Currency pegging stabilizes exchange rates by fixing a country's currency value to another major currency or basket of currencies, reducing volatility in international trade and investment. This approach can enhance economic predictability but may limit monetary policy flexibility and require significant foreign reserves to maintain the peg. Discover how currency pegging impacts your business and global markets in the rest of the article.

Table of Comparison

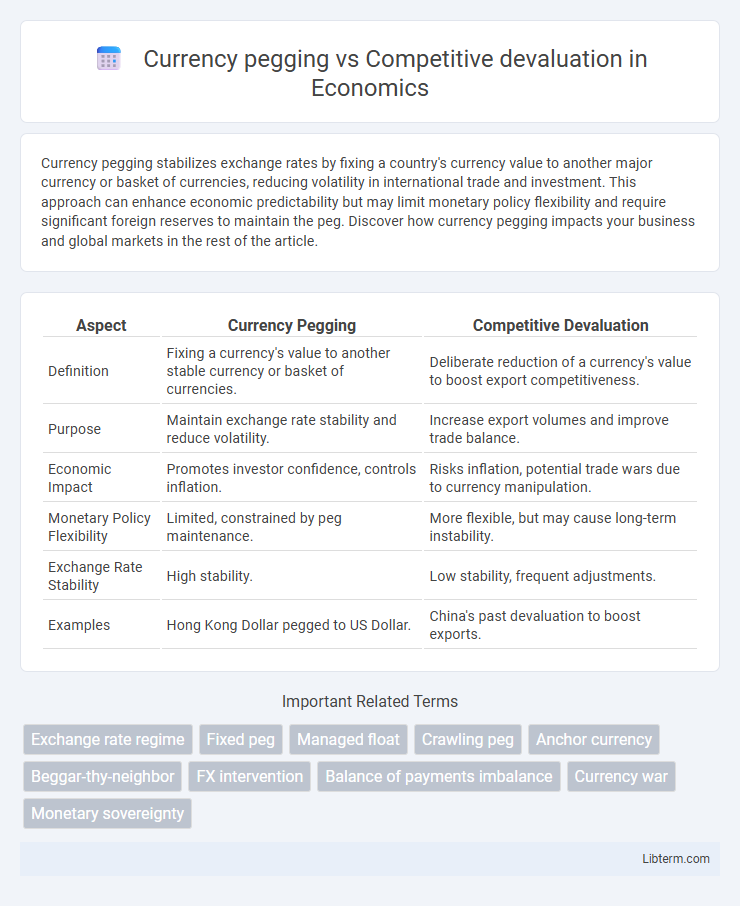

| Aspect | Currency Pegging | Competitive Devaluation |

|---|---|---|

| Definition | Fixing a currency's value to another stable currency or basket of currencies. | Deliberate reduction of a currency's value to boost export competitiveness. |

| Purpose | Maintain exchange rate stability and reduce volatility. | Increase export volumes and improve trade balance. |

| Economic Impact | Promotes investor confidence, controls inflation. | Risks inflation, potential trade wars due to currency manipulation. |

| Monetary Policy Flexibility | Limited, constrained by peg maintenance. | More flexible, but may cause long-term instability. |

| Exchange Rate Stability | High stability. | Low stability, frequent adjustments. |

| Examples | Hong Kong Dollar pegged to US Dollar. | China's past devaluation to boost exports. |

Introduction to Currency Pegging and Competitive Devaluation

Currency pegging involves fixing a country's exchange rate to a stable foreign currency, often the US dollar or euro, to maintain monetary stability and reduce exchange rate volatility. Competitive devaluation refers to deliberate downward adjustment of a country's currency value to boost export competitiveness by making goods cheaper internationally. Both strategies influence trade balances and inflation but differ in their approach to exchange rate management and economic objectives.

Defining Currency Pegging: Mechanisms and Examples

Currency pegging involves fixing a country's exchange rate to a stable foreign currency or basket of currencies, maintaining a consistent value through central bank interventions in the foreign exchange market. Mechanisms include direct market operations, adjusting interest rates, and using foreign reserves to stabilize the peg, with notable examples such as Hong Kong linking the Hong Kong dollar to the US dollar and Saudi Arabia pegging the Saudi riyal to the US dollar. This system offers predictability in trade and investment but requires sufficient reserves and policy discipline to sustain the fixed rate.

Understanding Competitive Devaluation: Concept and Drivers

Competitive devaluation involves intentionally lowering a country's currency value to boost export competitiveness and improve trade balances by making goods cheaper abroad. This strategy is driven by factors such as trade deficits, economic downturns, and the desire to stimulate domestic industries. Unlike currency pegging, which maintains stable exchange rates by fixing a currency to another, competitive devaluation embraces currency volatility to gain short-term economic advantages.

Historical Context: Currency Pegs vs Currency Wars

Currency pegging has historically provided stability by fixing a country's exchange rate to a major currency like the US dollar, helping nations avoid volatile fluctuations during the Bretton Woods system era. In contrast, competitive devaluation emerged prominently during the 1930s Great Depression as countries deliberately lowered their currency values to boost exports and stimulate economic growth, often triggering retaliatory measures known as currency wars. The post-World War II period saw a mix of these strategies, with many developing countries adopting pegs to foster investment, while others engaged in currency manipulation to gain trade advantages, reflecting divergent economic priorities and geopolitical tensions.

Economic Objectives: Stability vs Export Advantage

Currency pegging aims to ensure economic stability by fixing exchange rates to reduce inflation and foster investor confidence. Competitive devaluation focuses on gaining export advantage by deliberately lowering currency value to make domestic goods cheaper and boost trade balance. While pegging prioritizes long-term price stability, devaluation targets short-term export competitiveness.

Policy Tools: How Governments Manage Exchange Rates

Currency pegging involves governments fixing their exchange rate by tying their currency's value to a stable foreign currency, using foreign reserves and monetary policy to maintain the peg. Competitive devaluation refers to deliberate lowering of a currency's value through monetary tools like lowering interest rates or direct market intervention to boost export competitiveness. Both policy tools require active central bank management to influence trade balances, inflation, and economic growth by controlling exchange rate fluctuations.

Impact on International Trade and Investment

Currency pegging stabilizes exchange rates, reducing foreign exchange risk and encouraging long-term international trade and investment by providing predictable pricing. Competitive devaluation, often aimed at boosting export competitiveness through lowering currency value, can lead to short-term trade gains but increases volatility, deterring foreign investors due to uncertainty. Persistent devaluation risks provoking retaliatory trade measures, harming global trade relationships and investment flows.

Risks and Challenges Associated with Each Strategy

Currency pegging risks include loss of monetary policy autonomy, vulnerability to speculative attacks, and the challenge of maintaining adequate foreign exchange reserves to defend the peg. Competitive devaluation challenges involve triggering retaliatory actions from trading partners, escalating trade tensions, and potentially fueling inflation and economic instability in the devaluing country. Both strategies can lead to market distortions and long-term economic inefficiencies if not managed carefully.

Case Studies: Notable Examples from Global Economies

China's currency pegging strategy maintained the yuan's fixed rate against the US dollar for years, stabilizing trade but drawing criticism for undervaluation and export-driven growth. In contrast, Argentina's competitive devaluation episodes, particularly during the 2001 crisis, aimed to boost exports by significantly lowering the peso's value, resulting in short-term trade gains but long-term economic instability. These case studies highlight the trade-offs between maintaining fixed exchange rates through pegging and pursuing aggressive currency devaluation to achieve competitive advantages in global markets.

Future Trends and Policy Implications

Future trends indicate a shift toward more flexible exchange rate regimes as global economic interdependence challenges the sustainability of strict currency pegging, prompting policymakers to consider hybrid models that balance stability with responsiveness. Competitive devaluation risks escalating currency wars, potentially undermining global trade, which drives international institutions to advocate coordinated monetary policies and transparency to mitigate volatility. Emphasizing digital currencies and enhanced surveillance tools may shape policy frameworks, enabling real-time adjustments while preserving foreign exchange market stability.

Currency pegging Infographic

libterm.com

libterm.com