Subnormal profit occurs when a business's total revenue is less than its total costs, including opportunity costs, resulting in losses rather than gains. This situation indicates that the firm is not covering all its expenses, signaling potential inefficiencies or market challenges that require strategic adjustments. Discover how understanding subnormal profit can guide your decisions and improve your business outcomes in the rest of this article.

Table of Comparison

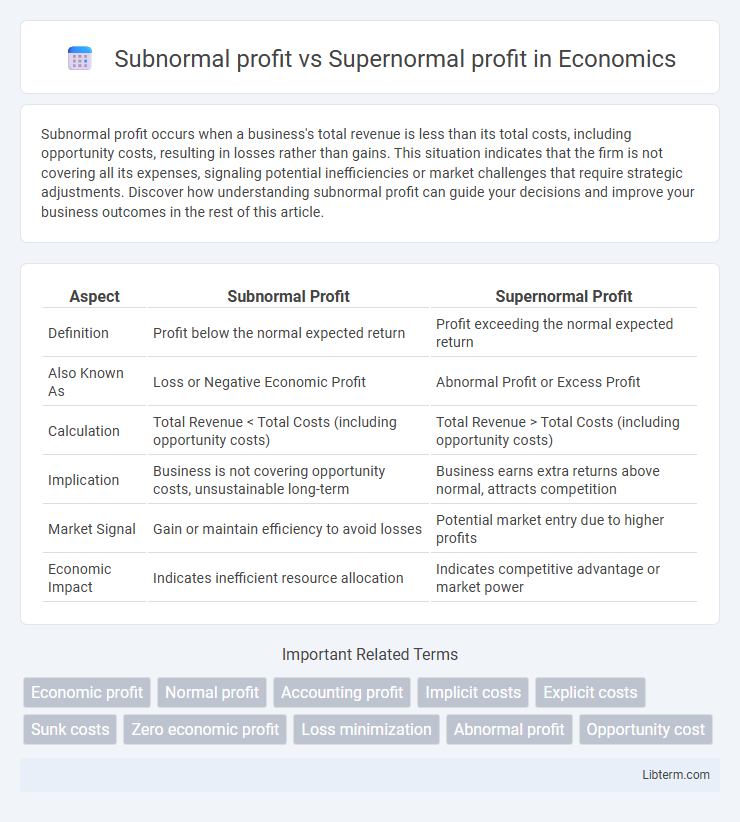

| Aspect | Subnormal Profit | Supernormal Profit |

|---|---|---|

| Definition | Profit below the normal expected return | Profit exceeding the normal expected return |

| Also Known As | Loss or Negative Economic Profit | Abnormal Profit or Excess Profit |

| Calculation | Total Revenue < Total Costs (including opportunity costs) | Total Revenue > Total Costs (including opportunity costs) |

| Implication | Business is not covering opportunity costs, unsustainable long-term | Business earns extra returns above normal, attracts competition |

| Market Signal | Gain or maintain efficiency to avoid losses | Potential market entry due to higher profits |

| Economic Impact | Indicates inefficient resource allocation | Indicates competitive advantage or market power |

Understanding Subnormal and Supernormal Profit

Subnormal profit occurs when total revenue fails to cover total costs, resulting in losses that signal a business is underperforming within its market. Supernormal profit, also known as economic profit, arises when total revenue exceeds all explicit and implicit costs, indicating exceptional business performance and market advantage. Understanding these profit types is crucial for evaluating firm sustainability, competitive positioning, and long-term growth potential.

Defining Subnormal Profit

Subnormal profit occurs when a firm's total revenue falls short of covering its total costs, including both explicit and implicit expenses, resulting in economic losses. This situation contrasts with supernormal profit, where earnings exceed all opportunity costs, yielding above-average returns. Understanding subnormal profit is essential for assessing a firm's viability and long-term sustainability within competitive markets.

What Constitutes Supernormal Profit?

Supernormal profit constitutes returns exceeding the normal expected profit level, calculated after covering all opportunity costs and explicit expenses. It represents residual earnings above the break-even point, reflecting a firm's competitive advantage or market power. This profit signals exceptional business performance, often driven by innovation, brand strength, or market inefficiencies.

Key Differences Between Subnormal and Supernormal Profit

Subnormal profit occurs when total revenue is less than total cost, leading to losses, whereas supernormal profit represents earnings exceeding normal expected returns, indicating higher than average profitability. Subnormal profit signals inefficiency or poor business performance, while supernormal profit reflects competitive advantage or market dominance. Firms experiencing subnormal profit may exit the market, unlike those earning supernormal profit who typically reinvest to sustain growth.

Causes of Subnormal Profit

Subnormal profit occurs when a firm's total revenue is less than its total costs, often caused by increased competition lowering prices or rising production costs such as labor or raw materials. Market inefficiencies, poor management decisions, or economic downturns can also contribute to subnormal profits by reducing demand or operational effectiveness. Firms experiencing subnormal profits may need to reassess pricing strategies, cost structures, and market positioning to return to normal or supernormal profit levels.

Factors Leading to Supernormal Profit

Factors leading to supernormal profit include high demand, limited competition, innovative products, and effective cost management. Companies experience supernormal profit when they have a unique value proposition or trademark rights that allow premium pricing. Market barriers such as strong brand loyalty and access to scarce resources further enhance the ability to generate profits exceeding normal levels.

Examples of Subnormal Profit in Business

Subnormal profit occurs when a company's total revenue fails to cover its total costs, resulting in losses, such as a retail store experiencing decreased sales due to increased competition or a startup facing high initial expenses without sufficient income. An example includes a local restaurant operating at a loss during an economic downturn when customer spending decreases significantly. Subnormal profits signal the need for businesses to reassess strategies to either increase revenue or reduce costs to regain profitability.

Examples of Supernormal Profit in Business

Supernormal profit occurs when a company's total revenue exceeds its total costs, including both explicit and implicit costs, resulting in profits above the normal expected return. Examples of supernormal profit can be seen in tech giants like Apple and Google, which leverage innovation and market dominance to generate excessive returns beyond industry standards. Companies in high-demand sectors such as pharmaceutical firms with patented drugs also often achieve supernormal profits by maintaining exclusive market control and premium pricing.

Impact on Market Structure and Competition

Subnormal profit signals inefficiencies causing firms to exit the market, leading to reduced competition and potential market consolidation. Supernormal profit attracts new entrants, intensifying competition and driving innovation, which can alter market structures by shifting from monopoly or oligopoly towards more competitive landscapes. The dynamics of profits directly influence barriers to entry and long-term market equilibrium.

Strategies for Moving from Subnormal to Supernormal Profit

Businesses experiencing subnormal profit must focus on enhancing operational efficiency by reducing costs and optimizing resource allocation to increase profitability. Implementing innovative marketing strategies and product differentiation can attract new customers and boost revenue streams. Investing in technology and expanding into high-margin markets often drives the transition from subnormal to supernormal profit levels.

Subnormal profit Infographic

libterm.com

libterm.com