reduce effectiveness. Effective coordination requires integrated frameworks that balance macro-level stability goals with micro-level risk controls to mitigate systemic vulnerabilities without stifling financial innovation.

Future Trends in Structural and Microprudential Policy Development

Future trends in structural policy emphasize enhancing systemic resilience through macroeconomic adjustments and regulatory reforms aimed at long-term stability. Microprudential policy development focuses on improving risk assessment tools and supervisory practices to strengthen individual financial institutions' soundness. Integration of advanced data analytics and stress-testing methodologies is expected to drive innovation in both structural and microprudential frameworks.

Structural policy Infographic

libterm.com

libterm.com