Policy neutrality ensures that algorithms or systems do not favor any particular group or viewpoint, promoting fairness and impartiality in decision-making processes. Maintaining this neutrality is crucial for building trust and credibility in automated systems, preventing biases that could negatively impact users. Explore the rest of the article to understand how policy neutrality can benefit your organization and ensure ethical standards.

Table of Comparison

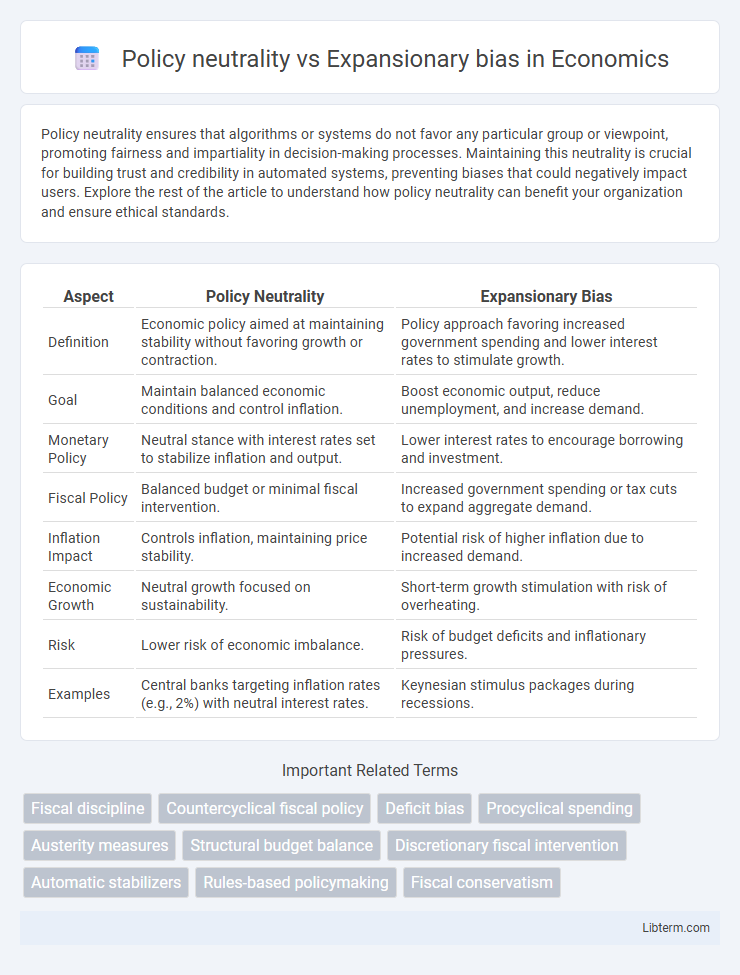

| Aspect | Policy Neutrality | Expansionary Bias |

|---|---|---|

| Definition | Economic policy aimed at maintaining stability without favoring growth or contraction. | Policy approach favoring increased government spending and lower interest rates to stimulate growth. |

| Goal | Maintain balanced economic conditions and control inflation. | Boost economic output, reduce unemployment, and increase demand. |

| Monetary Policy | Neutral stance with interest rates set to stabilize inflation and output. | Lower interest rates to encourage borrowing and investment. |

| Fiscal Policy | Balanced budget or minimal fiscal intervention. | Increased government spending or tax cuts to expand aggregate demand. |

| Inflation Impact | Controls inflation, maintaining price stability. | Potential risk of higher inflation due to increased demand. |

| Economic Growth | Neutral growth focused on sustainability. | Short-term growth stimulation with risk of overheating. |

| Risk | Lower risk of economic imbalance. | Risk of budget deficits and inflationary pressures. |

| Examples | Central banks targeting inflation rates (e.g., 2%) with neutral interest rates. | Keynesian stimulus packages during recessions. |

Understanding Policy Neutrality: Definition and Principles

Policy neutrality refers to the economic stance where monetary authorities maintain interest rates and financial conditions at levels that neither stimulate nor restrain economic activity, aiming for a balanced approach to support sustainable growth. Core principles include avoiding systematic bias towards either expansionary or contractionary policies, ensuring decisions are data-driven, and promoting price stability along with full employment. This concept contrasts with expansionary bias, where policies consistently favor stimulating economic growth, potentially leading to inflationary pressures and financial imbalances.

What Drives Expansionary Policy Bias?

Expansionary policy bias is primarily driven by political incentives where policymakers favor short-term economic growth and employment gains to secure electoral support. Public pressure and the desire to avoid unpopular austerity measures often lead to persistent deficits and loose fiscal policies. Furthermore, asymmetric information and time inconsistency issues contribute to policymakers' preference for expansionary policies despite long-term fiscal risks.

Historical Context: Neutrality vs Expansionism in Economic Policy

Throughout the 20th century, economic policy debates often centered on the tension between policy neutrality and expansionary bias, with neutrality emphasizing balanced approaches to avoid market distortions while expansionary bias favored proactive fiscal and monetary interventions to stimulate growth. Historical episodes such as the Great Depression and post-World War II recovery highlighted the practical challenges of strict neutrality, as governments pursued aggressive expansionary policies to combat unemployment and deflation. Over time, the evolution of Keynesian economics reinforced expansionist strategies during downturns, whereas later shifts toward monetarism and new classical approaches revived calls for policy neutrality to ensure long-term economic stability.

Fiscal Policy Approaches: A Comparative Analysis

Policy neutrality emphasizes maintaining balanced government budgets to avoid distorting economic signals, ensuring sustainable long-term growth. Expansionary bias occurs when fiscal policies consistently favor increased government spending and deficits, often driven by short-term political incentives rather than economic fundamentals. Comparative analysis reveals that countries with institutionalized policy neutrality frameworks, such as fiscal rules and independent budget offices, tend to experience lower debt levels and more stable economic performance than those exhibiting expansionary bias.

Impacts on Inflation: Expansionary Bias vs Neutrality

Expansionary bias in fiscal policy often leads to persistent budget deficits that fuel inflation by increasing aggregate demand beyond the economy's productive capacity. Policy neutrality, by contrast, aims to maintain a balanced budget over economic cycles, helping to stabilize prices and anchor inflation expectations. The inflationary impact of expansionary bias contrasts sharply with the price stability promoted by neutral fiscal policy frameworks.

Political Incentives Behind Expansionary Bias

Political incentives behind expansionary bias arise because elected officials often prioritize short-term economic growth to appeal to voters and increase the likelihood of reelection. This bias leads governments to implement overly stimulative fiscal or monetary policies, disregarding long-term consequences like inflation or debt accumulation. The desire to demonstrate immediate economic improvements distorts policy neutrality, undermining sustainable economic management.

Long-Term Economic Stability and Policy Choices

Policy neutrality emphasizes balanced fiscal and monetary measures that avoid overstimulation, thereby supporting sustainable long-term economic stability by preventing asset bubbles and inflationary pressures. Expansionary bias occurs when policymakers favor stimulus policies to boost short-term growth, risking higher debt levels and economic volatility over time. Long-term economic stability relies on policy choices that maintain equilibrium without excessively favoring expansion, ensuring steady growth and resilience to economic shocks.

Case Studies: Policy Neutrality vs Expansionary Outcomes

Case studies such as the Federal Reserve during the 1990s highlight policy neutrality aimed at maintaining stable inflation despite economic fluctuations, promoting long-term growth. In contrast, Japan's quantitative easing strategy in the 2000s exemplifies expansionary bias, emphasizing aggressive monetary stimulus to counter deflationary pressures and stimulate demand. These cases reveal the trade-offs between minimizing market distortions with neutral policies and prioritizing economic growth through expansionary measures.

Global Perspectives: Different Approaches Across Countries

Countries exhibit varying policy stances, reflecting distinct priorities between policy neutrality and expansionary bias. Advanced economies like the United States often balance inflation targeting with growth objectives, while emerging markets may lean towards expansionary policies to spur development and employment. In contrast, nations such as Japan emphasize policy neutrality to maintain long-term financial stability amid demographic challenges.

Striking the Balance: Recommendations for Policymakers

Policymakers should prioritize policy neutrality to maintain economic stability by avoiding excessive stimulus that leads to expansionary bias and potential inflationary pressures. Implementing transparent fiscal rules and independent oversight can help strike the balance between stimulating growth and preventing unsustainable debt accumulation. Data-driven decision frameworks that account for real-time economic indicators support calibrated interventions, ensuring responsiveness without bias.

Policy neutrality Infographic

libterm.com

libterm.com