Computable general equilibrium (CGE) models simulate how economies respond to changes in policy, technology, or external shocks by capturing interactions between multiple markets and agents. These models are essential for analyzing the economic impact of trade policies, environmental regulations, and fiscal changes, providing a comprehensive framework that reflects real-world complexities. Discover how CGE models can inform your understanding of economic dynamics by exploring the detailed insights in the rest of this article.

Table of Comparison

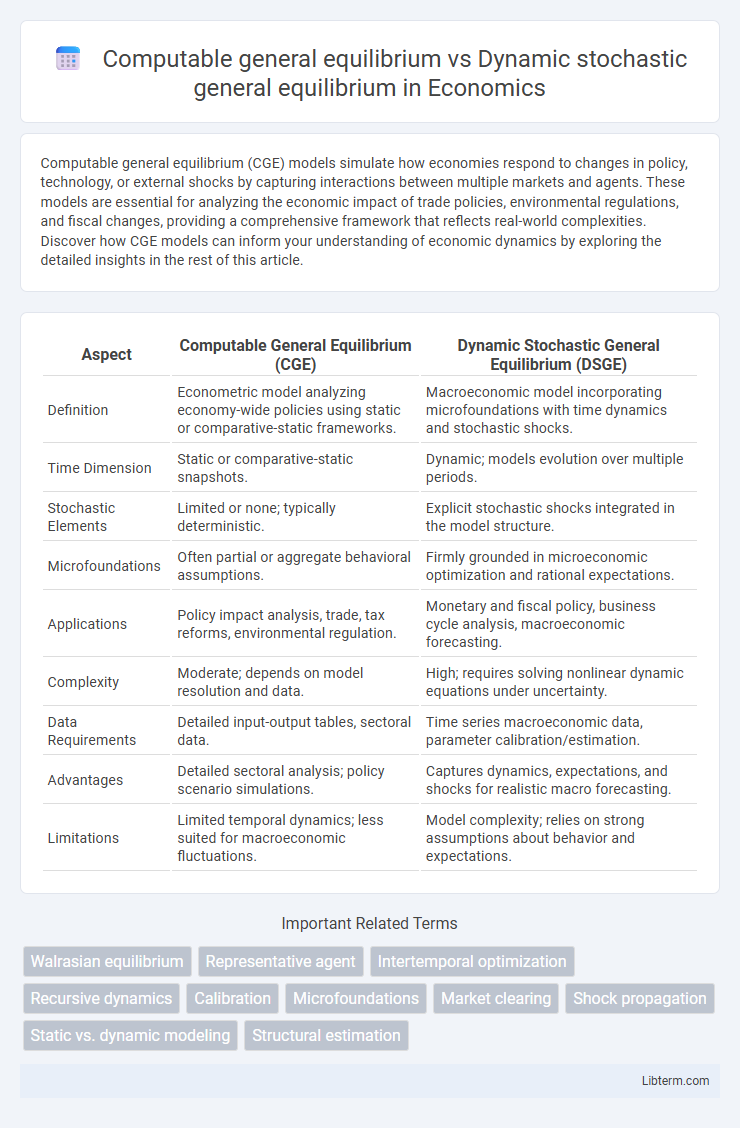

| Aspect | Computable General Equilibrium (CGE) | Dynamic Stochastic General Equilibrium (DSGE) |

|---|---|---|

| Definition | Econometric model analyzing economy-wide policies using static or comparative-static frameworks. | Macroeconomic model incorporating microfoundations with time dynamics and stochastic shocks. |

| Time Dimension | Static or comparative-static snapshots. | Dynamic; models evolution over multiple periods. |

| Stochastic Elements | Limited or none; typically deterministic. | Explicit stochastic shocks integrated in the model structure. |

| Microfoundations | Often partial or aggregate behavioral assumptions. | Firmly grounded in microeconomic optimization and rational expectations. |

| Applications | Policy impact analysis, trade, tax reforms, environmental regulation. | Monetary and fiscal policy, business cycle analysis, macroeconomic forecasting. |

| Complexity | Moderate; depends on model resolution and data. | High; requires solving nonlinear dynamic equations under uncertainty. |

| Data Requirements | Detailed input-output tables, sectoral data. | Time series macroeconomic data, parameter calibration/estimation. |

| Advantages | Detailed sectoral analysis; policy scenario simulations. | Captures dynamics, expectations, and shocks for realistic macro forecasting. |

| Limitations | Limited temporal dynamics; less suited for macroeconomic fluctuations. | Model complexity; relies on strong assumptions about behavior and expectations. |

Introduction to CGE and DSGE Models

Computable General Equilibrium (CGE) models simulate how economies respond to shocks by solving systems of equations representing markets and agents under equilibrium conditions, emphasizing static or comparative-static analysis. Dynamic Stochastic General Equilibrium (DSGE) models incorporate microfoundations with forward-looking agents facing uncertainty, capturing time-dependent economic fluctuations through stochastic processes. Both frameworks analyze policy impacts and economic dynamics, with CGE models focusing on detailed sectoral interactions, while DSGE models highlight expectations and shocks in macroeconomic environments.

Core Concepts: Understanding CGE

Computable General Equilibrium (CGE) models analyze economic systems by solving for equilibrium prices and quantities across multiple markets using real data, capturing static or comparative steady-state scenarios. They are grounded in microeconomic theory, emphasizing resource allocation, production technologies, and consumer preferences to evaluate policy impacts and structural changes. Unlike Dynamic Stochastic General Equilibrium (DSGE) models, CGE models typically do not explicitly incorporate time dynamics or stochastic shocks, focusing instead on how economies adjust to new equilibrium points.

Core Concepts: Understanding DSGE

Dynamic Stochastic General Equilibrium (DSGE) models incorporate microeconomic foundations, stochastic shocks, and forward-looking agents to analyze macroeconomic fluctuations, contrasting with Computable General Equilibrium (CGE) models that primarily focus on static or comparative static equilibrium without explicit dynamics. DSGE frameworks emphasize intertemporal optimization under uncertainty, allowing for the study of policy impacts over time by modeling expectations and adjustment processes. Core to DSGE models is the integration of stochastic processes and rational expectations, enabling nuanced analysis of economic volatility and dynamic responses absent in traditional CGE approaches.

Mathematical Foundations and Assumptions

Computable General Equilibrium (CGE) models rely on static or comparative-static algebraic systems representing market-clearing conditions and agent optimization problems, typically solved through nonlinear equation systems based on fixed-point theorems. Dynamic Stochastic General Equilibrium (DSGE) models incorporate intertemporal optimization and stochastic shocks within a microfounded framework, employing dynamic programming and stochastic differential/difference equations to capture time evolution and uncertainty. CGE assumes perfect competition and market clearing at a point in time, whereas DSGE models embed rational expectations and stochastic processes to reflect agents' forward-looking behavior under uncertainty.

Key Differences between CGE and DSGE

Computable General Equilibrium (CGE) models provide a static or comparative static analysis of an economy by simulating equilibrium across multiple markets using detailed sectoral data and fixed parameters. Dynamic Stochastic General Equilibrium (DSGE) models incorporate micro-founded behavior, forward-looking expectations, and stochastic shocks, allowing for the examination of economic fluctuations over time. Key differences include CGE's emphasis on static equilibrium with exogenous shocks versus DSGE's dynamic approach capturing temporal evolution and uncertainty in macroeconomic modeling.

Applications in Economic Policy Analysis

Computable General Equilibrium (CGE) models are widely used for analyzing the economic impact of policy changes, trade reforms, and environmental regulations by simulating the equilibrium effects on multiple sectors and agents within a static or comparative-static framework. Dynamic Stochastic General Equilibrium (DSGE) models incorporate microfoundations and stochastic shocks to study economic fluctuations, monetary and fiscal policy effectiveness, and macroeconomic dynamics over time. Both models are essential tools in economic policy analysis, with CGE models excelling in assessing structural policy impacts and DSGE models providing insights into time-dependent economic responses and uncertainty.

Strengths and Limitations of CGE Models

Computable General Equilibrium (CGE) models excel in capturing detailed sectoral interactions and policy impacts within a static or comparative steady-state framework, offering precise market equilibrium analysis based on actual economic data. Their major limitations include the inability to explicitly model time dynamics and uncertainty as found in Dynamic Stochastic General Equilibrium (DSGE) models, often resulting in less accurate predictions of short-term economic fluctuations and business cycles. CGE models rely heavily on assumptions of perfect competition and market clearance, which can oversimplify real-world frictions and adjustment processes.

Strengths and Limitations of DSGE Models

Dynamic Stochastic General Equilibrium (DSGE) models excel at integrating microeconomic foundations with stochastic shocks to analyze macroeconomic fluctuations and policy impacts over time, providing a rigorous, forward-looking framework for understanding dynamic economic responses. Their strengths lie in capturing time-varying behavior and expectations, as well as enabling counterfactual policy analysis under uncertainty. Limitations include heavy reliance on strong assumptions like rational expectations and representative agents, difficulty in accurately modeling real-world frictions, and challenges in empirically validating complex model structures, which can restrict their predictive power and realism compared to more flexible Computable General Equilibrium (CGE) models.

Choosing the Right Model for Research

Computable General Equilibrium (CGE) models offer a detailed snapshot of economic interactions based on actual data, ideal for policy analysis under specific economic structures. Dynamic Stochastic General Equilibrium (DSGE) models incorporate microeconomic foundations and stochastic shocks, making them suitable for analyzing time-dependent economic fluctuations and monetary policy effects. Selecting the appropriate model depends on research goals: CGE is preferred for static policy impact studies, while DSGE excels in dynamic macroeconomic analysis with uncertainty.

Future Directions and Model Integration

Future directions in Computable General Equilibrium (CGE) and Dynamic Stochastic General Equilibrium (DSGE) models emphasize enhanced integration to capture both detailed sectoral interactions and macroeconomic dynamics under uncertainty. Combining CGE's capacity for structural policy analysis with DSGE's strengths in stochastic shocks and time evolution offers a comprehensive framework for policy evaluation. Advancements in computational power and data availability are enabling hybrid models that improve predictive accuracy and policy relevance across multiple economic dimensions.

Computable general equilibrium Infographic

libterm.com

libterm.com