Time value refers to the additional amount an investor is willing to pay for an option above its intrinsic value, reflecting the potential for future profit due to time remaining until expiration. This concept is crucial in options trading as it quantifies the premium linked to the possibility of favorable price movements before the option expires. Explore the rest of the article to deepen your understanding of how time value impacts your investment strategies.

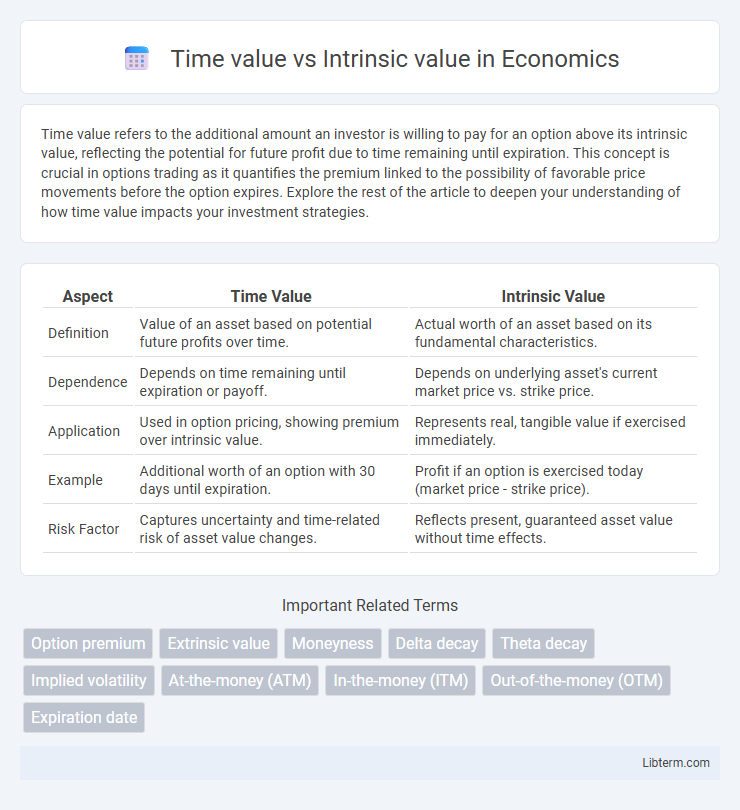

Table of Comparison

| Aspect | Time Value | Intrinsic Value |

|---|---|---|

| Definition | Value of an asset based on potential future profits over time. | Actual worth of an asset based on its fundamental characteristics. |

| Dependence | Depends on time remaining until expiration or payoff. | Depends on underlying asset's current market price vs. strike price. |

| Application | Used in option pricing, showing premium over intrinsic value. | Represents real, tangible value if exercised immediately. |

| Example | Additional worth of an option with 30 days until expiration. | Profit if an option is exercised today (market price - strike price). |

| Risk Factor | Captures uncertainty and time-related risk of asset value changes. | Reflects present, guaranteed asset value without time effects. |

Introduction to Time Value and Intrinsic Value

Time value represents the portion of an option's premium that exceeds its intrinsic value, reflecting the potential for further profit before expiration. Intrinsic value measures the immediate financial benefit of exercising an option, calculated as the difference between the underlying asset's current price and the option's strike price. Understanding the distinction between time value and intrinsic value is crucial for options traders assessing risk and reward in market strategies.

Defining Intrinsic Value

Intrinsic value represents the actual worth of an option if exercised immediately, calculated as the difference between the underlying asset's current price and the option's strike price. It measures the tangible profit potential inherent in the option without considering expiration time or market volatility. Time value, on the other hand, reflects the extra premium based on the remaining duration until expiration and expected price fluctuations.

Understanding Time Value

Time value represents the portion of an option's price that exceeds its intrinsic value, reflecting the potential for future profitability before expiration. It depends on factors such as volatility, time remaining until expiration, and interest rates, which influence the likelihood of the option becoming more valuable. Understanding time value enables traders to assess the risk and reward dynamics of options more effectively, optimizing strategic decisions in options trading.

Key Differences Between Time Value and Intrinsic Value

Time value represents the portion of an option's premium that exceeds its intrinsic value, reflecting the potential for further profit before expiration. Intrinsic value measures the immediate, tangible profit if the option were exercised today, calculated as the difference between the asset's current price and the option's strike price. Key differences include that intrinsic value can never be negative and is directly tied to the asset's price, whereas time value diminishes as the option approaches expiration and accounts for volatility and time remaining.

Why Time Value Matters in Options Pricing

Time value in options pricing represents the premium buyers are willing to pay over the intrinsic value due to the potential for future gains before expiration. It reflects the uncertainty and volatility of the underlying asset, making it a crucial factor in determining an option's market price. Understanding time value helps traders evaluate the risk and potential reward, influencing strategic decisions in options trading.

Calculating Intrinsic Value: Step-by-Step

Calculating intrinsic value involves determining the difference between an option's strike price and the underlying asset's current market price, considering only profitable scenarios for the option holder. For a call option, intrinsic value equals the current stock price minus the strike price if this result is positive; otherwise, it is zero. For a put option, intrinsic value is calculated as the strike price minus the current stock price when this value is positive, or zero if negative, reflecting the option's real, immediate exercise value.

Factors Affecting Time Value

Time value of an option reflects the premium investors are willing to pay above its intrinsic value, influenced by factors such as time until expiration, volatility of the underlying asset, and prevailing interest rates. Longer expiration periods increase the likelihood of profitable price movements, elevating time value, while higher volatility amplifies potential gains, further boosting the time premium. Interest rates impact the cost of carrying the underlying asset, subtly affecting time value through the cost-of-carry effect.

Real-World Examples: Time Value vs Intrinsic Value

In options trading, intrinsic value represents the immediate profit potential of an option, such as a call option with a strike price of $50 when the underlying stock is priced at $60, yielding an intrinsic value of $10. Time value reflects the additional premium traders are willing to pay based on the remaining time until expiration and market volatility, often seen in out-of-the-money options like a $55 call on the same stock trading at $60, where the total premium exceeds intrinsic value. Real-world examples include options nearing expiration, where time value diminishes and intrinsic value dominates the option price, contrasting with long-dated options that maintain substantial time value despite lower or no intrinsic value.

Strategic Uses for Time Value and Intrinsic Value

Time value in options trading reflects the potential for an asset's price to move favorably before expiration, making it crucial for strategies like buying call or put options to capitalize on volatility and market timing. Intrinsic value represents the immediate profit potential if the option were exercised, guiding decisions in exercises, assignments, or rolling positions to lock in gains or limit losses. Strategic use of time value involves managing decay and leveraging market momentum, while intrinsic value insights optimize entry and exit points for maximizing realized returns.

Common Mistakes in Evaluating Option Values

Confusing time value with intrinsic value often leads to inaccurate option pricing, as intrinsic value reflects the immediate exercise profit while time value accounts for potential future gains influenced by volatility and time until expiration. Many investors mistakenly overlook the impact of implied volatility and remaining contract duration, causing misjudgment of an option's market worth beyond its intrinsic value. Proper evaluation requires distinguishing intrinsic value as the baseline and recognizing time value as a premium shaped by market expectations and risk factors.

Time value Infographic

libterm.com

libterm.com