Arrow-Debreu prices represent the fundamental state prices for securities in a complete market, reflecting the present value of payoffs contingent on specific future states of the world. These prices are crucial in asset pricing theory, providing a way to price any contingent claim by decomposing it into basic state-contingent claims. Explore the article to understand how Arrow-Debreu prices influence financial modeling and investment strategies.

Table of Comparison

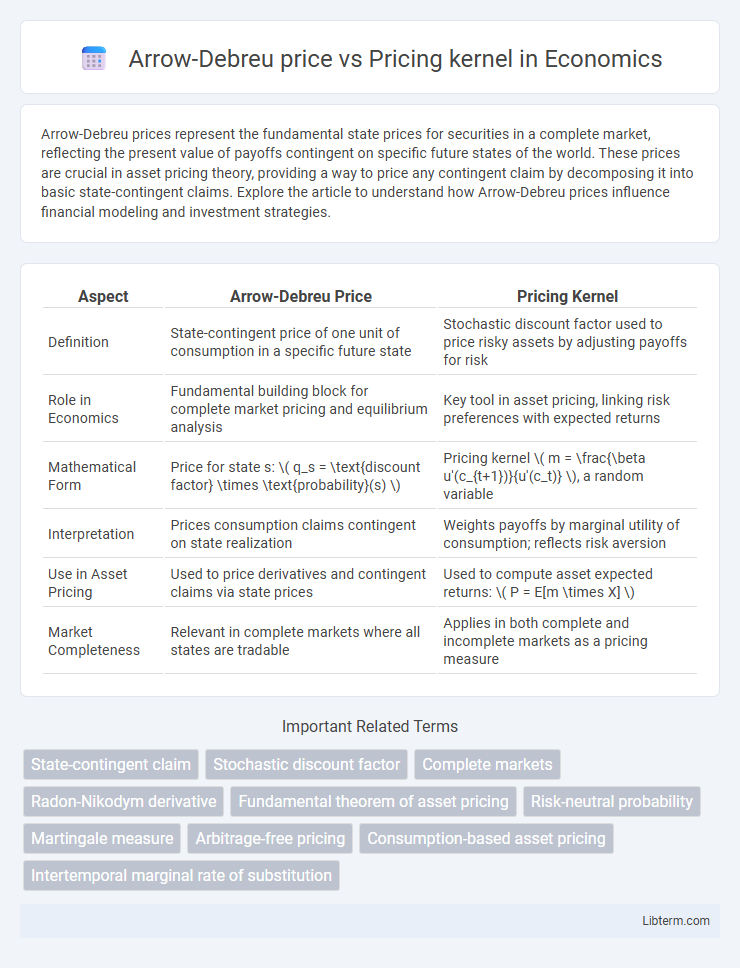

| Aspect | Arrow-Debreu Price | Pricing Kernel |

|---|---|---|

| Definition | State-contingent price of one unit of consumption in a specific future state | Stochastic discount factor used to price risky assets by adjusting payoffs for risk |

| Role in Economics | Fundamental building block for complete market pricing and equilibrium analysis | Key tool in asset pricing, linking risk preferences with expected returns |

| Mathematical Form | Price for state s: \( q_s = \text{discount factor} \times \text{probability}(s) \) | Pricing kernel \( m = \frac{\beta u'(c_{t+1})}{u'(c_t)} \), a random variable |

| Interpretation | Prices consumption claims contingent on state realization | Weights payoffs by marginal utility of consumption; reflects risk aversion |

| Use in Asset Pricing | Used to price derivatives and contingent claims via state prices | Used to compute asset expected returns: \( P = E[m \times X] \) |

| Market Completeness | Relevant in complete markets where all states are tradable | Applies in both complete and incomplete markets as a pricing measure |

Introduction to Arrow-Debreu Prices

Arrow-Debreu prices represent the present value of a state-contingent claim paying one unit of currency if a specific future state occurs, serving as fundamental building blocks in complete markets for asset pricing. These prices reflect the unique state price vector used to price all contingent claims under perfect market assumptions, enabling the decomposition of complex payoffs into linear combinations of Arrow-Debreu securities. The pricing kernel, or stochastic discount factor, relates closely by discounting future payoffs under uncertainty, but Arrow-Debreu prices explicitly anchor valuation in individual future states, offering a granular framework for understanding equilibrium asset prices.

Understanding the Pricing Kernel Concept

The Arrow-Debreu price represents the state price or the cost of securing one unit of consumption in a particular future state, forming the foundation for pricing contingent claims in general equilibrium. The pricing kernel, also known as the stochastic discount factor, bridges Arrow-Debreu prices with subjective probabilities by weighting payoffs according to marginal utility changes across states, capturing investors' risk preferences. Understanding the pricing kernel concept is essential for linking market prices to investors' valuation of risk, enabling robust asset pricing models and equilibrium analysis.

Mathematical Formulation: Arrow-Debreu vs. Pricing Kernel

The Arrow-Debreu price is mathematically defined as the present value of a contingent claim paying one unit of currency in a specific state of the world, represented as \( q(s) = \pi(s) m(s) \), where \( \pi(s) \) is the state price density and \( m(s) \) is the pricing kernel or stochastic discount factor. The pricing kernel \( m(s) \) acts as a Radon-Nikodym derivative linking the risk-neutral measure to the physical measure, enabling the transformation of expected payoffs under \( \mathbb{P} \) to the risk-neutral measure \( \mathbb{Q} \). Consequently, the Arrow-Debreu price isolates state-specific payoffs, while the pricing kernel serves as a fundamental stochastic discounting tool that adjusts for risk preferences and time value of money in asset pricing.

The Role in Asset Pricing Theory

Arrow-Debreu prices represent state-contingent claims that assign a value to payoffs in specific future states, serving as fundamental building blocks for asset pricing in complete markets. The pricing kernel, or stochastic discount factor, transforms future payoffs into present values by adjusting for risk preferences and time value, effectively summarizing investors' marginal utility of consumption across states. Both concepts play a central role in asset pricing theory by linking observable prices to underlying economic fundamentals through a consistent valuation framework.

Risk-Neutral Valuation and State Prices

Arrow-Debreu prices represent the value of securities that pay one unit of currency in a specific future state, serving as fundamental building blocks for state-contingent claims. The pricing kernel, or stochastic discount factor, weights future payoffs by adjusting for risk and time preferences, enabling risk-neutral valuation by transforming actual probabilities into equivalent martingale measures. This framework links state prices directly to the pricing kernel, allowing derivative pricing through expected discounted payoffs under the risk-neutral measure.

Economic Intuition Behind Arrow-Debreu Prices

Arrow-Debreu prices represent state-contingent claims that assign value to payoffs occurring in specific future states, reflecting the marginal rate of substitution between consumption in those states. The economic intuition behind Arrow-Debreu prices lies in their role as fundamental building blocks for pricing all assets, encapsulating the market participants' preferences and beliefs about future uncertainties. Unlike the pricing kernel, which aggregates marginal utilities across states to discount payoffs, Arrow-Debreu prices directly correspond to the value of elementary securities paying off in single states, enabling decomposition of complex asset pricing.

Interpretation and Properties of the Pricing Kernel

The pricing kernel, also known as the stochastic discount factor, represents the state-price density used to value uncertain future payoffs by discounting them to present values under investor preferences and risk aversion, reflecting marginal utility changes. Unlike Arrow-Debreu prices, which are specific security prices for individual states of the world, the pricing kernel summarizes these state prices across all states, encoding the entire risk-neutral probability measure. Key properties of the pricing kernel include positivity, normalization, and its role as a Radon-Nikodym derivative linking real-world probabilities to risk-neutral measures, making it central to asset pricing and risk assessment.

Comparing Market Completeness Assumptions

Arrow-Debreu prices, derived under the assumption of complete markets, represent state-contingent claims allowing perfect hedging of all future payoffs, whereas pricing kernels operate in potentially incomplete markets by weighting payoffs according to marginal utility changes. Market completeness ensures Arrow-Debreu prices form a unique equivalent martingale measure, enabling exact replication and no-arbitrage pricing, while pricing kernels accommodate market frictions and incomplete asset spans by adjusting discount factors flexibly. Comparing these frameworks highlights that Arrow-Debreu models assume complete markets with full state spanning, whereas pricing kernel methods extend valuation to realistic settings with market incompleteness and stochastic investment opportunities.

Applications in Financial Modeling

Arrow-Debreu prices serve as state-price securities representing payoffs contingent on future states, enabling precise valuation of derivative securities within complete markets. Pricing kernels, also known as stochastic discount factors, adjust future payoffs for risk preferences and time value, facilitating the consistent pricing of assets under uncertainty. In financial modeling, leveraging Arrow-Debreu prices allows for explicit construction of replicating portfolios, while pricing kernels support risk-adjusted discounting, both crucial for option pricing, asset allocation, and equilibrium analysis.

Summary: Key Differences and Practical Implications

Arrow-Debreu prices represent state-contingent claims that directly price payoffs in specific future states, serving as fundamental building blocks in complete market models. The pricing kernel, or stochastic discount factor, encapsulates investors' marginal utilities and combines risk preferences with probabilities to discount uncertain future cash flows. Practically, Arrow-Debreu prices facilitate explicit decomposition of risks by state, while the pricing kernel is used for asset pricing under uncertainty, enabling valuation across incomplete markets and linking consumption-based utility with equilibrium prices.

Arrow-Debreu price Infographic

libterm.com

libterm.com