The Earned Income Tax Credit (EITC) offers a valuable tax break for low to moderate-income workers, potentially boosting your refund significantly. Qualifying depends on your earned income, filing status, and number of dependents, making it essential to understand eligibility criteria. Discover how you can maximize this credit and reduce your tax burden by reading the full article.

Table of Comparison

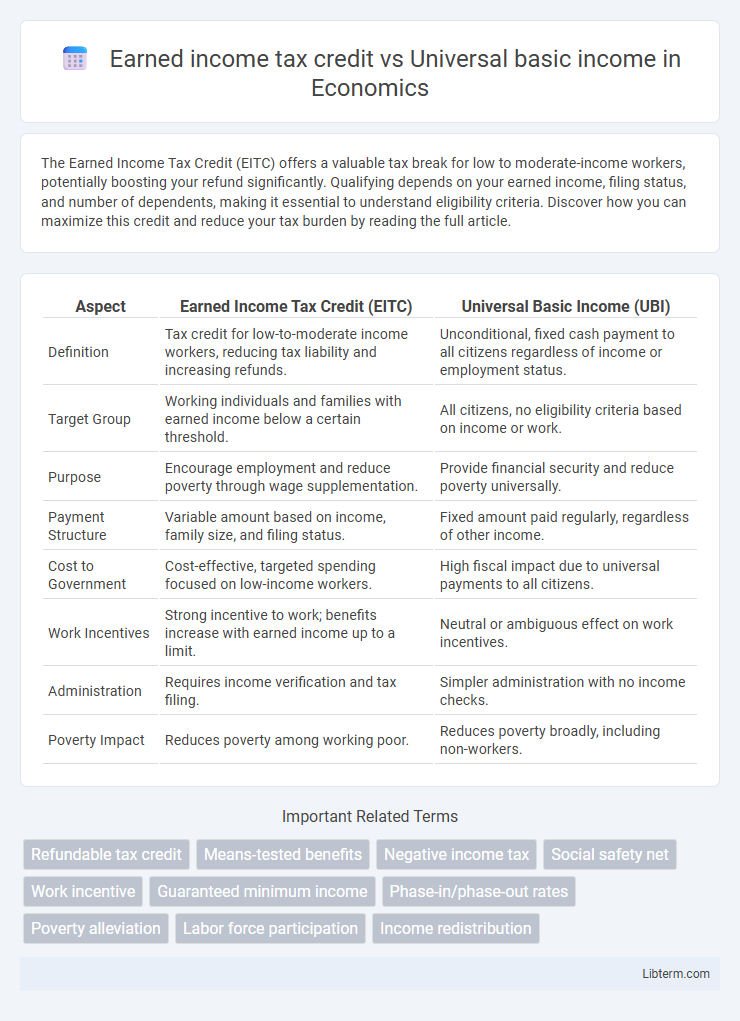

| Aspect | Earned Income Tax Credit (EITC) | Universal Basic Income (UBI) |

|---|---|---|

| Definition | Tax credit for low-to-moderate income workers, reducing tax liability and increasing refunds. | Unconditional, fixed cash payment to all citizens regardless of income or employment status. |

| Target Group | Working individuals and families with earned income below a certain threshold. | All citizens, no eligibility criteria based on income or work. |

| Purpose | Encourage employment and reduce poverty through wage supplementation. | Provide financial security and reduce poverty universally. |

| Payment Structure | Variable amount based on income, family size, and filing status. | Fixed amount paid regularly, regardless of other income. |

| Cost to Government | Cost-effective, targeted spending focused on low-income workers. | High fiscal impact due to universal payments to all citizens. |

| Work Incentives | Strong incentive to work; benefits increase with earned income up to a limit. | Neutral or ambiguous effect on work incentives. |

| Administration | Requires income verification and tax filing. | Simpler administration with no income checks. |

| Poverty Impact | Reduces poverty among working poor. | Reduces poverty broadly, including non-workers. |

Introduction to Earned Income Tax Credit and Universal Basic Income

The Earned Income Tax Credit (EITC) is a refundable tax credit designed to support low- to moderate-income working individuals and families by reducing their tax liability and potentially providing a refund. Universal Basic Income (UBI) refers to unconditional cash payments given regularly to all citizens regardless of employment status, aiming to ensure a minimum standard of living. Both policies target economic security, but EITC incentivizes employment, whereas UBI provides direct financial support without work requirements.

Definitions: EITC and UBI Explained

The Earned Income Tax Credit (EITC) is a refundable tax credit aimed at low- to moderate-income working individuals and families, designed to reduce tax liability and supplement wages. Universal Basic Income (UBI) is a government program that provides all citizens with a fixed, unconditional sum of money regularly, regardless of employment status or income level. EITC targets incentivizing work through income supplementation, while UBI focuses on universal financial security without work requirements.

Historical Background of EITC and UBI

The Earned Income Tax Credit (EITC) was established in the United States in 1975 as a refundable tax credit aimed at reducing poverty by supplementing wages for low- to moderate-income working individuals and families. Universal Basic Income (UBI) traces its philosophical roots to 16th-century thinkers like Thomas More and gained modern traction through 20th-century experiments advocating guaranteed income regardless of employment status. While EITC targets incentivized work through tax policy, UBI proposes unconditional cash distribution as a broader social safety net.

Eligibility Criteria: Who Qualifies?

The Earned Income Tax Credit (EITC) primarily targets low to moderate-income working individuals and families, requiring earned income below specific thresholds and varying by filing status and number of dependents. Universal Basic Income (UBI) programs differ widely but generally provide unconditional cash payments to all citizens regardless of employment status or income level. Eligibility for EITC demands active employment and meeting IRS income limits, while UBI focuses on universal access without income or work prerequisites.

Funding Mechanisms: How Are They Financed?

The Earned Income Tax Credit (EITC) is primarily funded through federal income tax revenues, targeting low- to moderate-income workers by offering refundable tax credits to incentivize employment. Universal Basic Income (UBI) proposals usually require broader funding sources such as increased taxes on wealth, value-added tax (VAT), or reallocation of existing welfare budgets to provide unconditional cash payments to all citizens. EITC's design leverages payroll and income taxes within targeted groups, whereas UBI's funding demands systemic fiscal restructuring to ensure universal cash distribution.

Economic Impact: EITC vs UBI

The Earned Income Tax Credit (EITC) targets low to moderate-income workers by incentivizing employment and reducing poverty through refundable tax credits, leading to increased labor force participation and economic productivity. Universal Basic Income (UBI) provides unconditional cash payments to all citizens, potentially reducing income inequality and poverty but may decrease work incentives, impacting labor supply and overall economic growth. Studies indicate EITC's employment-driven model fosters economic activity, while UBI emphasizes income security with mixed effects on labor market dynamics and fiscal sustainability.

Poverty Reduction Outcomes

Earned Income Tax Credit (EITC) directly targets low-to-moderate-income working families, incentivizing employment while reducing poverty by supplementing wages, with studies showing a significant decrease in child poverty rates. Universal Basic Income (UBI) provides unconditional cash payments to all individuals regardless of employment status, aiming to alleviate poverty broadly by ensuring a minimum income floor, but its effectiveness varies based on implementation scale and funding. Comparative analyses indicate EITC's focused approach yields stronger short-term poverty reduction for working families, whereas UBI offers wider coverage but may require higher fiscal resources and policy adjustments to achieve similar impact.

Work Incentives and Employment Effects

The Earned Income Tax Credit (EITC) incentivizes work by providing targeted financial support to low- and moderate-income workers, often increasing labor force participation and reducing unemployment rates. Universal Basic Income (UBI) offers unconditional payments regardless of employment status, which may reduce work disincentives for some individuals but also risks decreasing labor supply due to guaranteed income without work requirements. Empirical studies on EITC consistently show positive employment effects, while UBI experiments present mixed results on work incentives, necessitating careful policy design to balance social welfare and labor market participation.

Policy Challenges and Criticisms

The Earned Income Tax Credit (EITC) faces policy challenges including complexity in eligibility requirements, potential fraud, and limited reach among non-working low-income individuals, which restricts its effectiveness in poverty alleviation. Universal Basic Income (UBI) encounters criticisms related to high fiscal costs, potential disincentives to work, and difficulties in targeting resources efficiently within diverse economic systems. Both policies prompt debates over balancing social support goals with economic sustainability and political feasibility in addressing income inequality.

Future Prospects and Policy Recommendations

Future prospects for Earned Income Tax Credit (EITC) emphasize targeted poverty reduction through incentivizing work and supporting low-to-moderate income families, with proposals to expand eligibility and increase credit amounts gaining momentum. Universal Basic Income (UBI) presents a more radical shift by providing unconditional financial support to all citizens, potentially simplifying welfare systems but requiring significant fiscal restructuring and clear funding strategies. Policy recommendations suggest combining expanded EITC programs with pilot UBI initiatives to evaluate economic impacts, address labor market changes, and ensure sustainable social safety nets amid evolving technological and economic landscapes.

Earned income tax credit Infographic

libterm.com

libterm.com