The four-sector model divides the economy into households, firms, government, and foreign sectors, illustrating the flow of goods, services, and finances between them. This framework helps explain how money circulates through different parts of the economy, influencing production and consumption patterns. Explore the following article to understand how this model impacts your financial decisions and economic understanding.

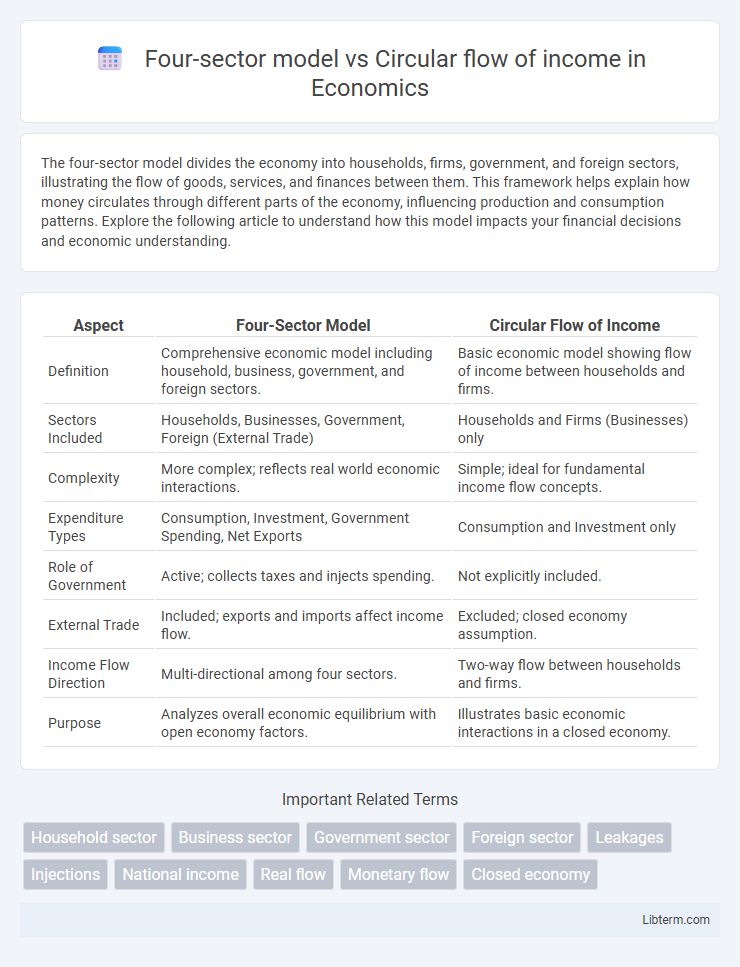

Table of Comparison

| Aspect | Four-Sector Model | Circular Flow of Income |

|---|---|---|

| Definition | Comprehensive economic model including household, business, government, and foreign sectors. | Basic economic model showing flow of income between households and firms. |

| Sectors Included | Households, Businesses, Government, Foreign (External Trade) | Households and Firms (Businesses) only |

| Complexity | More complex; reflects real world economic interactions. | Simple; ideal for fundamental income flow concepts. |

| Expenditure Types | Consumption, Investment, Government Spending, Net Exports | Consumption and Investment only |

| Role of Government | Active; collects taxes and injects spending. | Not explicitly included. |

| External Trade | Included; exports and imports affect income flow. | Excluded; closed economy assumption. |

| Income Flow Direction | Multi-directional among four sectors. | Two-way flow between households and firms. |

| Purpose | Analyzes overall economic equilibrium with open economy factors. | Illustrates basic economic interactions in a closed economy. |

Introduction to Economic Models

The four-sector model expands on the circular flow of income by integrating the government and foreign sectors alongside households and firms, providing a comprehensive framework for analyzing national economies. This economic model incorporates taxation, government spending, exports, and imports, allowing for a nuanced understanding of economic activities and their interdependencies. By including these sectors, the four-sector model offers a more realistic representation of complex economic interactions compared to the simpler circular flow, which primarily illustrates money flows between households and firms.

Overview of the Four-Sector Model

The Four-Sector Model expands the Circular Flow of Income by incorporating the government and foreign markets alongside households and firms, highlighting government spending, taxation, exports, and imports. This model provides a comprehensive framework to analyze national income distribution, fiscal policies, and international trade impact on the economy. It enables better understanding of leakages and injections influencing overall economic equilibrium and growth.

Components of the Circular Flow of Income

The Four-sector model of the circular flow of income incorporates households, firms, government, and the foreign sector, highlighting the interactions of these components through injections and withdrawals in the economy. This model extends the basic circular flow by including government spending and taxation, as well as exports and imports, which influence national income and aggregate demand. Components such as consumption, investment, government expenditure, exports, imports, and taxes form the core variables that drive the continuous movement of income and output within this framework.

Key Differences Between the Models

The four-sector model expands the basic circular flow of income by including the government and foreign sectors alongside households and businesses, reflecting real-world economic interactions more comprehensively. Unlike the simple circular flow, which primarily tracks the flow of money between households and firms, the four-sector model incorporates government taxation, public spending, imports, and exports. This inclusion allows for a more detailed analysis of economic activities such as fiscal policy effects and international trade impacts on national income.

Roles of Households, Firms, Government, and Foreign Sector

Households supply labor, consume goods, and pay taxes in both the four-sector model and the circular flow of income, acting as primary consumers and income earners. Firms produce goods and services, pay wages, invest, and respond to government regulations, driving economic output. The government collects taxes, provides public goods, redistributes income, and influences the economy through fiscal policy, while the foreign sector engages in exports, imports, and international financial flows, impacting the overall balance of trade and income.

Income Flow and Leakages in the Economy

The Four-sector model expands on the Circular Flow of Income by incorporating the government and foreign sectors alongside households and firms, highlighting more complex income flows and leakages. Income flows through consumption, investment, government spending, and net exports, while leakages occur via savings, taxes, and imports, reducing the total amount circulating in the economy. This model provides a detailed framework to analyze how these leakages impact aggregate demand and overall economic equilibrium.

Impact on Economic Analysis and Policy

The Four-sector model, incorporating households, firms, government, and foreign markets, provides a comprehensive framework for analyzing economic interactions and policy impacts on trade, fiscal measures, and external sector fluctuations, enhancing precision in national income accounting. The Circular Flow of Income model simplifies these interactions by visualizing the continuous movement of money and goods between two or three sectors, aiding in understanding aggregate demand, income distribution, and multipliers but often lacks detail on government and foreign sector influences. Policymakers rely on the Four-sector model for targeted interventions in taxation, government spending, and trade policies, while the Circular Flow model remains essential for grasping fundamental economic flows and identifying leakages and injections in the economy.

Advantages and Limitations of Each Model

The Four-sector model incorporates the government and foreign sectors into the traditional household and business framework, offering a more comprehensive analysis of economic activities by reflecting real-world fiscal policies and international trade, which enhances policy assessment and economic forecasting. However, this model's complexity can obscure the direct monetary flows and make it less accessible for basic economic teaching compared to the Circular flow of income, which simplifies interactions between households and firms to illustrate fundamental economic exchanges and income generation. While the Circular flow model benefits from its straightforwardness and clarity in demonstrating core market processes, it lacks the nuanced details of government intervention and global trade, limiting its applicability in analyzing modern economies with significant external sector dynamics.

Real-World Applications and Examples

The Four-sector model incorporates households, firms, government, and foreign markets, providing a comprehensive framework to analyze real-world economic activities like international trade, fiscal policies, and consumer spending. Unlike the simpler Circular Flow of Income, which primarily shows the flow between households and firms, the Four-sector model allows for a more detailed examination of government interventions, taxation, and net exports in practical economic scenarios. Real-world applications include evaluating the impacts of government stimulus packages and trade deficits on national income and overall economic equilibrium.

Conclusion: Choosing the Right Model

The choice between the Four-sector model and the Circular Flow of Income depends on the level of economic complexity being analyzed; the Four-sector model offers a detailed framework by incorporating households, firms, government, and foreign sectors for comprehensive macroeconomic assessment. The Circular Flow of Income simplifies economic interactions focusing primarily on households and firms, making it suitable for basic economic analysis and understanding core market dynamics. Selecting the appropriate model ensures accurate representation of economic activities and effective policy formulation based on the specific analytical objectives.

Four-sector model Infographic

libterm.com

libterm.com