Moneyness measures the intrinsic value of an option relative to the current price of the underlying asset, indicating whether exercising the option would be profitable. Understanding moneyness helps you evaluate potential gains or losses, guiding smarter trading decisions and risk management. Explore the rest of the article to uncover how moneyness influences option pricing and strategy selection.

Table of Comparison

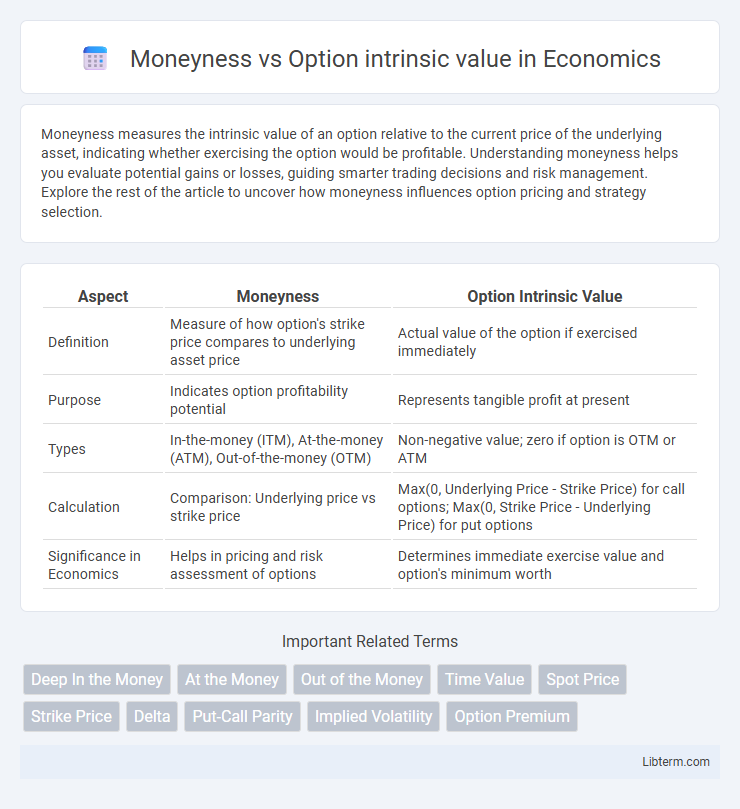

| Aspect | Moneyness | Option Intrinsic Value |

|---|---|---|

| Definition | Measure of how option's strike price compares to underlying asset price | Actual value of the option if exercised immediately |

| Purpose | Indicates option profitability potential | Represents tangible profit at present |

| Types | In-the-money (ITM), At-the-money (ATM), Out-of-the-money (OTM) | Non-negative value; zero if option is OTM or ATM |

| Calculation | Comparison: Underlying price vs strike price | Max(0, Underlying Price - Strike Price) for call options; Max(0, Strike Price - Underlying Price) for put options |

| Significance in Economics | Helps in pricing and risk assessment of options | Determines immediate exercise value and option's minimum worth |

Introduction to Moneyness and Intrinsic Value

Moneyness measures the relationship between an option's strike price and the underlying asset's current market price, indicating whether the option is in-the-money, at-the-money, or out-of-the-money. Intrinsic value represents the actual profit potential of an option if exercised immediately, defined as the difference between the underlying asset's price and the strike price for in-the-money options. Understanding moneyness helps investors gauge the intrinsic value and overall attractiveness of call and put options in trading strategies.

Defining Moneyness in Options Trading

Moneyness in options trading measures the relationship between the option's strike price and the underlying asset's current market price, categorizing options as in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM). This classification directly influences an option's intrinsic value, where ITM options possess positive intrinsic value, ATM options have zero intrinsic value, and OTM options have no intrinsic value. Understanding moneyness is essential for evaluating option pricing, potential profitability, and strategic exercise decisions in options trading.

Understanding Option Intrinsic Value

Option intrinsic value represents the immediate profit potential if the option is exercised, directly correlating to the difference between the underlying asset's current price and the option's strike price. Moneyness categorizes options as in-the-money, at-the-money, or out-of-the-money based on this intrinsic value relationship, impacting the option's effective worth. Understanding intrinsic value helps traders assess an option's real exercise value distinct from its time value or volatility premium.

Types of Moneyness: ITM, ATM, and OTM

Types of moneyness--In The Money (ITM), At The Money (ATM), and Out of The Money (OTM)--determine the intrinsic value of options by comparing strike price to underlying asset price. ITM options have positive intrinsic value because the strike price is favorable; call options are ITM when the underlying asset price exceeds the strike price, while put options are ITM when it is below. ATM options have zero intrinsic value with strike price equal to the underlying price, and OTM options have no intrinsic value as the strike price is unfavorable relative to the asset price.

Relationship Between Moneyness and Intrinsic Value

Moneyness directly determines an option's intrinsic value by indicating whether the option is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM). For call options, intrinsic value exists when the underlying asset's price exceeds the strike price, whereas for put options, intrinsic value is present when the strike price exceeds the underlying asset's price. The degree of moneyness quantifies how far an option is ITM or OTM, thus reflecting the magnitude of its intrinsic value.

Calculating Intrinsic Value for Calls and Puts

Moneyness determines whether an option is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM), directly influencing its intrinsic value. The intrinsic value of a call option is calculated as the maximum of zero or the difference between the underlying asset's current price and the option's strike price (max(0, S - K)). For a put option, intrinsic value is the maximum of zero or the difference between the strike price and the underlying's current price (max(0, K - S)).

Impacts of Moneyness on Option Pricing

Moneyness significantly impacts option pricing by determining the intrinsic value and influencing the premium buyers pay. In-the-money options possess positive intrinsic value, making them more expensive due to higher exercise likelihood, while out-of-the-money options have zero intrinsic value and lower premiums reflecting lower probability of profitability. At-the-money options balance time value and intrinsic value, often resulting in moderate pricing driven primarily by implied volatility and time until expiration.

Real-World Examples: Moneyness vs Intrinsic Value

Moneyness categorizes options based on the relationship between the current stock price and the option's strike price, such as in-the-money, at-the-money, or out-of-the-money, directly influencing an option's intrinsic value, which is the amount by which an option is profitable if exercised immediately. For example, a call option with a strike price of $50 on a stock trading at $60 has intrinsic value of $10 and is considered in-the-money, whereas the same call option with stock price at $45 has zero intrinsic value and is out-of-the-money. Real-world trading strategies often assess both moneyness and intrinsic value to determine option pricing, potential profit, and risk metrics.

Moneyness, Intrinsic Value, and Trading Strategies

Moneyness measures an option's intrinsic value by comparing the underlying asset's current price to the option's strike price, categorizing options as in-the-money, at-the-money, or out-of-the-money. Intrinsic value represents the immediate profit potential if the option were exercised, calculated as the difference between the underlying price and strike price for in-the-money options, with no intrinsic value for out-of-the-money options. Trading strategies leverage moneyness to optimize risk and reward, such as buying in-the-money options for higher intrinsic value and lower time decay or selling out-of-the-money options to collect premiums with less capital outlay.

Key Takeaways: Optimizing Option Decisions

Moneyness measures the relationship between an option's strike price and the underlying asset's current price, indicating whether the option is in-the-money, at-the-money, or out-of-the-money. Intrinsic value represents the actual profit an option would yield if exercised immediately, calculated as the difference between the underlying asset price and strike price for in-the-money options. Optimizing option decisions involves analyzing both moneyness and intrinsic value to balance potential gains with risk, improving timing and strategy in option trading.

Moneyness Infographic

libterm.com

libterm.com