Risk arbitrage involves capitalizing on price discrepancies that occur during mergers and acquisitions, aiming to profit from the successful completion of a deal. This investment strategy requires careful analysis of regulatory approvals, financial health, and market conditions to assess potential risks and rewards accurately. Explore the rest of the article to understand how you can leverage risk arbitrage for your investment portfolio.

Table of Comparison

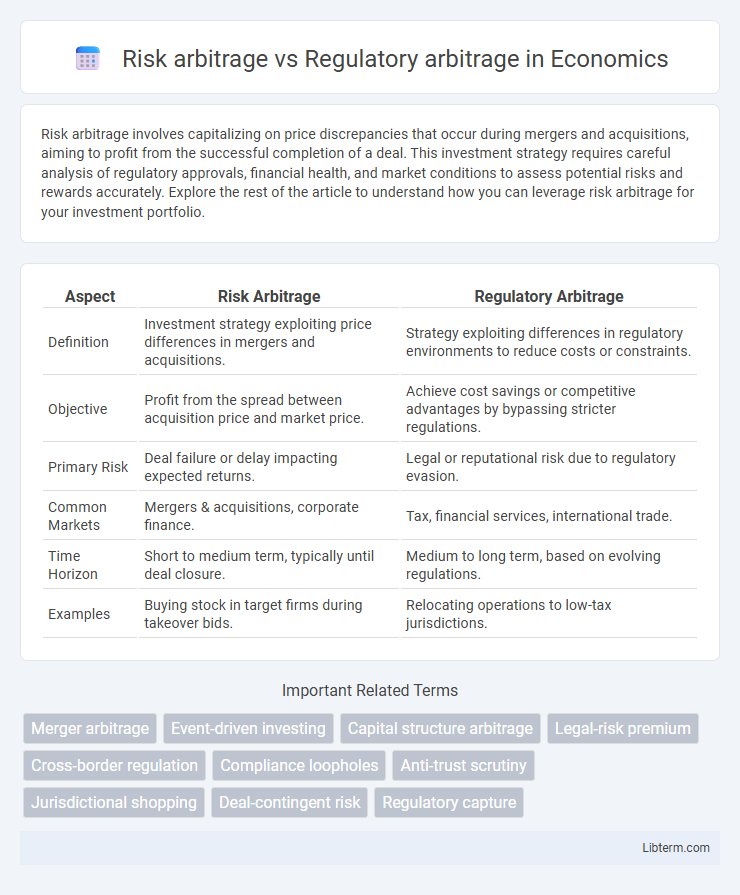

| Aspect | Risk Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Investment strategy exploiting price differences in mergers and acquisitions. | Strategy exploiting differences in regulatory environments to reduce costs or constraints. |

| Objective | Profit from the spread between acquisition price and market price. | Achieve cost savings or competitive advantages by bypassing stricter regulations. |

| Primary Risk | Deal failure or delay impacting expected returns. | Legal or reputational risk due to regulatory evasion. |

| Common Markets | Mergers & acquisitions, corporate finance. | Tax, financial services, international trade. |

| Time Horizon | Short to medium term, typically until deal closure. | Medium to long term, based on evolving regulations. |

| Examples | Buying stock in target firms during takeover bids. | Relocating operations to low-tax jurisdictions. |

Understanding Risk Arbitrage

Risk arbitrage, also known as merger arbitrage, involves capitalizing on price discrepancies during mergers and acquisitions by buying shares of the target company and often short-selling the acquirer's stock to profit from the spread. This strategy hinges on the successful completion of corporate deals and requires thorough analysis of deal terms, regulatory approvals, and market reactions to mitigate risks. Investors must carefully evaluate event-driven factors and potential deal breakpoints to effectively manage exposure in risk arbitrage.

Defining Regulatory Arbitrage

Regulatory arbitrage refers to the strategic practice where companies exploit differences in regulations between jurisdictions to minimize regulatory burdens and maximize financial gains. Unlike risk arbitrage, which involves profiting from corporate events like mergers or acquisitions, regulatory arbitrage focuses on navigating and leveraging variations in legal frameworks to reduce compliance costs or avoid restrictive rules. This tactic often leads firms to operate in less regulated environments or structure transactions to benefit from favorable regulatory conditions.

Key Differences Between Risk and Regulatory Arbitrage

Risk arbitrage involves exploiting price inefficiencies during corporate events such as mergers and acquisitions, focusing on market risk and potential profit from deal outcomes. Regulatory arbitrage aims to capitalize on discrepancies in regulatory frameworks across jurisdictions, allowing firms to minimize legal or compliance costs. The key difference lies in risk arbitrage targeting financial event-driven opportunities, while regulatory arbitrage centers on navigating and benefiting from regulatory environments.

Mechanisms of Risk Arbitrage

Risk arbitrage relies on exploiting price discrepancies during merger and acquisition events by purchasing shares of target companies below the anticipated acquisition price, profiting when the deal closes successfully. This strategy involves analyzing deal terms, regulatory approvals, and market sentiment to assess deal completion likelihood and timing, thereby managing inherent merger risks. Traders use hedging techniques, such as shorting the acquirer's stock, to mitigate exposure to deal failure or delays, optimizing returns through precise event-driven timing.

How Regulatory Arbitrage Operates

Regulatory arbitrage operates by exploiting differences in regulatory frameworks across jurisdictions to reduce compliance costs and maximize profits. Companies strategically shift operations, transactions, or financial activities to regions with more favorable regulations, thereby gaining competitive advantages. This practice often involves complex structuring to bypass stricter rules without violating the formal letter of the law.

Benefits and Drawbacks of Risk Arbitrage

Risk arbitrage offers significant benefits such as potential high returns from exploiting price discrepancies during mergers and acquisitions, along with portfolio diversification by investing in event-driven strategies. However, the drawbacks include high risk due to deal uncertainty, regulatory hurdles that can delay or cancel transactions, and vulnerability to market volatility impacting asset prices. Unlike regulatory arbitrage, which aims to exploit differences in regulatory regimes to reduce compliance costs, risk arbitrage demands deep market analysis and carries substantial execution risk.

Risks and Rewards of Regulatory Arbitrage

Regulatory arbitrage involves exploiting differences in regulatory frameworks to reduce costs or gain competitive advantages, but it carries risks such as increased legal scrutiny, potential penalties, and reputational damage. The rewards of regulatory arbitrage include lower compliance costs, enhanced profitability, and access to markets with more favorable regulatory conditions. Firms engaging in regulatory arbitrage must balance these benefits against the risks of regulatory changes, enforcement actions, and loss of stakeholder trust.

Impact on Financial Markets

Risk arbitrage influences financial markets by exploiting price inefficiencies during mergers and acquisitions, often increasing market liquidity and volatility due to speculative trading. Regulatory arbitrage impacts markets by shifting activities to jurisdictions with more favorable rules, potentially undermining regulatory oversight and causing capital flow distortions. Both strategies affect market stability and investor behavior but operate through different mechanisms related to risk and compliance frameworks.

Regulatory Responses and Legal Implications

Regulatory responses to risk arbitrage often involve enhanced disclosure requirements and tightened oversight by securities regulators to prevent market manipulation and protect investors. In contrast, regulatory arbitrage triggers authorities to close loopholes and harmonize cross-border regulations, aiming to curb firms exploiting jurisdictional differences for competitive advantage. Legal implications in risk arbitrage include potential securities fraud lawsuits, while regulatory arbitrage may result in complex compliance challenges and increased risk of sanctions due to breaches in divergent regulatory frameworks.

Future Trends in Arbitrage Strategies

Risk arbitrage strategies are evolving with increased use of artificial intelligence to better predict merger outcomes and optimize trade executions, enhancing returns while managing uncertainties. Regulatory arbitrage continues to adapt as financial institutions leverage digital assets and cross-border regulatory disparities to minimize compliance costs and capitalize on variations in financial regulations. Future trends indicate a convergence where technology-driven insights enable dynamic arbitrage approaches, blending risk and regulatory considerations to identify more sophisticated and adaptive investment opportunities.

Risk arbitrage Infographic

libterm.com

libterm.com