A deflationary spiral occurs when decreasing prices lead to lower production, wages, and demand, causing a continuous economic decline. This cycle can exacerbate recessions as consumers delay spending, expecting further price drops, which further suppresses economic activity. Discover how understanding this phenomenon can help you recognize its impact and navigate its challenges in the full article.

Table of Comparison

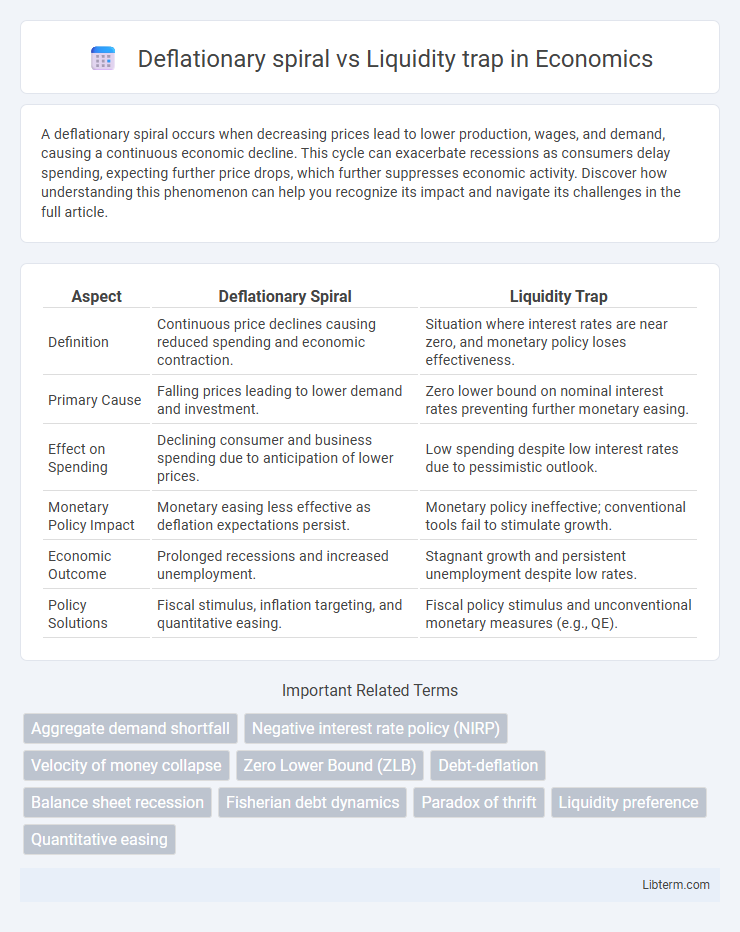

| Aspect | Deflationary Spiral | Liquidity Trap |

|---|---|---|

| Definition | Continuous price declines causing reduced spending and economic contraction. | Situation where interest rates are near zero, and monetary policy loses effectiveness. |

| Primary Cause | Falling prices leading to lower demand and investment. | Zero lower bound on nominal interest rates preventing further monetary easing. |

| Effect on Spending | Declining consumer and business spending due to anticipation of lower prices. | Low spending despite low interest rates due to pessimistic outlook. |

| Monetary Policy Impact | Monetary easing less effective as deflation expectations persist. | Monetary policy ineffective; conventional tools fail to stimulate growth. |

| Economic Outcome | Prolonged recessions and increased unemployment. | Stagnant growth and persistent unemployment despite low rates. |

| Policy Solutions | Fiscal stimulus, inflation targeting, and quantitative easing. | Fiscal policy stimulus and unconventional monetary measures (e.g., QE). |

Understanding Deflationary Spiral

A deflationary spiral occurs when falling prices lead consumers and businesses to delay spending and investment, causing further declines in demand and prices, worsening economic contraction. This cycle reduces corporate revenues and employment, increasing debt burdens and triggering more deflation, making recovery difficult without aggressive monetary or fiscal intervention. Understanding the deflationary spiral highlights the risks of persistent price declines undermining economic stability and the challenges policymakers face in restoring growth.

What is a Liquidity Trap?

A liquidity trap occurs when interest rates are near zero, and monetary policy becomes ineffective because people prefer holding cash over investing or spending, despite low borrowing costs. In this situation, even large increases in the money supply fail to stimulate economic activity, resulting in stagnant demand and persistent deflationary pressures. Unlike a deflationary spiral, a liquidity trap specifically highlights the breakdown of monetary policy transmission in a low-interest environment.

Key Differences Between Deflationary Spiral and Liquidity Trap

A deflationary spiral occurs when falling prices lead to decreased consumer spending and business investment, triggering further price declines and economic contraction, whereas a liquidity trap happens when interest rates are near zero and monetary policy becomes ineffective in stimulating demand. In a deflationary spiral, the primary concern is persistent deflation reducing economic activity, while a liquidity trap centers on the inability of low interest rates to boost lending and consumption despite abundant liquidity. Key differences include the deflationary spiral's emphasis on sustained price drops causing economic decline versus the liquidity trap's focus on monetary policy impotence amid stagnant growth and near-zero interest rates.

Causes of Deflationary Spirals

Deflationary spirals are primarily caused by persistent declines in aggregate demand, leading to falling prices and reduced consumer spending, which further suppresses demand. Excessive debt burdens force households and businesses to cut back on expenditure, exacerbating the contraction in economic activity. Unlike liquidity traps, where monetary policy becomes ineffective due to near-zero interest rates, deflationary spirals result from self-reinforcing cycles of declining prices and output.

Triggers of Liquidity Traps

Liquidity traps are primarily triggered by near-zero interest rates combined with deflationary expectations, causing consumers and investors to hoard cash rather than spend or invest. Central banks lose effectiveness in stimulating the economy because lowering nominal interest rates further is impossible, leading to stagnant demand and economic stagnation. In contrast, deflationary spirals are driven by falling prices that increase real debt burdens, further reducing consumption and investment, but liquidity traps specifically arise from constrained monetary policy and panic-induced liquidity preference.

Economic Consequences of Deflationary Spirals

Deflationary spirals result in declining consumer spending as falling prices lead to reduced business revenues and wage cuts, exacerbating economic contraction and increasing unemployment rates. This downward economic momentum undermines investment incentives, causing prolonged stagnation and heightened risk of debt defaults. In contrast, liquidity traps hinder monetary policy effectiveness by trapping interest rates near zero, but do not inherently trigger the self-reinforcing economic decline characteristic of deflationary spirals.

Impacts of Liquidity Traps on Monetary Policy

Liquidity traps restrict central banks' ability to stimulate the economy as nominal interest rates hit the zero lower bound, rendering conventional monetary policy tools ineffective. In such scenarios, despite increased money supply, consumer spending and investment remain stagnant, leading to prolonged economic stagnation and deflationary pressures. This phenomenon challenges policymakers to adopt unconventional measures like quantitative easing or fiscal interventions to revive demand and break the persistent cycle of low growth and low inflation.

Historical Examples: Deflationary Spiral vs Liquidity Trap

The Great Depression of the 1930s exemplifies a deflationary spiral, where falling prices led to decreased consumer spending, business failures, and rising unemployment, further deepening economic contraction. In contrast, Japan's Lost Decade during the 1990s illustrates a liquidity trap, characterized by near-zero interest rates and stagnant demand, rendering monetary policy ineffective in stimulating growth despite ample liquidity. These historical cases highlight distinct challenges: deflationary spirals erode asset values and economic confidence, while liquidity traps result in monetary policy impotence despite efforts to boost liquidity.

Policy Responses to Deflationary Spirals and Liquidity Traps

Policy responses to deflationary spirals emphasize aggressive monetary easing, fiscal stimulus, and structural reforms to restore demand and prevent prolonged price declines. In liquidity traps, conventional monetary policy loses effectiveness due to near-zero interest rates, necessitating unconventional measures like quantitative easing and direct fiscal interventions to stimulate economic activity. Coordination between central banks and governments is crucial for effectively addressing both deflationary spirals and liquidity traps to stabilize prices and promote growth.

Strategies for Preventing Deflationary Spirals and Escaping Liquidity Traps

Preventing deflationary spirals requires proactive monetary policies such as ensuring ample liquidity supply, lowering interest rates, and deploying quantitative easing to stimulate spending and investment. Escaping liquidity traps involves unconventional measures like forward guidance to influence expectations, fiscal stimulus to increase demand, and negative interest rates to incentivize borrowing. Central banks must coordinate with governments to implement these strategies effectively, as timely intervention is critical to restore economic growth and price stability.

Deflationary spiral Infographic

libterm.com

libterm.com