Normal profit represents the minimum earnings a business must generate to cover its opportunity costs, ensuring resources are efficiently allocated and the firm remains sustainable. It acts as a benchmark for evaluating whether a company is breaking even or making an economic profit beyond all costs. Explore the full article to understand how normal profit influences business decisions and market behavior.

Table of Comparison

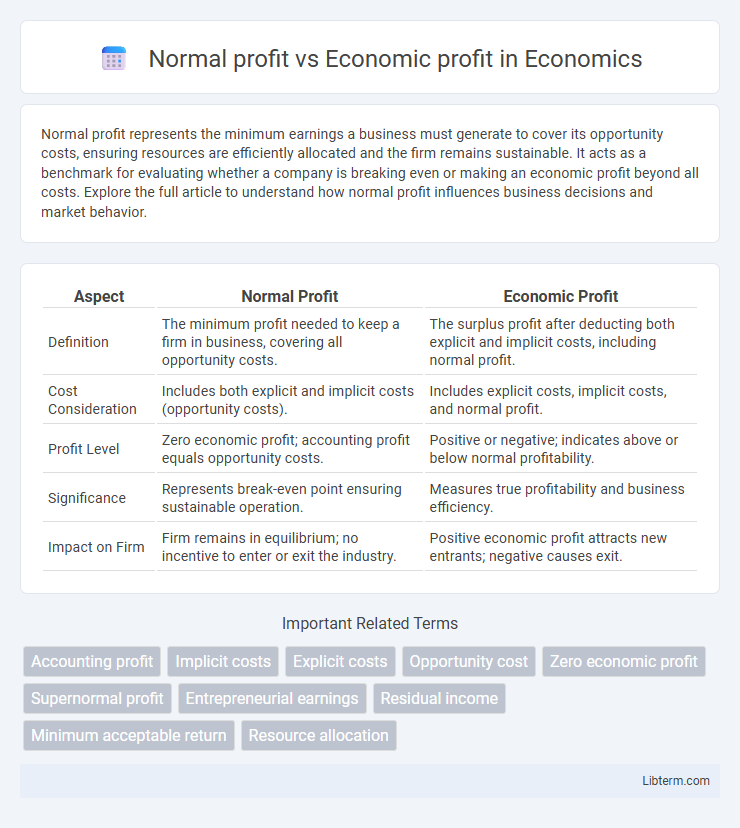

| Aspect | Normal Profit | Economic Profit |

|---|---|---|

| Definition | The minimum profit needed to keep a firm in business, covering all opportunity costs. | The surplus profit after deducting both explicit and implicit costs, including normal profit. |

| Cost Consideration | Includes both explicit and implicit costs (opportunity costs). | Includes explicit costs, implicit costs, and normal profit. |

| Profit Level | Zero economic profit; accounting profit equals opportunity costs. | Positive or negative; indicates above or below normal profitability. |

| Significance | Represents break-even point ensuring sustainable operation. | Measures true profitability and business efficiency. |

| Impact on Firm | Firm remains in equilibrium; no incentive to enter or exit the industry. | Positive economic profit attracts new entrants; negative causes exit. |

Introduction to Profit Concepts

Normal profit represents the minimum earnings required for a business to cover all explicit and implicit costs, including opportunity costs, ensuring its sustainability in the long run. Economic profit measures the surplus after subtracting both explicit and implicit costs from total revenue, reflecting true profitability beyond normal return. Understanding the distinction between normal and economic profit is essential for analyzing firm behavior, investment decisions, and market efficiency.

Definition of Normal Profit

Normal profit represents the minimum revenue required for a firm to cover all its explicit and implicit costs, including opportunity costs, ensuring the business remains viable in the long term. It is considered the breakeven point where total revenue equals total cost, meaning the firm earns zero economic profit. Unlike economic profit, which includes returns above normal profit, normal profit does not indicate additional gains beyond covering all expenses and opportunity costs.

Definition of Economic Profit

Economic profit measures a firm's total revenue minus both explicit and implicit costs, including opportunity costs, reflecting the true profitability of a business decision. Unlike normal profit, which occurs when total revenue equals total costs (explicit plus implicit), economic profit indicates when a company earns more than the minimum required to cover all costs. This concept is crucial for evaluating real financial performance and the efficiency of resource allocation in competitive markets.

Key Differences Between Normal and Economic Profit

Normal profit occurs when total revenue equals total costs, including explicit and implicit costs, representing the minimum earnings needed to keep a firm in its current activity. Economic profit, on the other hand, measures total revenue minus both explicit and implicit costs, indicating whether a firm earns above-normal returns that exceed all opportunity costs. The key difference lies in normal profit being a break-even point within economic profit analysis, while economic profit highlights actual excess earnings beyond all costs considered.

Calculation Methods for Each Profit Type

Normal profit is calculated by equating total revenue with total explicit and implicit costs, representing the minimum earnings needed to keep a firm operating in the long run. Economic profit, on the other hand, is determined by subtracting both explicit costs and opportunity costs from total revenue, indicating the surplus above normal profit. The key difference lies in including opportunity costs for economic profit, whereas normal profit covers only implicit and explicit costs to reflect zero economic gain.

The Role of Opportunity Cost

Normal profit represents the minimum earnings required to keep a firm operating in its current industry, reflecting the implicit opportunity costs of resources employed. Economic profit takes into account both explicit costs and implicit opportunity costs, measuring the surplus that exceeds normal profit and indicates the firm's true profitability. Opportunity cost plays a crucial role in distinguishing these profits by including the value of foregone alternatives, ensuring that economic profit captures the full cost of resource utilization beyond accounting expenses.

Importance of Normal Profit in Business Sustainability

Normal profit represents the minimum earnings required for a business to remain operational, covering opportunity costs and ensuring resource allocation efficiency. It serves as a crucial benchmark in business sustainability because it maintains investor confidence and justifies continued investment without overestimating profitability. Economic profit, which exceeds normal profit, signals competitive advantage but normal profit sustains long-term viability by preventing resource misallocation.

Economic Profit and Competitive Advantage

Economic profit measures the difference between total revenue and total costs, including both explicit and implicit costs, providing a more comprehensive view of profitability than normal profit, which only covers explicit costs and opportunity costs. A positive economic profit indicates a firm's competitive advantage, demonstrating superior efficiency or innovation that allows it to outperform industry rivals and achieve returns above the market norm. Firms sustaining economic profit often reinvest in unique resources, intellectual property, or operational efficiencies to strengthen their market position and long-term competitive edge.

Real-World Examples of Normal vs Economic Profit

Normal profit occurs when a company's total revenue equals its explicit and implicit costs, representing the minimum earnings needed to keep the business operational, such as a small local coffee shop covering its expenses without extra gain. Economic profit, on the other hand, arises when total revenue surpasses combined explicit and implicit costs, exemplified by a tech startup earning significantly more than its opportunity costs due to innovative product demand. Real-world examples include Walmart showing normal profit during stable market conditions, while Apple demonstrates economic profit through high-margin products and brand loyalty, reflecting superior market positioning.

Conclusion: Choosing the Right Profit Metric

Economic profit provides a more comprehensive measure by accounting for explicit and implicit costs, reflecting true business performance. Normal profit represents the minimum earnings necessary to keep resources employed in their current use, serving as a baseline for viability. Selecting between economic and normal profit depends on whether a decision-maker seeks to evaluate overall profitability or merely ensure sustainability in competitive markets.

Normal profit Infographic

libterm.com

libterm.com