Monopoly is a classic board game where players buy, trade, and develop properties to dominate the market and bankrupt opponents. Strategic investment and negotiation skills are crucial to outperform competitors and build a winning empire. Explore the rest of the article to master Monopoly strategies and enhance your gameplay experience.

Table of Comparison

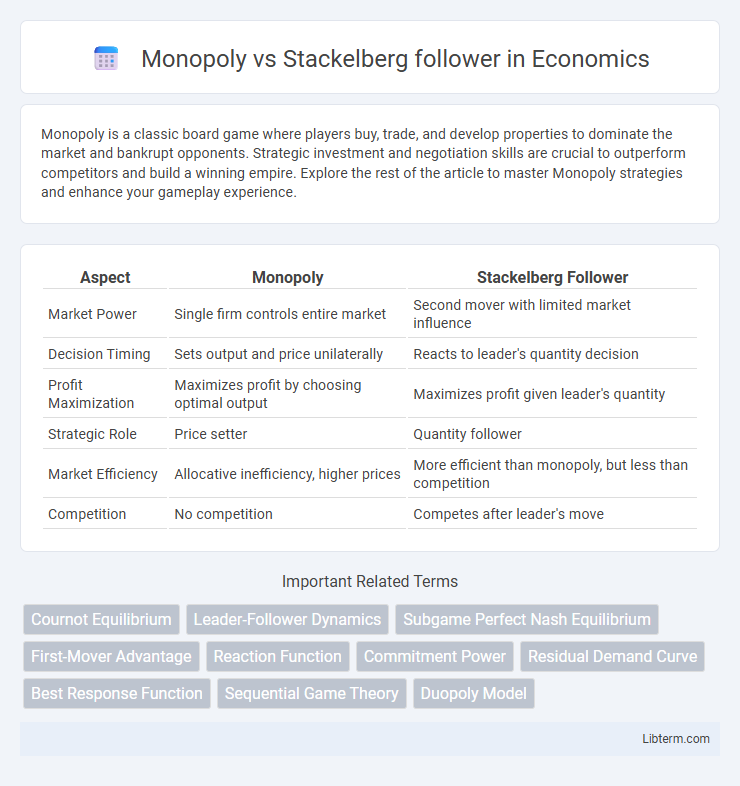

| Aspect | Monopoly | Stackelberg Follower |

|---|---|---|

| Market Power | Single firm controls entire market | Second mover with limited market influence |

| Decision Timing | Sets output and price unilaterally | Reacts to leader's quantity decision |

| Profit Maximization | Maximizes profit by choosing optimal output | Maximizes profit given leader's quantity |

| Strategic Role | Price setter | Quantity follower |

| Market Efficiency | Allocative inefficiency, higher prices | More efficient than monopoly, but less than competition |

| Competition | No competition | Competes after leader's move |

Introduction to Monopoly and Stackelberg Follower

A Monopoly is a market structure where a single firm dominates the entire industry, controlling prices and output without competition. In contrast, a Stackelberg follower operates in a sequential game where the leader firm moves first, and the follower firm optimizes its strategy based on the leader's decision. The follower's role in the Stackelberg model highlights strategic behavior influenced by the leader's market actions, resulting in different equilibrium outcomes compared to monopolistic markets.

Key Definitions and Economic Context

Monopoly refers to a market structure where a single firm dominates the entire industry, setting prices and output without competition, resulting in profit maximization under price-making conditions. The Stackelberg follower operates in a sequential game where one firm (leader) sets its output first, and the follower firm reacts optimally to this decision, emphasizing strategic interdependence and hierarchical decision-making in oligopoly markets. Economic models show monopoly outcomes typically lead to higher prices and lower quantities compared to the Stackelberg equilibrium, where follower firms adjust to the leader's strategy to optimize payoffs.

Market Structure Comparison

Monopoly market structure features a single firm dominating the entire market with full price-setting power and no direct competition, leading to restricted output and higher prices. In contrast, the Stackelberg follower operates in a duopolistic framework where one leader firm moves first and the follower firm reacts optimally, resulting in sequential quantity decisions and strategic interdependence. Market competition in Stackelberg models induces more output and potentially lower prices compared to monopolistic markets, reflecting the dynamics of leader-follower interaction in oligopolies.

Assumptions Behind Each Model

The Monopoly model assumes a single firm controls the entire market supply and sets output or price unilaterally without competitors, presuming complete market power and no strategic interactions. In contrast, the Stackelberg follower model involves sequential competition where the follower firm observes the leader's output decision before choosing its own, assuming asymmetric information and hierarchical decision-making. Both models rely on assumptions about firm behavior, market structure, and the timing of moves to predict equilibrium outcomes in oligopolistic markets.

Profit Maximization Strategies

In profit maximization strategies, a Monopoly sets output and price unilaterally to maximize total profit without competition constraints, resulting in higher prices and restricted output compared to competitive markets. The Stackelberg follower reacts to the leader's quantity decision by choosing their output to maximize their own profit, taking the leader's output as given and adjusting to optimize their payoff within the leader-follower hierarchy. Stackelberg competition results in different equilibrium quantities and profits compared to monopoly, with the follower typically earning less profit due to the strategic advantage of the leader.

Output and Pricing Decisions

In a Monopoly market, the firm sets output and price unilaterally to maximize profit, facing the entire market demand curve. In contrast, a Stackelberg follower determines output by observing the leader's quantity decision and adjusts its price accordingly, often resulting in lower output and prices than the leader. Price competition in a Stackelberg framework leads to strategic interdependence, whereas monopoly pricing remains solely dependent on the monopolist's cost structure and demand elasticity.

Role of Market Power

Monopoly firms wield significant market power by directly controlling prices and output levels without competition, enabling them to maximize profits through strategic quantity or price settings. In Stackelberg competition, the follower's market power is constrained by the leader's commitment to output decisions, forcing the follower to optimize output based on residual demand after the leader acts. The leader's first-mover advantage enhances its market power, while the follower has less influence on market price, reflecting asymmetric market power dynamics.

Welfare Implications for Consumers and Producers

Monopoly markets typically result in higher prices and reduced output compared to Stackelberg follower scenarios, leading to lower consumer surplus and overall welfare loss. In the Stackelberg follower model, the follower firm's strategic quantity decisions promote more competitive market outcomes, increasing total welfare by expanding output and lowering prices. Producers in monopoly gain higher profits due to market power, whereas Stackelberg followers experience moderated profits but contribute to improved allocative efficiency and consumer welfare.

Real-World Applications and Examples

Monopoly markets often emerge in natural monopolies such as utilities, where a single firm controls the entire supply, enabling price-setting power without competition, exemplified by electric companies in many regions. In contrast, Stackelberg follower models apply to industries with sequential competition, like aerospace manufacturing, where firms observe leaders' output decisions before optimizing their strategies, as seen in Boeing and Airbus production planning. These models illustrate how market structure and timing impact pricing, output decisions, and competitive dynamics in real-world economic environments.

Conclusion: Strategic Insights and Policy Implications

Monopoly markets centralize production decisions, leading to higher prices and reduced output compared to Stackelberg follower settings, where firms react to leaders by adjusting quantities optimally. Understanding these strategic interactions highlights the importance of regulatory policies that encourage competition and reduce market power to enhance consumer welfare. Policymakers should focus on promoting transparency and entry conditions that mitigate monopolistic dominance and foster dynamic competitive responses.

Monopoly Infographic

libterm.com

libterm.com