The marginal tax rate determines the percentage of tax applied to your next dollar of income, impacting how much you take home as you earn more. Understanding this rate helps you plan finances, optimize tax strategies, and avoid surprises during tax season. Explore the rest of the article to see how marginal tax rates influence your overall tax burden and financial decisions.

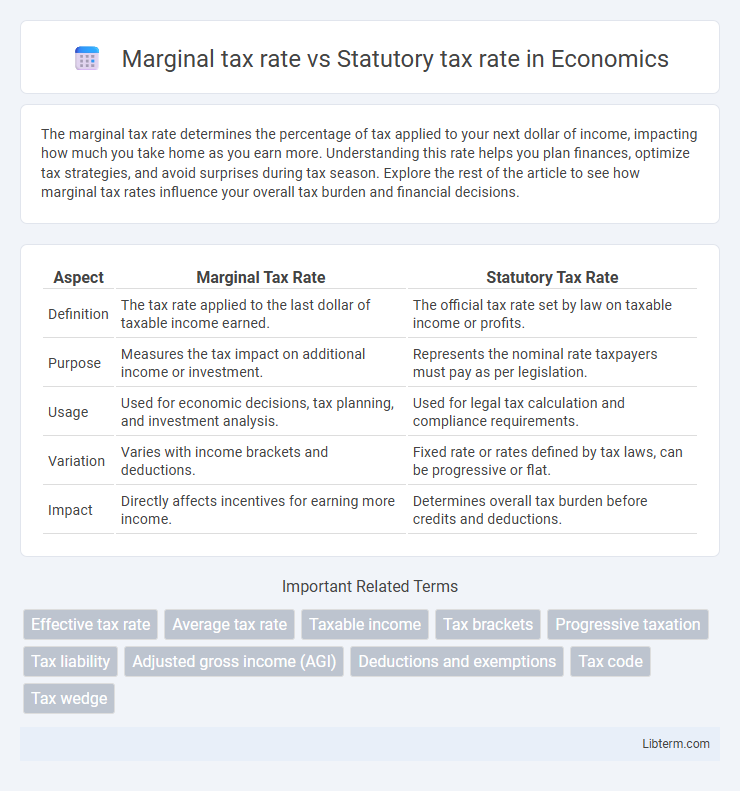

Table of Comparison

| Aspect | Marginal Tax Rate | Statutory Tax Rate |

|---|---|---|

| Definition | The tax rate applied to the last dollar of taxable income earned. | The official tax rate set by law on taxable income or profits. |

| Purpose | Measures the tax impact on additional income or investment. | Represents the nominal rate taxpayers must pay as per legislation. |

| Usage | Used for economic decisions, tax planning, and investment analysis. | Used for legal tax calculation and compliance requirements. |

| Variation | Varies with income brackets and deductions. | Fixed rate or rates defined by tax laws, can be progressive or flat. |

| Impact | Directly affects incentives for earning more income. | Determines overall tax burden before credits and deductions. |

Introduction to Marginal and Statutory Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of a person's or corporation's income, highlighting the additional tax due on incremental earnings. Statutory tax rate is the legally mandated rate set by tax authorities, representing the official tax percentage before deductions and credits. Understanding the distinction is crucial for tax planning, as marginal rates affect decision-making on earnings and investments, while statutory rates indicate the baseline tax liability.

Defining Marginal Tax Rate

The marginal tax rate refers to the percentage of tax applied to the last dollar of an individual's or corporation's income, reflecting how much tax is paid on additional earnings beyond a specific threshold. The statutory tax rate is the legally established tax rate set by tax authorities, often represented as a flat or bracketed rate without accounting for deductions or credits. Understanding the marginal tax rate is crucial for effective tax planning, as it influences decisions on earning additional income or making investments.

Understanding Statutory Tax Rate

The statutory tax rate refers to the legally imposed tax rate set by law on taxable income before any deductions or credits are applied. It serves as the baseline percentage taxpayers are subject to and is crucial for understanding potential tax liabilities in financial planning. Unlike the marginal tax rate, which reflects the rate on the next dollar earned, the statutory rate defines the official tax burden at each income level as stipulated by tax statutes.

Key Differences Between Marginal and Statutory Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of an individual's or corporation's income, indicating how much tax is paid on additional income earned. Statutory tax rate is the legally imposed tax rate set by law, representing the official rate before deductions, credits, or exemptions. Key differences include that the marginal tax rate reflects the effective impact on incremental income, while the statutory tax rate serves as the baseline figure used to calculate tax liability on the entire taxable income.

How Marginal Tax Rate Affects Taxpayers

The marginal tax rate directly influences taxpayers' decisions by determining the tax percentage paid on the next dollar of income, incentivizing or discouraging additional earnings. Unlike the statutory tax rate, which is the officially legislated rate, the marginal tax rate reflects real-world taxation impacts on incremental income. High marginal tax rates can reduce work effort, savings, and investment by increasing the effective tax burden on additional income.

The Role of Statutory Tax Rate in Tax Law

The statutory tax rate defines the legally imposed percentage rate set by law on taxable income, serving as the foundational benchmark for tax calculations and policy formulation. It establishes the official tax liability framework that guides both taxpayers and tax authorities in compliance, enforcement, and revenue projections. Understanding the statutory tax rate is essential for interpreting tax codes, assessing fiscal policy impacts, and differentiating it from marginal tax rates, which reflect the tax rate on additional income increments.

Practical Examples of Marginal vs Statutory Tax Rates

A statutory tax rate is the legally imposed rate set by tax authorities, such as the 21% federal corporate tax rate in the United States, while the marginal tax rate refers to the rate applied to the next dollar of taxable income, which varies with income brackets. For example, an individual with a statutory rate of 22% may have a marginal tax rate of 24% if their next dollar of income crosses into a higher tax bracket. Corporations often face a statutory rate but may have an effective marginal tax rate influenced by deductions, credits, and state taxes, illustrating practical differences in tax liabilities.

Impact on Personal and Corporate Taxation

The marginal tax rate determines the tax paid on the next dollar of income, directly influencing personal and corporate financial planning by affecting incentives to earn additional income and invest. The statutory tax rate, as the legally imposed rate, sets the baseline for tax liability but often diverges from the effective tax rate due to deductions, credits, and exemptions, impacting actual tax burdens. Understanding the gap between marginal and statutory rates is crucial for optimizing tax strategies and compliance in both personal and corporate taxation contexts.

Common Misconceptions About Tax Rates

Many taxpayers confuse the marginal tax rate, which applies to the last dollar earned, with the statutory tax rate, the legally imposed rate on taxable income. A prevalent misconception is believing that every dollar of income is taxed at the marginal rate, rather than understanding that income is taxed progressively across different brackets. This misunderstanding can lead to overestimating tax liability and poor financial planning decisions.

Conclusion: Choosing the Right Perspective on Tax Rates

The marginal tax rate reflects the tax percentage applied to the next dollar of income, providing insight into the financial impact of earning additional income, while the statutory tax rate is the legislated rate applied to taxable income. Understanding both rates is crucial for effective tax planning, as the marginal rate influences decision-making on income increments and investments, whereas the statutory rate represents the baseline tax obligation. Selecting the appropriate perspective depends on the context: use the marginal tax rate for evaluating incremental earnings and tax avoidance strategies, and reference the statutory tax rate for compliance and reporting purposes.

Marginal tax rate Infographic

libterm.com

libterm.com