Rational expectations theory assumes that individuals use all available information efficiently when forecasting future economic variables, leading to unbiased and consistent predictions. This concept plays a crucial role in macroeconomic models by influencing how policies impact markets and economic behavior. Explore the rest of the article to understand how rational expectations shape economic decision-making and policy outcomes.

Table of Comparison

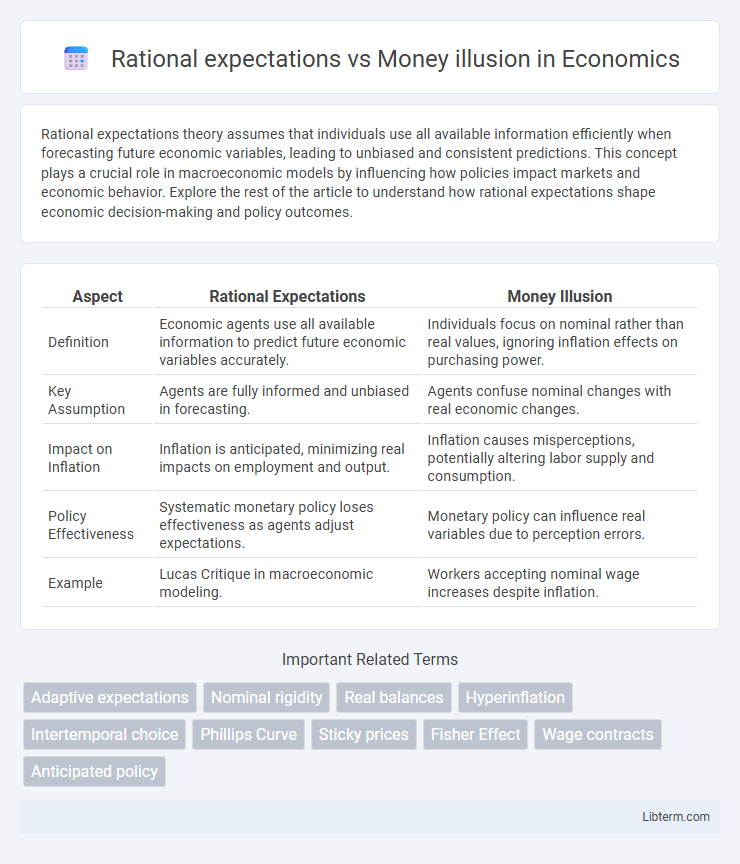

| Aspect | Rational Expectations | Money Illusion |

|---|---|---|

| Definition | Economic agents use all available information to predict future economic variables accurately. | Individuals focus on nominal rather than real values, ignoring inflation effects on purchasing power. |

| Key Assumption | Agents are fully informed and unbiased in forecasting. | Agents confuse nominal changes with real economic changes. |

| Impact on Inflation | Inflation is anticipated, minimizing real impacts on employment and output. | Inflation causes misperceptions, potentially altering labor supply and consumption. |

| Policy Effectiveness | Systematic monetary policy loses effectiveness as agents adjust expectations. | Monetary policy can influence real variables due to perception errors. |

| Example | Lucas Critique in macroeconomic modeling. | Workers accepting nominal wage increases despite inflation. |

Understanding Rational Expectations

Rational expectations theory asserts that individuals use all available information, including past trends and current policies, to forecast future economic variables accurately, minimizing systematic errors. This contrasts sharply with money illusion, where people focus on nominal rather than real values, leading to distorted perception of income and inflation effects. Understanding rational expectations helps explain why anticipated monetary policy changes often have limited real effects on output and employment.

Defining Money Illusion

Money illusion refers to the tendency of individuals to think in nominal rather than real monetary terms, often leading to misperceptions about their actual purchasing power. Rational expectations theory assumes that economic agents use all available information to accurately anticipate real economic variables, thereby avoiding money illusion. Understanding money illusion is crucial for analyzing how nominal wage or price changes can distort economic decision-making despite unchanged real values.

Historical Development of Both Concepts

Rational expectations theory, developed in the 1960s by economists like John Muth and later popularized by Robert Lucas, posits that individuals use all available information to predict future economic variables accurately, minimizing systematic errors. The concept of money illusion, initially observed by Irving Fisher in the early 20th century, describes the tendency of individuals to think in nominal rather than real terms, misleading them about inflation's impact on purchasing power. These contrasting theories have shaped macroeconomic thought, with rational expectations challenging traditional views influenced by money illusion in understanding wage and price adjustments during inflationary periods.

Core Differences Between Rational Expectations and Money Illusion

Rational expectations rely on the premise that individuals use all available information to predict future economic variables accurately, avoiding systematic errors in judgment. Money illusion occurs when people focus on nominal rather than real values, causing them to misinterpret inflation effects on wages, prices, or purchasing power. The core difference lies in rational expectations assuming agents adjust for inflation and economic changes, while money illusion reflects a cognitive bias leading to suboptimal decision-making based on nominal values.

Impact on Individual Decision-Making

Rational expectations theory posits that individuals use all available information to make informed economic decisions, anticipating future events accurately, which leads to optimal resource allocation and adjustment to real price changes. In contrast, money illusion occurs when individuals focus on nominal rather than real values, causing decisions based on misleading perceptions of purchasing power and inflation effects. This discrepancy significantly impacts individual decision-making by leading to suboptimal labor supply, consumption, and investment choices under money illusion, while rational expectations promote decisions aligned with true economic conditions.

Influence on Market Behavior

Rational expectations drive market participants to anticipate future economic conditions accurately, leading to more efficient pricing and reduced opportunities for arbitrage. Money illusion, where individuals interpret nominal rather than real values, causes misperceptions in inflation-adjusted returns, resulting in suboptimal investment and consumption decisions. These contrasting behaviors influence market volatility, asset pricing, and the effectiveness of monetary policy interventions.

Policy Implications in Economics

Rational expectations theory suggests that economic agents use all available information to forecast future policy impacts, reducing the effectiveness of systematic monetary or fiscal policies. Money illusion, where individuals focus on nominal rather than real values, can lead to temporary non-neutrality of money, allowing policymakers to influence real output and employment in the short term. Understanding the interplay between these concepts is crucial for designing policies that anticipate behavioral responses and avoid unintended economic distortions.

Empirical Evidence and Case Studies

Empirical evidence from financial markets and macroeconomic data consistently supports rational expectations, demonstrating that individuals and firms adjust their behavior based on anticipated policy changes and inflation rates. Case studies such as the 1970s stagflation period reveal how money illusion, the tendency to focus on nominal rather than real values, leads to suboptimal decision-making and wage-price rigidities. Experimental research further confirms that while some consumers exhibit money illusion, the prevalence diminishes in contexts with widespread information and inflation awareness, underscoring the dominance of rational expectations in economic dynamics.

Critiques and Limitations of Each Theory

Rational expectations theory assumes agents have perfect foresight and utilize all available information, but it often overlooks cognitive biases and information constraints, leading to critiques about its practical applicability. Money illusion theory, which posits that individuals focus on nominal rather than real values, is criticized for oversimplifying decision-making and ignoring the role of inflation expectations. Both theories face limitations regarding the heterogeneity of agent behavior and the dynamic complexities of real-world economic environments.

Future Directions in Economic Thought

Future directions in economic thought emphasize integrating rational expectations with insights from money illusion to better model real-world decision-making. Advances in behavioral economics and neuroeconomics challenge the assumption that agents always process information rationally, suggesting hybrid models that incorporate cognitive biases. These approaches aim to refine policy analysis by accounting for how perceived nominal changes influence economic behavior despite rational forecasting frameworks.

Rational expectations Infographic

libterm.com

libterm.com