An equity tranche represents the riskiest portion of a structured financial product, absorbing initial losses before other tranches are affected. Investors in this tranche have the potential for higher returns but face significant risk exposure. Discover how understanding the equity tranche can impact your investment strategy by reading the rest of the article.

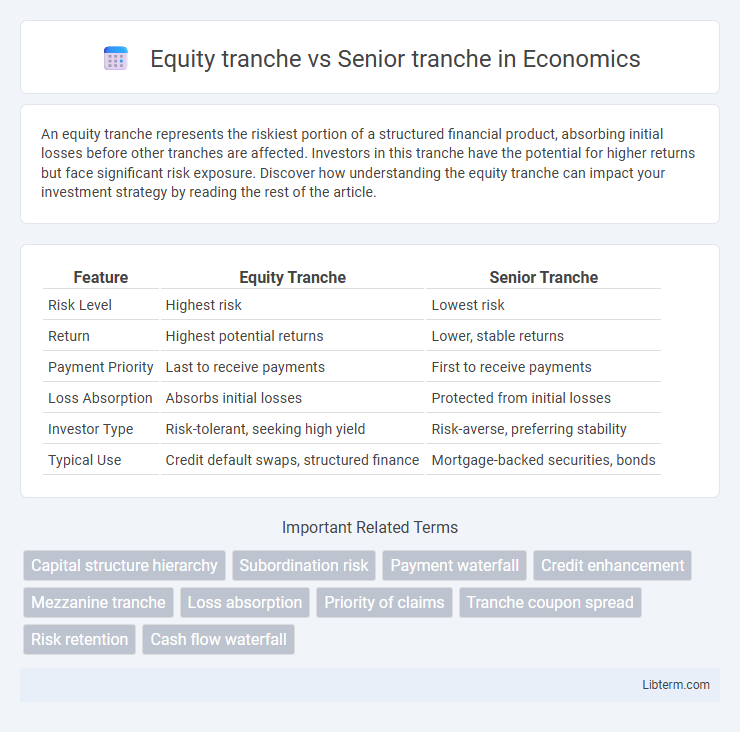

Table of Comparison

| Feature | Equity Tranche | Senior Tranche |

|---|---|---|

| Risk Level | Highest risk | Lowest risk |

| Return | Highest potential returns | Lower, stable returns |

| Payment Priority | Last to receive payments | First to receive payments |

| Loss Absorption | Absorbs initial losses | Protected from initial losses |

| Investor Type | Risk-tolerant, seeking high yield | Risk-averse, preferring stability |

| Typical Use | Credit default swaps, structured finance | Mortgage-backed securities, bonds |

Understanding Tranches in Structured Finance

Equity tranches represent the first-loss layer in structured finance, absorbing initial defaults and carrying the highest risk but offering potentially higher returns. Senior tranches have priority claim on cash flows, possess lower risk due to credit enhancements, and usually receive lower interest rates reflecting their safer position. Understanding the balance between equity and senior tranches is critical for investors to evaluate risk exposure and return expectations in collateralized debt obligations (CDOs) or mortgage-backed securities (MBS).

What is a Senior Tranche?

A senior tranche is a debt segment in structured finance that holds the highest priority for repayment and lowest risk compared to equity tranches. It typically offers lower yields but greater protection against losses, as payments are made before subordinated or equity tranches receive funds. Senior tranches are favored by conservative investors seeking stable returns and strong credit ratings in securitized products like collateralized debt obligations (CDOs).

Defining the Equity Tranche

The equity tranche represents the most subordinated portion of a securitized debt structure, absorbing first losses and bearing higher risk compared to the senior tranche. It typically offers higher potential returns to compensate for increased credit risk and lack of priority in cash flow distributions. Senior tranches possess priority claims on underlying assets, resulting in lower risk and lower yields relative to the equity tranche.

Risk and Return: Senior vs Equity Tranche

The equity tranche carries the highest risk as it absorbs initial losses but offers the highest potential returns due to its subordinate position in the capital structure. In contrast, the senior tranche has lower risk exposure, receiving priority in cash flow payments and protection against defaults, resulting in comparatively lower but more stable returns. Investors in senior tranches benefit from enhanced creditworthiness, while equity tranche investors seek higher yields to compensate for elevated credit and market risk.

Priority of Payment and Loss Absorption

The Equity tranche holds the lowest priority of payment, absorbing losses first and serving as a protective buffer for senior tranches which have higher priority and are paid before equity investors. Senior tranches benefit from reduced risk due to their position in the payment waterfall, receiving scheduled interest and principal repayments before any equity distribution. Loss absorption primarily impacts the equity tranche, shielding senior tranche investors by absorbing initial defaults or losses within the underlying asset pool.

Investor Profile: Who Buys Which Tranche?

Equity tranches attract high-risk tolerant investors such as hedge funds and private equity firms seeking higher returns through subordinated debt exposure. Senior tranches appeal to conservative investors like pension funds and insurance companies prioritizing capital preservation and steady income due to their higher credit ratings and priority claim on assets. Understanding the risk-return profile aligns investor objectives with tranche characteristics in structured finance products.

Credit Ratings Comparison

Equity tranches typically carry the lowest credit ratings due to their high risk and subordinate position in the capital structure, often rated below investment grade or not rated at all. Senior tranches receive higher credit ratings, frequently investment grade, as they have priority claim on cash flows and are protected by subordinate tranches absorbing initial losses. Credit rating agencies assess senior tranches for lower default risk, while equity tranches are viewed as riskier with higher potential returns.

Impact on Portfolio Diversification

Equity tranches, characterized by higher risk and first-loss exposure, offer significant diversification benefits in a portfolio by providing non-correlated returns during credit downturns. Senior tranches, with their lower risk and priority claim on cash flows, contribute to portfolio stability but exhibit less sensitivity to market dislocations, resulting in more correlated performance with traditional fixed-income assets. Balancing equity and senior tranches enhances risk-adjusted returns by combining high-yield diversification potential with capital preservation features.

Role in Collateralized Debt Obligations (CDOs)

Equity tranches in Collateralized Debt Obligations (CDOs) absorb the first losses and provide credit enhancement to senior tranches by acting as a buffer. Senior tranches are prioritized for payments, have lower risk, and receive stable interest based on the higher credit rating supported by the equity tranche's subordinate position. The equity tranche also has higher potential returns due to its increased exposure to default risk compared to the more secure senior tranche.

Key Considerations for Investors

Equity tranches offer higher potential returns by absorbing initial losses in structured finance deals, making them suitable for risk-tolerant investors seeking maximum yield. Senior tranches provide lower risk exposure with priority claim on assets and fixed interest payments, appealing to conservative investors prioritizing capital preservation. Understanding credit risk, expected return, and position in the capital structure is essential for investors when choosing between equity and senior tranches.

Equity tranche Infographic

libterm.com

libterm.com