Debt restructuring offers a strategic solution for companies and individuals facing financial challenges by renegotiating terms to reduce debt burden, improve cash flow, and avoid bankruptcy. It involves adjusting interest rates, extending payment deadlines, or converting debt into equity to create manageable repayment plans. Explore this article to understand how debt restructuring can safeguard your financial future and the steps involved in the process.

Table of Comparison

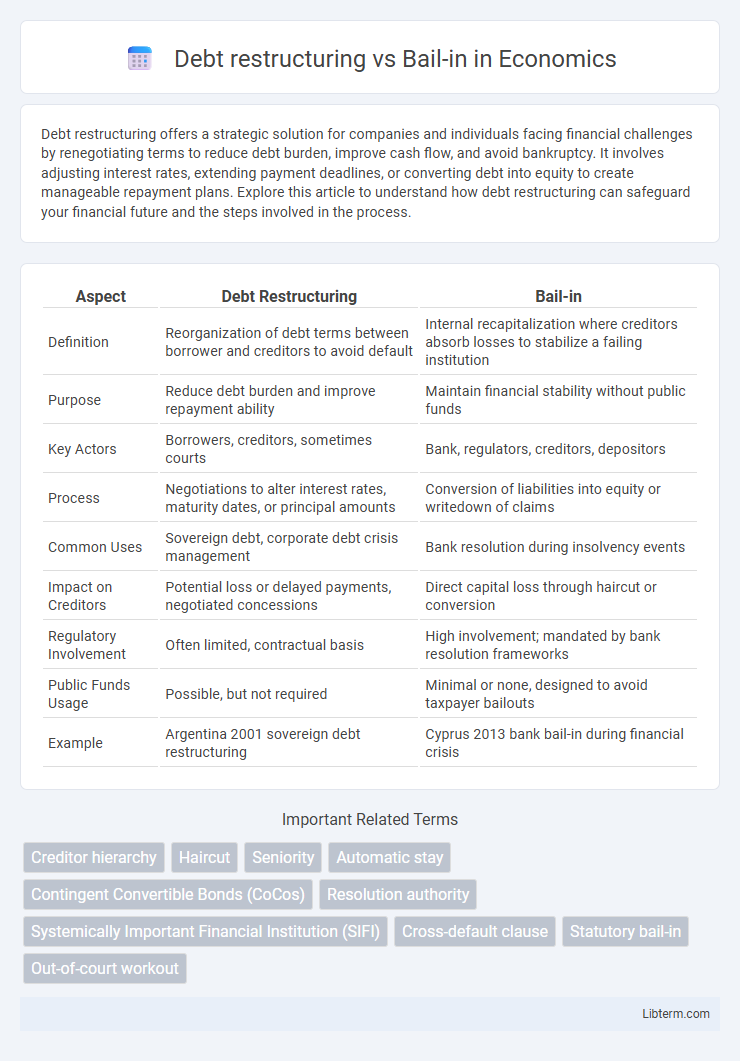

| Aspect | Debt Restructuring | Bail-in |

|---|---|---|

| Definition | Reorganization of debt terms between borrower and creditors to avoid default | Internal recapitalization where creditors absorb losses to stabilize a failing institution |

| Purpose | Reduce debt burden and improve repayment ability | Maintain financial stability without public funds |

| Key Actors | Borrowers, creditors, sometimes courts | Bank, regulators, creditors, depositors |

| Process | Negotiations to alter interest rates, maturity dates, or principal amounts | Conversion of liabilities into equity or writedown of claims |

| Common Uses | Sovereign debt, corporate debt crisis management | Bank resolution during insolvency events |

| Impact on Creditors | Potential loss or delayed payments, negotiated concessions | Direct capital loss through haircut or conversion |

| Regulatory Involvement | Often limited, contractual basis | High involvement; mandated by bank resolution frameworks |

| Public Funds Usage | Possible, but not required | Minimal or none, designed to avoid taxpayer bailouts |

| Example | Argentina 2001 sovereign debt restructuring | Cyprus 2013 bank bail-in during financial crisis |

Introduction to Debt Restructuring and Bail-in

Debt restructuring involves modifying the terms of existing debt agreements to improve a borrower's financial stability, often through extending payment deadlines, reducing interest rates, or writing off part of the debt. Bail-in is a financial mechanism where a failing bank's creditors and depositors take losses or convert debt into equity to recapitalize the institution without using public funds. Both approaches aim to manage financial distress but differ in their impact on creditors and systemic risk management strategies.

Defining Debt Restructuring

Debt restructuring involves renegotiating the terms of existing debt obligations to improve liquidity and avoid default, typically by adjusting interest rates, extending maturity dates, or reducing principal amounts. This process aims to provide financial relief to distressed borrowers while preserving creditor value. Unlike a bail-in, which forces creditors to absorb losses by converting debt into equity, debt restructuring is a consensual agreement between debtor and creditor.

Understanding the Bail-in Mechanism

The bail-in mechanism allows a failing financial institution to restructure its liabilities by converting debt into equity, thereby recapitalizing the bank without external taxpayer funding. This approach contrasts with traditional debt restructuring, which often involves negotiations to amend repayment terms or reduce debt burdens. Bail-ins prioritize protecting financial stability by imposing losses on creditors and shareholders rather than relying on government bailouts.

Key Differences: Debt Restructuring vs Bail-in

Debt restructuring involves renegotiating the terms of existing debt to provide relief to the borrower, often through extended deadlines, reduced interest rates, or partial debt forgiveness, primarily used to avoid default. A bail-in forces creditors and depositors to absorb losses by converting debt into equity or writing off debt during a financial crisis, aiming to stabilize banks without using taxpayer funds. The key difference lies in debt restructuring being a voluntary renegotiation process, while a bail-in is a compulsory regulatory intervention designed to restore a distressed financial institution's solvency.

Legal Frameworks and Regulatory Considerations

Debt restructuring involves negotiated adjustments to existing debt terms under bankruptcy laws or out-of-court frameworks, aiming to restore debtor solvency while protecting creditor rights within established commercial and insolvency statutes. Bail-in mechanisms are governed by specialized regulatory frameworks such as the EU Bank Recovery and Resolution Directive (BRRD) or the Dodd-Frank Act in the U.S., which empower regulators to write down or convert bank liabilities to absorb losses and stabilize financial institutions without taxpayer bailouts. Legal considerations for both emphasize creditor hierarchy, transparency, and compliance with insolvency and financial regulations to ensure orderly resolution and minimize systemic risk.

Stakeholders Impacted by Each Approach

Debt restructuring primarily affects creditors by altering the terms of debt repayment, often reducing principal or extending maturities to improve the debtor's financial stability, while shareholders may face dilution or losses. Bail-in mechanisms involve converting creditors' claims into equity or writing down debt, directly impacting bondholders and large depositors, but aiming to protect taxpayers and maintain financial system stability. Both approaches influence management decisions and can affect employee job security depending on the organization's financial health and operational continuity.

Pros and Cons of Debt Restructuring

Debt restructuring offers the advantage of improving a company's cash flow by extending payment terms or reducing interest rates, which can prevent insolvency and preserve stakeholder value. However, it may damage the company's credit rating and investor confidence, potentially increasing future borrowing costs. Unlike bail-ins, which impose losses directly on creditors, debt restructuring seeks negotiated solutions but can be time-consuming and may not fully restore financial stability.

Advantages and Disadvantages of Bail-ins

Bail-ins offer the advantage of minimizing taxpayer burden by requiring creditors and depositors to absorb losses during a financial crisis, preserving liquidity and stabilizing the distressed institution without external public funding. However, bail-ins carry the disadvantage of potentially undermining creditor confidence, leading to market instability and possible contagion effects as investors may perceive higher risks in the banking sector. The complexity of implementing bail-ins and legal uncertainties can delay resolution efforts, contrasting with debt restructuring, which often involves negotiated agreements but may be less effective in systemic crises.

Case Studies: Real-world Applications

Debt restructuring involves renegotiating terms between creditors and debtors to avoid default, exemplified by Greece's 2012 sovereign bond restructuring, which reduced debt burdens and extended maturities. Bail-in mechanisms, as seen in the Cyprus banking crisis of 2013, convert a portion of bank deposits into equity, stabilizing financial institutions without external bailouts. These case studies highlight how debt restructuring prioritizes creditor negotiations while bail-ins focus on internal recapitalization to maintain financial stability.

Choosing the Right Solution for Financial Distress

Debt restructuring involves modifying the terms of existing debt to provide relief to financially distressed entities, often through extended payment schedules or reduced interest rates. Bail-ins require creditors to absorb losses by converting debt into equity, stabilizing the institution without external bailout funds. Selecting the appropriate approach depends on the severity of financial distress, regulatory environment, and long-term viability of the organization.

Debt restructuring Infographic

libterm.com

libterm.com