Monte Carlo Simulation uses random sampling and statistical modeling to estimate complex probabilities and forecast potential outcomes across various fields like finance, engineering, and science. This technique helps you analyze risk and uncertainty by generating numerous scenarios, providing valuable insights for decision-making. Explore the rest of the article to learn how Monte Carlo Simulation can enhance your predictive analytics and strategic planning.

Table of Comparison

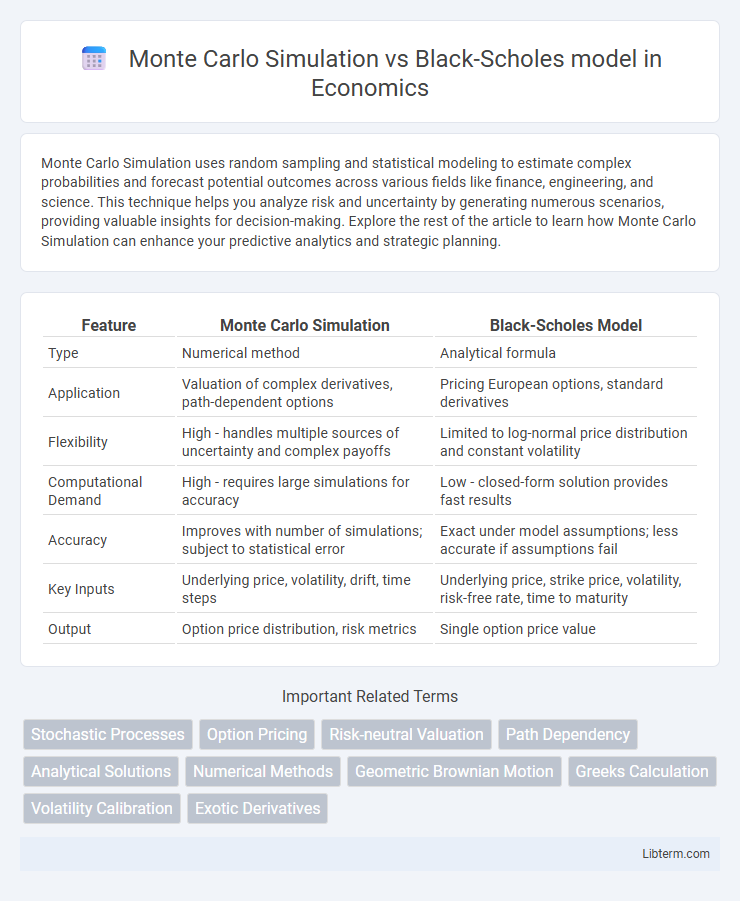

| Feature | Monte Carlo Simulation | Black-Scholes Model |

|---|---|---|

| Type | Numerical method | Analytical formula |

| Application | Valuation of complex derivatives, path-dependent options | Pricing European options, standard derivatives |

| Flexibility | High - handles multiple sources of uncertainty and complex payoffs | Limited to log-normal price distribution and constant volatility |

| Computational Demand | High - requires large simulations for accuracy | Low - closed-form solution provides fast results |

| Accuracy | Improves with number of simulations; subject to statistical error | Exact under model assumptions; less accurate if assumptions fail |

| Key Inputs | Underlying price, volatility, drift, time steps | Underlying price, strike price, volatility, risk-free rate, time to maturity |

| Output | Option price distribution, risk metrics | Single option price value |

Introduction to Financial Modeling Techniques

Monte Carlo Simulation leverages random sampling to model and analyze complex financial systems and derivatives, capturing a wide range of possible outcomes and uncertainties in asset prices. The Black-Scholes model provides a closed-form analytical solution for pricing European options based on assumptions like constant volatility and risk-free rates. Combining these financial modeling techniques enhances risk assessment and option pricing accuracy in dynamic market conditions.

Overview of the Monte Carlo Simulation

Monte Carlo Simulation is a numerical method used to model the probability of different outcomes in processes that involve uncertainty, making it highly effective for valuing complex financial derivatives and assessing risk. Unlike the Black-Scholes model, which provides closed-form solutions for European options under specific assumptions, Monte Carlo Simulation can handle a wider range of payoff structures, path dependencies, and stochastic processes. Its flexibility and ability to incorporate real-world complexities make it an essential tool in modern quantitative finance for option pricing and risk management.

Fundamentals of the Black-Scholes Model

The Black-Scholes model is based on the assumption of a constant volatility and a lognormal distribution of stock prices, enabling the analytical pricing of European options through a partial differential equation. It relies on key parameters such as the risk-free interest rate, time to maturity, and the underlying asset's current price to derive option prices. Unlike Monte Carlo simulation, which uses stochastic sampling to approximate option values, the Black-Scholes model provides closed-form solutions under idealized market conditions.

Key Assumptions of Monte Carlo and Black-Scholes

Monte Carlo Simulation assumes stochastic processes with the ability to model complex, path-dependent options by simulating numerous possible price paths, capturing volatility and randomness over time. The Black-Scholes model relies on assumptions of constant volatility, log-normal distribution of asset prices, no dividends, risk-free rate constancy, and frictionless markets with continuous trading. These fundamental differences influence the choice between Monte Carlo's flexible scenario analysis and Black-Scholes' closed-form analytical solutions for option pricing.

Mathematical Foundations Compared

Monte Carlo Simulation relies on stochastic processes and repeated random sampling to numerically estimate the expected value of option payoffs under various possible future asset price paths, embodying the law of large numbers for convergence. In contrast, the Black-Scholes model derives a closed-form analytical solution based on the partial differential equation formed from geometric Brownian motion assumptions, utilizing Ito's Lemma and risk-neutral valuation. The Monte Carlo method offers flexibility in handling complex derivative features, whereas Black-Scholes depends on strict assumptions such as constant volatility and log-normal distribution of returns.

Application in Option Pricing

Monte Carlo Simulation uses random sampling to model numerous possible price paths for an underlying asset, providing flexibility in pricing complex options with path-dependent or American-style features. The Black-Scholes model offers a closed-form analytical solution based on assumptions of constant volatility and log-normal price distribution, ideal for European options with simpler payoff structures. For scenarios involving early exercise opportunities or stochastic volatility, Monte Carlo Simulation often delivers more accurate and adaptable option pricing results.

Advantages and Limitations of Monte Carlo Simulation

Monte Carlo Simulation offers advantages such as its flexibility to model complex derivatives and accommodate multiple sources of uncertainty, making it ideal for pricing path-dependent options. It excels in scenarios with high-dimensional problems where analytical methods like Black-Scholes fall short. However, Monte Carlo Simulation is computationally intensive and may require a large number of simulations to achieve accuracy, which can lead to slower performance compared to the closed-form solutions provided by the Black-Scholes model.

Strengths and Weaknesses of the Black-Scholes Model

The Black-Scholes model excels in providing closed-form solutions for European option pricing, enabling quick and straightforward valuation under assumptions of constant volatility and risk-free rate. However, its weaknesses include sensitivity to market anomalies such as volatility smiles, inability to accurately price American options or options with early exercise features, and reliance on assumptions like lognormal asset returns and frictionless markets that often do not hold in real-world conditions. Compared to Monte Carlo simulation, which can handle complex derivatives and path-dependent features more flexibly, Black-Scholes is less adaptable to scenarios involving stochastic volatility or jumps in asset prices.

Use Cases: When to Choose Monte Carlo vs Black-Scholes

Monte Carlo simulation excels in pricing complex derivatives with path-dependent features or when multiple sources of uncertainty interact, such as American options or exotic derivatives. The Black-Scholes model is more suitable for plain vanilla European options with constant volatility and interest rates, providing quick and analytically tractable solutions. Choosing between these methods depends on the derivative's complexity, payoff structure, and computational resources available.

Summary and Future Trends in Financial Modeling

Monte Carlo Simulation offers flexible, stochastic modeling of asset price paths, accommodating complex derivatives and path-dependent options, while the Black-Scholes model provides a closed-form solution under assumptions of constant volatility and log-normal price distribution. Recent advancements integrate machine learning algorithms to enhance the calibration of Monte Carlo methods and extend the Black-Scholes framework to incorporate stochastic volatility and jumps, improving accuracy in turbulent markets. Future financial modeling trends emphasize hybrid models combining Monte Carlo simulation's adaptability with Black-Scholes analytical efficiency, alongside increased use of high-performance computing and quantum algorithms to manage computational complexity.

Monte Carlo Simulation Infographic

libterm.com

libterm.com