The Monetarist model emphasizes the role of money supply in influencing economic output and inflation, advocating for controlled growth in money stock to ensure price stability. This model challenges Keynesian views by stressing that excessive government intervention can lead to inflation without improving employment levels. Discover how the Monetarist model can shape your understanding of economic policies in the full article.

Table of Comparison

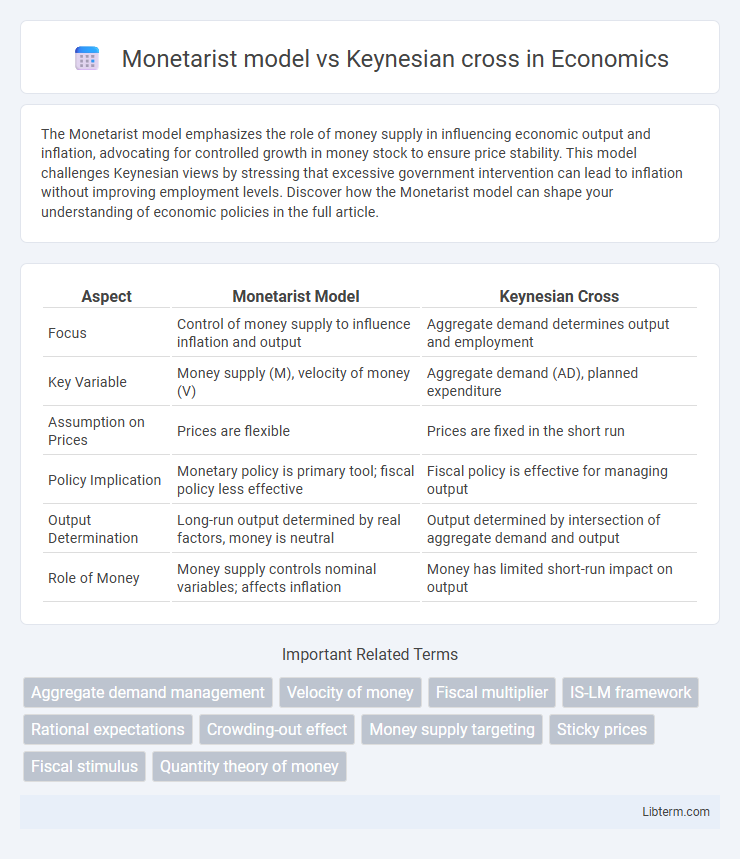

| Aspect | Monetarist Model | Keynesian Cross |

|---|---|---|

| Focus | Control of money supply to influence inflation and output | Aggregate demand determines output and employment |

| Key Variable | Money supply (M), velocity of money (V) | Aggregate demand (AD), planned expenditure |

| Assumption on Prices | Prices are flexible | Prices are fixed in the short run |

| Policy Implication | Monetary policy is primary tool; fiscal policy less effective | Fiscal policy is effective for managing output |

| Output Determination | Long-run output determined by real factors, money is neutral | Output determined by intersection of aggregate demand and output |

| Role of Money | Money supply controls nominal variables; affects inflation | Money has limited short-run impact on output |

Introduction to Monetarist and Keynesian Theories

Monetarist theory emphasizes the role of money supply in controlling inflation and influencing economic output, advocating for steady, predictable increases in money supply to achieve long-term economic stability. Keynesian theory focuses on aggregate demand as the primary driver of economic activity, suggesting that government intervention through fiscal policy is essential to manage economic fluctuations and achieve full employment. While Monetarists prioritize monetary policy for stabilizing the economy, Keynesians emphasize fiscal policy's role in combating recessions and stimulating growth.

Core Principles of the Monetarist Model

The Monetarist model emphasizes the role of the money supply in controlling inflation and influencing economic output, asserting that markets naturally adjust to equilibrium without extensive government intervention. It prioritizes a stable growth rate of money supply, guided by the Quantity Theory of Money, where changes in money supply directly affect price levels rather than real output in the long run. Unlike the Keynesian cross, which focuses on aggregate demand and fiscal policy to manage economic fluctuations, the Monetarist perspective advocates for limited fiscal interference and stresses monetary policy as the key tool for economic stability.

Fundamentals of the Keynesian Cross

The Keynesian Cross model emphasizes aggregate demand as the primary driver of economic output, illustrating how equilibrium output is determined where planned expenditures equal actual output. This framework highlights the role of government spending and fiscal policy in addressing demand shortfalls, contrasting with the Monetarist model's focus on monetary policy and the money supply's impact on inflation and output. Understanding the Keynesian Cross is fundamental for analyzing short-run economic fluctuations and the multiplier effect inherent in fiscal interventions.

Money Supply and Aggregate Demand Dynamics

The Monetarist model emphasizes the control of money supply as the primary tool to regulate aggregate demand, asserting that changes in money supply directly influence price levels and output in the long run. The Keynesian Cross focuses on aggregate expenditure and output determination without explicitly modeling money supply, highlighting the role of fiscal policy in managing demand shortfalls. Monetarists argue for stable money growth to avoid inflation, while Keynesians prioritize government spending and taxation adjustments to stabilize demand fluctuations.

Government Intervention: Monetarist vs Keynesian Perspectives

Monetarists argue that government intervention disrupts market equilibrium by distorting money supply, advocating for limited fiscal policies and a focus on controlling inflation through monetary tools. Keynesians emphasize active government fiscal intervention to manage aggregate demand, believing that public spending and taxation can stabilize economic fluctuations and reduce unemployment. While Monetarists prioritize monetary stability, Keynesians support direct government spending to address demand shortfalls.

Short-Run vs Long-Run Economic Adjustments

The Monetarist model emphasizes price level flexibility and market self-correction, highlighting that economies tend to return to natural output levels in the long run through monetary policy adjustments. In contrast, the Keynesian cross model focuses on demand-driven short-run fluctuations where output and employment deviate from natural levels due to rigid prices and wages. Short-run Keynesian analysis stresses fiscal policy's role in stabilizing demand, while Monetarists advocate for controlling money supply to influence long-run growth and inflation.

Policy Effectiveness: Fiscal vs Monetary Tools

The Monetarist model emphasizes the effectiveness of monetary policy, arguing that changes in the money supply have a direct and predictable impact on output and inflation, while fiscal policy is often seen as less effective due to crowding out effects. In contrast, the Keynesian cross highlights fiscal policy as the primary tool for managing aggregate demand, especially during recessions, asserting that government spending and taxation can directly influence output and employment levels. Monetary policy in the Keynesian framework is considered less potent when interest rates are near zero or in liquidity traps, making fiscal interventions critical for economic stabilization.

Inflation and Unemployment: Comparative Insights

The Monetarist model emphasizes controlling inflation through regulation of the money supply, asserting that excessive money growth leads to higher inflation without long-term reductions in unemployment. The Keynesian cross framework highlights the role of aggregate demand in influencing output and employment, suggesting fiscal stimulus can reduce unemployment at the risk of increased inflation. Comparative analysis reveals Monetarists prioritize price stability and expect natural unemployment levels, whereas Keynesians advocate active demand management to address unemployment, often accepting short-term inflation trade-offs.

Historical Performance and Empirical Evidence

The Monetarist model, championed by Milton Friedman, emphasizes the control of money supply to manage inflation and economic stability, demonstrating robust predictive power during the 1970s stagflation when Keynesian policies faltered. Empirical evidence highlights the Keynesian cross's effectiveness in explaining short-term demand fluctuations and fiscal stimulus impacts, particularly during the Great Depression and the 2008 financial crisis. Historical performance shows the Monetarist approach excels in long-term inflation control, while the Keynesian cross provides critical insights into output and employment dynamics through aggregate demand management.

Practical Implications for Modern Economic Policy

The Monetarist model emphasizes controlling the money supply to manage inflation and stabilize the economy, guiding central banks to prioritize monetary policy tools such as interest rates and money supply regulation. In contrast, the Keynesian cross advocates for active fiscal policy, encouraging government spending and taxation adjustments to influence aggregate demand and address economic fluctuations. Modern economic policy blends these approaches by using monetary policy to maintain price stability while employing targeted fiscal measures to stimulate growth and manage unemployment.

Monetarist model Infographic

libterm.com

libterm.com