Sticky prices refer to the slow adjustment of prices despite changes in supply and demand, causing inefficiencies in the market. This phenomenon often leads to short-term imbalances, such as inflation or unemployment, as businesses hesitate to change prices rapidly. Explore the rest of the article to understand how sticky prices impact your economic decisions and market dynamics.

Table of Comparison

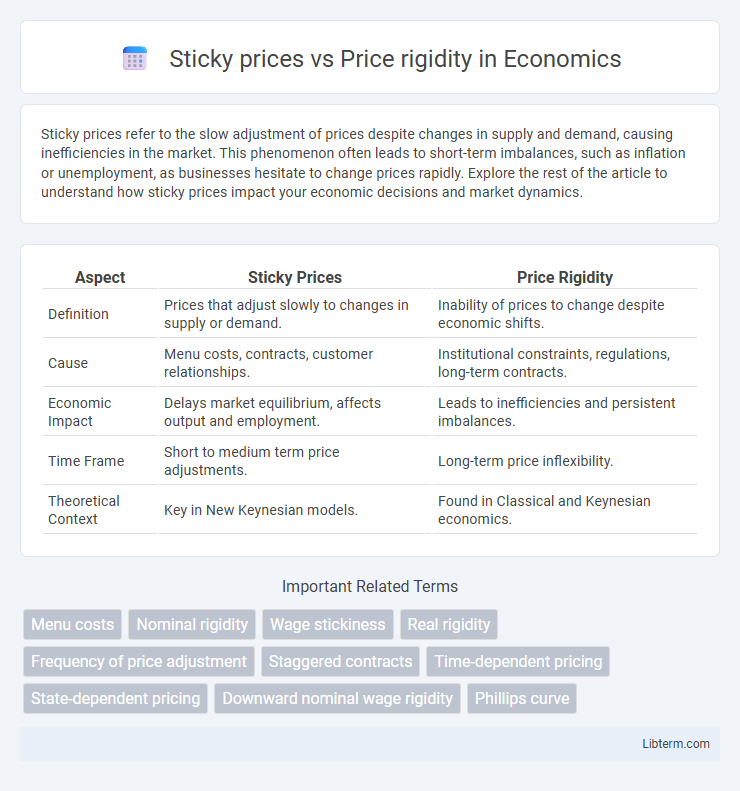

| Aspect | Sticky Prices | Price Rigidity |

|---|---|---|

| Definition | Prices that adjust slowly to changes in supply or demand. | Inability of prices to change despite economic shifts. |

| Cause | Menu costs, contracts, customer relationships. | Institutional constraints, regulations, long-term contracts. |

| Economic Impact | Delays market equilibrium, affects output and employment. | Leads to inefficiencies and persistent imbalances. |

| Time Frame | Short to medium term price adjustments. | Long-term price inflexibility. |

| Theoretical Context | Key in New Keynesian models. | Found in Classical and Keynesian economics. |

Understanding Sticky Prices: Definition and Examples

Sticky prices refer to situations where prices of goods or services remain fixed despite changes in supply or demand conditions, reflecting resistance to frequent adjustments in pricing structures. Price rigidity, often synonymous with sticky prices, emphasizes the inflexibility that can result from menu costs, long-term contracts, or customer loyalty, preventing immediate price changes. Examples include retail gasoline prices that do not fluctuate daily with crude oil prices or wages in labor contracts that stay constant despite economic shifts.

What is Price Rigidity? Key Characteristics

Price rigidity refers to the resistance of prices to change despite shifts in supply and demand conditions, often resulting from menu costs, long-term contracts, or institutional factors. Key characteristics include infrequent price adjustments, delayed response to economic fluctuations, and the persistence of nominal prices even amid significant market changes. This rigidity can lead to market inefficiencies, affecting resource allocation and output levels in the broader economy.

Sticky Prices vs Price Rigidity: Core Differences

Sticky prices refer to the slow adjustment of prices in response to changes in demand or supply, often due to menu costs or contractual agreements, causing temporary imbalances in the market. Price rigidity encompasses a broader range of price inflexibilities, including both sticky prices and other forms of price adjustments constrained by institutional or behavioral factors. The core difference lies in sticky prices specifically describing delayed price changes, while price rigidity includes various mechanisms that prevent prices from fluidly responding to economic shifts.

Causes of Sticky Prices in Modern Markets

Sticky prices in modern markets often result from menu costs, where businesses incur expenses updating prices across multiple platforms, deterring frequent adjustments. Consumer perception and demand uncertainty also contribute, as firms avoid price changes to maintain customer trust and avoid signaling unintended quality shifts. Furthermore, long-term contracts and wage agreements create inflexible pricing structures, reinforcing price rigidity despite fluctuating market conditions.

Factors Contributing to Price Rigidity

Price rigidity occurs when prices remain fixed despite changes in supply and demand, driven by factors such as menu costs, long-term contracts, and customer relationships. Sticky prices reflect the slow adjustment of prices due to information costs, coordination challenges, and wage contracts that prevent immediate price changes. Market conditions, including imperfect competition and expectations about future prices, also contribute significantly to the persistence of price rigidity in various industries.

Impacts on Supply and Demand Dynamics

Sticky prices refer to the slow adjustment of prices in response to changes in supply and demand, whereas price rigidity denotes prices that remain fixed despite economic fluctuations. These phenomena impact supply and demand dynamics by limiting market participants' ability to respond efficiently to shifts, leading to mismatches such as shortages or surpluses. In markets with high price stickiness or rigidity, resource allocation becomes less optimal, causing prolonged disequilibria and affecting overall economic efficiency.

The Role of Sticky Prices During Economic Shocks

Sticky prices limit firms' ability to adjust prices quickly in response to economic shocks, causing delays in price adjustments that can amplify output fluctuations. Price rigidity describes the resistance of prices to change, often due to menu costs or long-term contracts, stabilizing consumer expectations but slowing market equilibrium. During economic shocks, sticky prices can exacerbate unemployment and reduce economic efficiency by preventing immediate price corrections in labor and product markets.

Price Rigidity in Different Industries

Price rigidity refers to the resistance of prices to change despite shifts in supply or demand, commonly observed in industries like utilities and telecommunications where regulatory constraints and high fixed costs limit price adjustments. In contrast, sectors such as retail and technology exhibit more flexible pricing due to competitive markets and rapid innovation cycles. Understanding price rigidity across industries helps businesses strategize pricing models that balance profitability with market conditions.

Policy Implications: Addressing Price Inflexibility

Price rigidity, characterized by slow adjustment of prices in response to economic shocks, limits the effectiveness of monetary policy by delaying inflation targeting and output stabilization. Sticky prices, often due to menu costs or wage contracts, necessitate proactive fiscal measures and flexible labor policies to enhance market responsiveness. Implementing dynamic pricing regulations and improving communication strategies can mitigate price inflexibility, supporting smoother economic adjustments and more efficient policy transmission.

Sticky Prices and Price Rigidity: Future Trends and Research Directions

Sticky prices refer to the slow adjustment of prices in response to changes in supply and demand, often influenced by menu costs, contracts, and behavioral factors, while price rigidity encompasses broader factors causing infrequent or delayed price changes across markets. Future trends in sticky prices research explore the integration of digital pricing technologies and real-time data analytics, which may reduce traditional frictions and enhance price flexibility. Emerging research directions focus on the macroeconomic implications of price stickiness under varying monetary policies and the role of artificial intelligence in predicting and mitigating price rigidity effects.

Sticky prices Infographic

libterm.com

libterm.com