Monetary union involves multiple countries adopting a shared currency to facilitate trade, reduce exchange rate volatility, and enhance economic stability. This integration requires coordinated fiscal policies and can impact national sovereignty over monetary decisions. Explore the full article to understand how a monetary union could affect your economy and financial future.

Table of Comparison

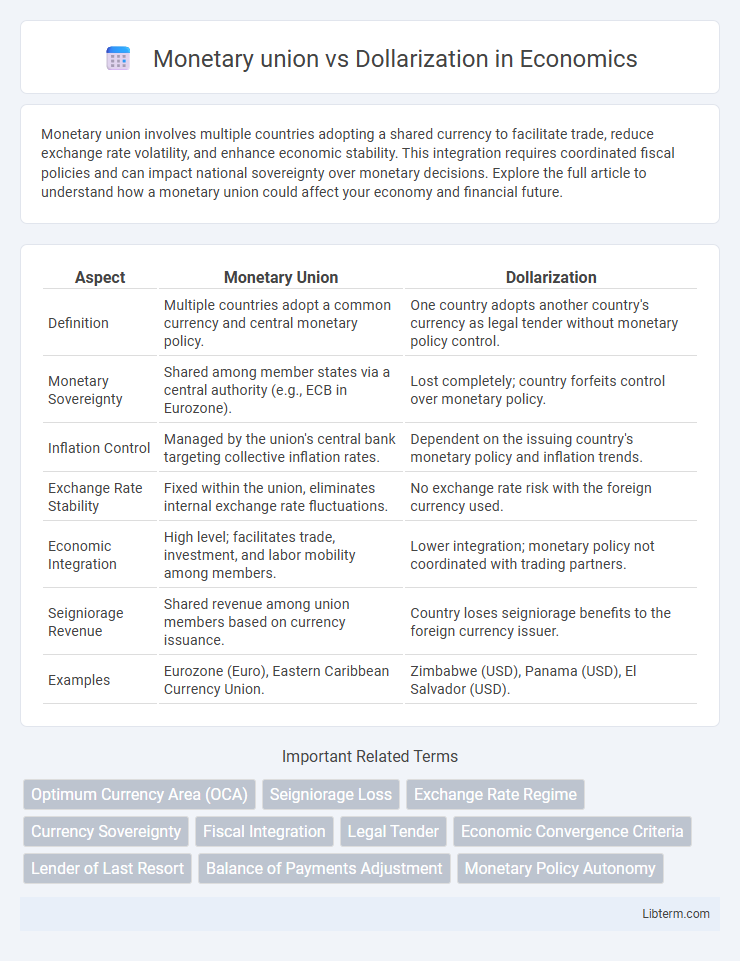

| Aspect | Monetary Union | Dollarization |

|---|---|---|

| Definition | Multiple countries adopt a common currency and central monetary policy. | One country adopts another country's currency as legal tender without monetary policy control. |

| Monetary Sovereignty | Shared among member states via a central authority (e.g., ECB in Eurozone). | Lost completely; country forfeits control over monetary policy. |

| Inflation Control | Managed by the union's central bank targeting collective inflation rates. | Dependent on the issuing country's monetary policy and inflation trends. |

| Exchange Rate Stability | Fixed within the union, eliminates internal exchange rate fluctuations. | No exchange rate risk with the foreign currency used. |

| Economic Integration | High level; facilitates trade, investment, and labor mobility among members. | Lower integration; monetary policy not coordinated with trading partners. |

| Seigniorage Revenue | Shared revenue among union members based on currency issuance. | Country loses seigniorage benefits to the foreign currency issuer. |

| Examples | Eurozone (Euro), Eastern Caribbean Currency Union. | Zimbabwe (USD), Panama (USD), El Salvador (USD). |

Introduction to Monetary Union and Dollarization

A monetary union involves multiple countries adopting a shared currency and coordinating monetary policy through a common central authority to enhance economic integration and stability. Dollarization occurs when a country unilaterally uses a foreign currency, typically the US dollar, as its official or de facto legal tender without formal agreements or shared monetary policy control. Both approaches impact economic sovereignty, but monetary unions emphasize collective governance while dollarization relies on the strength of an external currency.

Defining Monetary Union: Key Features

Monetary union involves multiple countries adopting a shared currency and a unified monetary policy governed by a central authority, such as the Eurozone countries and the European Central Bank. Key features include a common currency, fixed exchange rates among member states, and coordinated fiscal policies to ensure economic stability. Unlike dollarization, where a country unilaterally uses a foreign currency without policy control, a monetary union entails collective decision-making and shared economic governance.

Understanding Dollarization: Types and Examples

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, either officially or unofficially, to stabilize its economy and reduce inflation. There are two main types: official dollarization, where a foreign currency is legally recognized as the primary medium of exchange, like Ecuador and El Salvador; and unofficial dollarization, where the foreign currency circulates alongside the local currency without legal tender status, seen in countries such as Zimbabwe. Understanding these distinctions helps clarify the economic implications and sovereignty trade-offs involved in dollarization compared to a broader monetary union.

Economic Rationale for Monetary Union

The economic rationale for a monetary union centers on the benefits of reduced transaction costs, elimination of exchange rate volatility, and enhanced price transparency that promote trade and investment among member countries. Unlike dollarization, which entails adopting a foreign currency without formal fiscal and monetary integration, monetary unions involve coordinated economic policies and shared governance structures to maintain currency stability. This integration fosters economic convergence and reduces asymmetric shocks, enabling more effective collective macroeconomic management.

Motivations Behind Dollarization

Dollarization occurs when a country adopts a foreign currency, typically the U.S. dollar, to stabilize its economy and reduce inflation risks, especially in nations with a history of currency volatility. Motivations behind dollarization include enhancing investor confidence, lowering transaction costs in international trade, and eliminating exchange rate risk. Unlike monetary unions, which require political integration and shared monetary policy, dollarization offers a simpler, unilateral approach to monetary stability without sovereignty over the currency.

Comparative Impact on Monetary Policy

Monetary union involves member countries adopting a single currency and central monetary authority, allowing coordinated monetary policy that targets shared economic goals, while dollarization occurs when a country unofficially adopts a foreign currency, relinquishing control over independent monetary policy. In a monetary union, policy tools such as interest rates and money supply are harmonized, providing stability and facilitating trade, but requiring member states to cede some sovereignty. Dollarized economies face limited policy flexibility, as they cannot adjust money supply or exchange rates, potentially hindering their ability to respond to domestic shocks and inflationary pressures.

Effects on Financial Stability

Monetary union promotes financial stability by enabling member countries to share a common currency and central bank, reducing exchange rate volatility and fostering coordinated fiscal policies. Dollarization, the adoption of a foreign currency like the US dollar, can stabilize inflation but limits monetary policy autonomy and may increase vulnerability to external shocks. Both systems reduce currency risk but differ in their capacity to manage economic crises and maintain financial stability.

Trade and Investment Implications

Monetary union fosters deeper economic integration by enabling seamless trade and cross-border investment through a shared currency, which reduces transaction costs and exchange rate risks among member countries. Dollarization, on the other hand, offers currency stability and inflation control by adopting a foreign currency like the US dollar but limits a country's monetary policy autonomy, potentially hindering tailored economic responses that support trade competitiveness. Both frameworks influence foreign direct investment; monetary unions often attract greater multilateral investment due to institutional cooperation and reduced currency volatility, whereas dollarized economies benefit from increased investor confidence yet face constraints in addressing asymmetric economic shocks.

Case Studies: Successes and Failures

The European Monetary Union exemplifies success, fostering economic integration and stable exchange rates among member states through a shared currency, the euro. In contrast, Ecuador's dollarization in 2000 stabilized inflation but limited monetary policy flexibility, revealing potential drawbacks in sovereign economic control. Zimbabwe's failed dollarization highlighted hyperinflation control but resulted in liquidity shortages and constrained fiscal options, underscoring risks in adopting foreign currencies without robust economic structures.

Conclusion: Choosing the Optimal Path

Evaluating monetary union versus dollarization requires analyzing economic sovereignty, trade integration, and financial stability. Monetary unions offer shared currency governance and potential for synchronized economic policies, while dollarization eliminates currency risk but sacrifices independent monetary control. The optimal choice depends on a country's economic structure, institutional capacity, and strategic goals for regional cooperation or global financial integration.

Monetary union Infographic

libterm.com

libterm.com