The maturity premium refers to the higher yield investors demand for holding longer-term bonds compared to short-term bonds, compensating for increased risks such as interest rate fluctuations and inflation over time. Understanding how maturity premiums affect your investment returns is crucial for balancing risk and reward in fixed-income portfolios. Explore the rest of the article to learn how maturity premiums influence bond pricing and investment strategies.

Table of Comparison

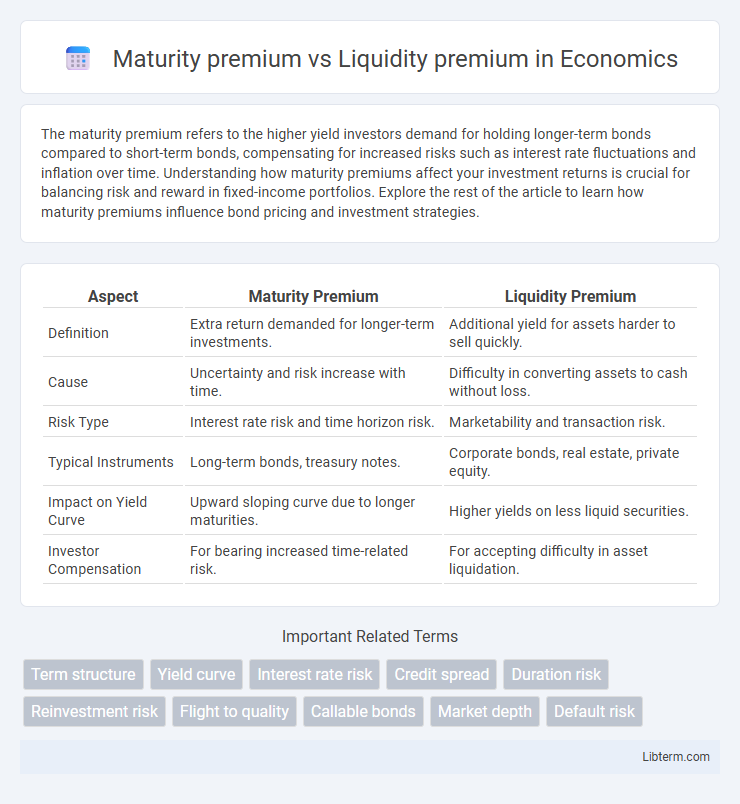

| Aspect | Maturity Premium | Liquidity Premium |

|---|---|---|

| Definition | Extra return demanded for longer-term investments. | Additional yield for assets harder to sell quickly. |

| Cause | Uncertainty and risk increase with time. | Difficulty in converting assets to cash without loss. |

| Risk Type | Interest rate risk and time horizon risk. | Marketability and transaction risk. |

| Typical Instruments | Long-term bonds, treasury notes. | Corporate bonds, real estate, private equity. |

| Impact on Yield Curve | Upward sloping curve due to longer maturities. | Higher yields on less liquid securities. |

| Investor Compensation | For bearing increased time-related risk. | For accepting difficulty in asset liquidation. |

Understanding Maturity Premium: Definition and Overview

Maturity premium refers to the additional return investors demand for holding longer-term securities that carry greater interest rate risk and uncertainty compared to short-term instruments. This premium compensates investors for the increased potential price volatility and opportunity cost associated with extended investment horizons. Understanding maturity premium is crucial for evaluating yield curves and making informed decisions about bond investments and portfolio duration strategies.

What is Liquidity Premium? Key Concepts

Liquidity premium represents the extra return investors demand for holding assets that cannot be quickly converted into cash without significant price concession. This premium compensates for the risk associated with lower marketability and longer time to sell, impacting bond yields and investment decisions. Understanding liquidity premium is crucial for accurately pricing securities and assessing potential returns in less liquid markets.

Theoretical Foundations of Maturity and Liquidity Premiums

Maturity premium is rooted in the term structure of interest rates, reflecting investors' compensation for increased risks associated with longer investment horizons, such as interest rate risk and inflation uncertainty. Liquidity premium arises from the marketability of an asset, representing the extra yield demanded by investors for holding securities that cannot be quickly converted to cash without significant price concessions. Theoretical models like the Liquidity Preference Theory and the Liquidity-Adjusted Capital Asset Pricing Model (LCAPM) explain these premiums by quantifying the trade-offs between risk, return, and ease of asset liquidation.

Factors Influencing Maturity Premium

The maturity premium reflects the additional return investors demand for holding longer-term bonds due to increased interest rate risk and uncertainty over time. Factors influencing maturity premium include inflation expectations, economic growth forecasts, and the volatility of interest rates, which increase the potential for price fluctuations in long-term securities. Higher uncertainty in future interest rates and inflation leads to a greater maturity premium as compensation for bearing these risks over an extended period.

Determinants of Liquidity Premium

Liquidity premium is primarily determined by the ease with which an asset can be traded without causing significant price changes, influenced by market depth and trading frequency. Assets with lower transaction costs, higher trading volumes, and more market participants tend to have smaller liquidity premiums. In contrast, maturity premium is driven by the interest rate risk associated with longer-term investments, reflecting compensation for uncertainty over time rather than trading ease.

Maturity Premium vs Liquidity Premium: Key Differences

Maturity premium refers to the additional return investors require for holding longer-term securities due to increased risks such as interest rate fluctuations and inflation uncertainty. Liquidity premium is the extra yield demanded for holding assets that are not easily convertible to cash without significant price concessions. The key difference lies in the risk type: maturity premium compensates for time-related risks, while liquidity premium compensates for marketability or ease-of-sale risks.

How Market Conditions Impact Both Premiums

Market conditions influence the maturity premium as investors demand higher returns for longer-term bonds during periods of economic uncertainty and rising interest rates, reflecting increased risk over extended horizons. Liquidity premium fluctuates based on market liquidity, with stressed or volatile markets causing a spike in premiums as investors require compensation for the difficulty in quickly buying or selling assets without significant price concessions. Both premiums rise in unstable markets, but while the maturity premium is driven by time-related interest rate risk, the liquidity premium is primarily affected by the availability and ease of trading securities.

Implications for Investors and Portfolio Management

Maturity premium compensates investors for the increased risk of holding longer-term bonds, influencing portfolio duration decisions and yield curve strategies. Liquidity premium reflects the additional yield required for securities that cannot be quickly sold without price concessions, affecting asset selection and trading flexibility. Understanding these premiums helps investors balance risk, return, and liquidity needs to optimize portfolio diversification and performance.

Real-World Examples: Maturity and Liquidity Premiums in Action

Investors in U.S. Treasury securities often witness the maturity premium through longer-term bonds offering higher yields than short-term notes, compensating for increased interest rate risk over time. Meanwhile, the liquidity premium is evident in corporate bonds with similar maturities but varying liquidity; less frequently traded bonds command higher yields to offset the difficulty of quick sale. For instance, during the 2008 financial crisis, liquidity premiums surged as investors demanded higher returns to hold illiquid assets, while maturity premiums remained relatively stable.

Strategies to Leverage Maturity and Liquidity Premiums

Investors can leverage the maturity premium by constructing bond portfolios with longer durations, capitalizing on higher yields offered by longer-term securities to enhance returns during stable interest rate environments. Strategies to exploit the liquidity premium involve selecting less liquid assets, such as corporate bonds or emerging market debt, where investors earn extra yield as compensation for lower marketability. Combining both premiums requires balancing portfolio duration and liquidity risk tolerance, optimizing yield without excessive exposure to interest rate volatility or illiquidity shocks.

Maturity premium Infographic

libterm.com

libterm.com