Monetary targeting is a monetary policy strategy where central banks focus on controlling money supply growth to achieve economic goals like price stability and inflation reduction. This approach relies on carefully monitoring monetary aggregates to influence interest rates and economic activity effectively. Explore the rest of the article to understand how monetary targeting can impact Your financial decisions and economic wellbeing.

Table of Comparison

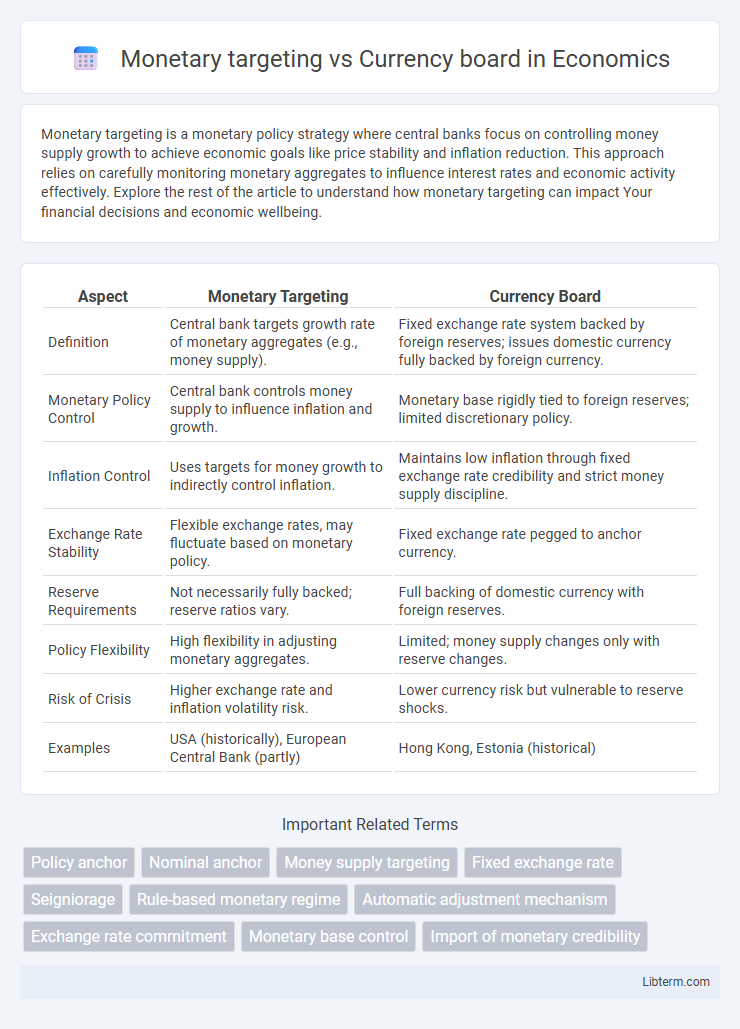

| Aspect | Monetary Targeting | Currency Board |

|---|---|---|

| Definition | Central bank targets growth rate of monetary aggregates (e.g., money supply). | Fixed exchange rate system backed by foreign reserves; issues domestic currency fully backed by foreign currency. |

| Monetary Policy Control | Central bank controls money supply to influence inflation and growth. | Monetary base rigidly tied to foreign reserves; limited discretionary policy. |

| Inflation Control | Uses targets for money growth to indirectly control inflation. | Maintains low inflation through fixed exchange rate credibility and strict money supply discipline. |

| Exchange Rate Stability | Flexible exchange rates, may fluctuate based on monetary policy. | Fixed exchange rate pegged to anchor currency. |

| Reserve Requirements | Not necessarily fully backed; reserve ratios vary. | Full backing of domestic currency with foreign reserves. |

| Policy Flexibility | High flexibility in adjusting monetary aggregates. | Limited; money supply changes only with reserve changes. |

| Risk of Crisis | Higher exchange rate and inflation volatility risk. | Lower currency risk but vulnerable to reserve shocks. |

| Examples | USA (historically), European Central Bank (partly) | Hong Kong, Estonia (historical) |

Introduction to Monetary Targeting and Currency Board

Monetary targeting involves controlling a specific monetary aggregate, such as the money supply, to achieve macroeconomic stability and low inflation by setting explicit growth targets. A currency board is a fixed exchange rate regime where the domestic currency is fully backed by foreign reserves, ensuring currency stability and limiting monetary policy autonomy. Both frameworks aim to maintain economic discipline but differ in operational mechanisms and policy flexibility.

Core Principles of Monetary Targeting

Monetary targeting focuses on controlling the growth rate of a key monetary aggregate, such as M1 or M2, to achieve price stability and guide inflation expectations. This approach relies on stable money demand functions, predictable velocity of money, and the central bank's ability to influence monetary aggregates precisely. In contrast, a currency board pegs the domestic currency to a foreign anchor currency with full backing, limiting monetary policy flexibility and emphasizing external stability over monetary aggregates control.

Key Features of Currency Board Systems

Currency board systems maintain a fixed exchange rate by issuing domestic currency fully backed by foreign reserves, ensuring automatic convertibility on demand. They restrict monetary policy discretion by eliminating the central bank's ability to act as a lender of last resort, enforcing fiscal discipline. Transparency and credibility are upheld through strict rules that limit money supply growth to changes in foreign reserves, reducing inflationary pressures and currency risk.

Historical Context and Implementation

Monetary targeting emerged in the 1970s as central banks sought to control inflation by setting growth targets for money supply aggregates, with historical examples including the Federal Reserve under Paul Volcker. Currency boards, such as those implemented in Hong Kong since 1983, provide a fixed exchange rate regime backed by full foreign reserves, ensuring currency stability and anchoring inflation expectations. Implementation of monetary targeting often requires sophisticated financial systems and credible policy frameworks, while currency boards demand strict fiscal discipline and external reserve management to maintain the fixed peg.

Monetary Policy Transmission Mechanisms

Monetary targeting relies on controlling money supply aggregates to influence interest rates, credit availability, and ultimately inflation, enabling central banks to guide economic activity through adjustments in liquidity. In contrast, a currency board fixes the domestic currency to a foreign anchor currency, limiting independent monetary policy and transmitting shocks primarily through exchange rate stability and external monetary conditions. The monetary policy transmission mechanism in a currency board is constrained by automatic adjustments in the money base, reducing the central bank's role in managing domestic liquidity and interest rates.

Economic Stability and Exchange Rate Impacts

Monetary targeting relies on controlling money supply growth to achieve economic stability, often resulting in flexible exchange rates that can adjust to economic shocks. In contrast, a currency board fixes the domestic currency to a foreign anchor currency, providing rigid exchange rate stability but limiting monetary policy flexibility. While monetary targeting allows for inflation control through money supply management, currency boards offer stronger credibility and lower inflation expectations by guaranteeing convertibility.

Flexibility versus Rigidity in Policy Response

Monetary targeting allows central banks to adjust money supply targets based on economic conditions, offering greater flexibility in responding to inflation or recession. In contrast, a currency board enforces a fixed exchange rate backed by foreign reserves, creating rigidity that limits monetary policy adjustments to maintain currency stability. This rigidity may constrain economic growth during shocks but ensures long-term credibility and inflation control.

Case Studies: Examples from Various Economies

Monetary targeting in Germany during the 1970s helped stabilize inflation by controlling money supply growth, whereas Argentina's currency board in the 1990s pegged the peso to the US dollar, successfully curbing hyperinflation but limiting monetary policy flexibility. Hong Kong's enduring currency board system maintained exchange rate stability against the US dollar, fostering investor confidence and economic resilience. In contrast, Brazil's monetary targeting efforts in the 1980s faced challenges due to fiscal imbalances and volatile money demand, highlighting the limitations of targeting money supply without strict fiscal discipline.

Advantages and Drawbacks Comparison

Monetary targeting allows central banks to control inflation by setting growth rates for money supply, offering flexibility to respond to economic changes but risking misestimation and time lags in policy effects. Currency boards provide stronger credibility and exchange rate stability by backing domestic currency fully with foreign reserves, reducing inflation risk but limiting monetary policy autonomy and adaptability during economic shocks. While monetary targeting supports proactive economic management, currency boards prioritize fixed exchange rates and fiscal discipline, each presenting trade-offs in monetary control and economic stability.

Conclusion: Suitability for Emerging and Developed Economies

Monetary targeting offers flexibility that can benefit emerging economies experiencing volatile capital flows and inflation pressures, allowing adjustments in money supply to stabilize growth. Currency boards provide strong credibility and low inflation risk, making them more suitable for developed economies with stable fiscal policies and trade structures. The choice depends on economic stability, institutional strength, and external vulnerability, with currency boards better for stable environments and monetary targeting for economies needing adaptive monetary control.

Monetary targeting Infographic

libterm.com

libterm.com