Industry loss warranties (ILWs) provide reinsurance coverage triggered when total losses from a specified industry event exceed a predetermined threshold. These contracts help insurers manage catastrophic risk by transferring a portion of potential losses, offering a cost-effective way to safeguard capital. Explore the article to understand how ILWs can protect your business against large-scale industry losses.

Table of Comparison

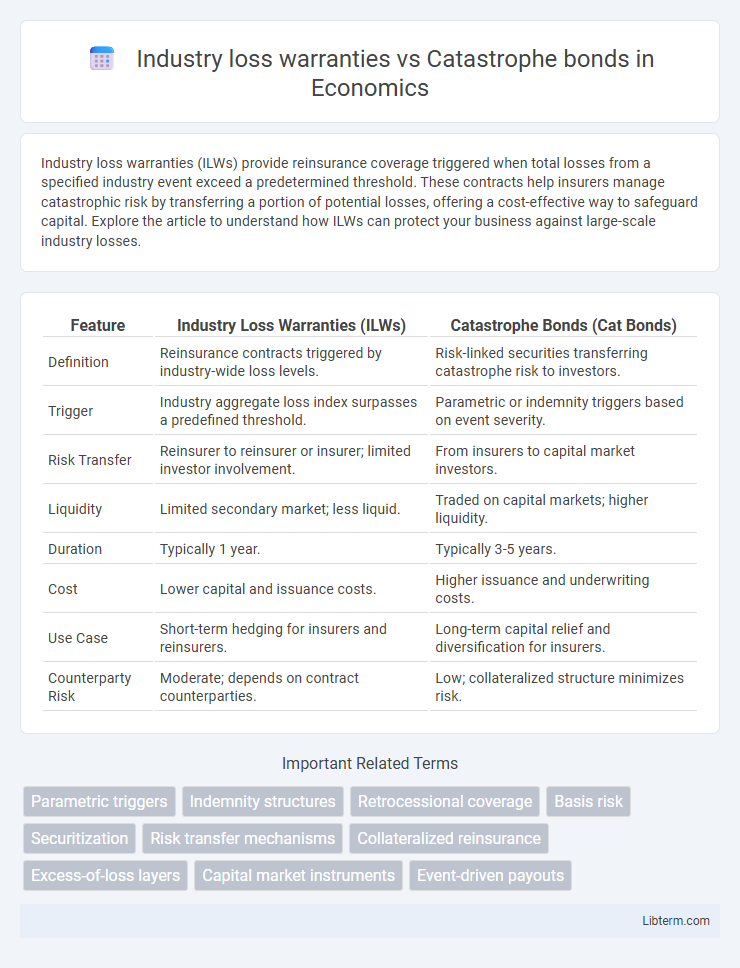

| Feature | Industry Loss Warranties (ILWs) | Catastrophe Bonds (Cat Bonds) |

|---|---|---|

| Definition | Reinsurance contracts triggered by industry-wide loss levels. | Risk-linked securities transferring catastrophe risk to investors. |

| Trigger | Industry aggregate loss index surpasses a predefined threshold. | Parametric or indemnity triggers based on event severity. |

| Risk Transfer | Reinsurer to reinsurer or insurer; limited investor involvement. | From insurers to capital market investors. |

| Liquidity | Limited secondary market; less liquid. | Traded on capital markets; higher liquidity. |

| Duration | Typically 1 year. | Typically 3-5 years. |

| Cost | Lower capital and issuance costs. | Higher issuance and underwriting costs. |

| Use Case | Short-term hedging for insurers and reinsurers. | Long-term capital relief and diversification for insurers. |

| Counterparty Risk | Moderate; depends on contract counterparties. | Low; collateralized structure minimizes risk. |

Introduction to Industry Loss Warranties and Catastrophe Bonds

Industry Loss Warranties (ILWs) are reinsurance contracts triggered by the total industry loss from a specific catastrophic event, providing indemnity based on aggregated loss data rather than individual claims. Catastrophe bonds (cat bonds) are risk-linked securities issued by insurers or reinsurers that transfer catastrophe risk to capital market investors, with principal repayment contingent on predefined trigger events. Both instruments serve as alternative risk transfer mechanisms, offering liquidity and risk diversification for managing large-scale catastrophe exposures.

Defining Industry Loss Warranties (ILWs)

Industry Loss Warranties (ILWs) are reinsurance contracts triggered by the insured industry's aggregate losses from specific catastrophic events exceeding predetermined thresholds. Unlike catastrophe bonds, which are insurance-linked securities sold to investors, ILWs provide a direct indemnity based on industry-wide loss indices rather than individual losses. ILWs facilitate risk transfer by offering protection tied to standardized loss metrics, enabling insurers to hedge exposure efficiently against large-scale disasters.

Understanding Catastrophe Bonds (Cat Bonds)

Catastrophe bonds (Cat Bonds) are risk-linked securities that transfer insurance risk from insurers to investors by providing capital relief in the event of predefined catastrophic events such as hurricanes or earthquakes. Unlike Industry Loss Warranties (ILWs), which pay out based on industry-wide loss indices, Cat Bonds trigger payouts based on specific event parameters or modeled losses, enabling more precise risk transfer. These bonds attract investors seeking high yields in exchange for exposure to catastrophe risks, offering insurers an alternative financing mechanism to traditional reinsurance or ILWs.

Key Differences Between ILWs and Cat Bonds

Industry Loss Warranties (ILWs) are reinsurance contracts triggered by industry-wide loss events exceeding a specified threshold, while Catastrophe Bonds (Cat Bonds) are securities issued to transfer catastrophe risk to capital markets investors, providing principal relief if predefined loss triggers occur. ILWs rely on industry loss indices to determine payout, making them contingent on aggregated catastrophic losses, whereas Cat Bonds often use parametric triggers or modeled loss criteria tied to specific events or insured portfolios. Cat Bonds typically involve longer maturities and have market-driven pricing influenced by investor demand, contrasting with ILWs which are more directly linked to traditional reinsurance market conditions and underwriting cycles.

Risk Transfer Mechanisms: ILWs vs Cat Bonds

Industry Loss Warranties (ILWs) and Catastrophe Bonds (Cat Bonds) represent distinct risk transfer mechanisms within insurance-linked securities, with ILWs providing protection based on industry-wide loss triggers while Cat Bonds rely on predefined parametric or indemnity triggers tied to specific catastrophe events. ILWs offer quicker settlements due to their dependence on aggregated industry loss data, whereas Cat Bonds involve investor participation and capital markets, facilitating risk diversification through securitization. Both mechanisms enhance insurers' capital relief by transferring catastrophic risk, but Cat Bonds typically allow for higher customization and investor engagement compared to the more standardized structure of ILWs.

Trigger Structures and Payout Processes

Industry loss warranties (ILWs) rely on third-party industry loss indices as triggers, activating payouts when aggregate losses exceed a predetermined threshold. In contrast, catastrophe bonds (cat bonds) use parametric or indemnity-based triggers linked directly to specific event characteristics such as wind speed or insured losses. ILWs provide faster settlement through fixed loss triggers, while cat bonds involve more complex payout processes often requiring event verification and collateral release mechanisms.

Market Participants and Investment Appeal

Industry loss warranties (ILWs) attract reinsurance companies and hedge funds seeking direct exposure to catastrophe risk with predefined loss triggers, offering quick payouts tied to industry-wide losses. Catastrophe bonds appeal to institutional investors like pension funds and asset managers by providing diversified, high-yield fixed income investments uncorrelated with traditional markets. Both instruments enable risk transfer but differ as ILWs offer contract-specific indemnity while cat bonds provide capital market financing, influencing their investor base and liquidity profiles.

Pricing and Return Dynamics

Industry loss warranties (ILWs) offer pricing linked directly to actual industry loss triggers, providing straightforward risk transfer with typically lower spreads due to limited basis risk. Catastrophe bonds exhibit complex pricing dynamics driven by modeled event probabilities and investor demand, often yielding higher returns to compensate for longer durations and liquidity risk. Return profiles differ as ILWs provide event-specific payouts tied closely to loss indices, while cat bonds deliver coupon payments until maturity or event triggering, reflecting broader market conditions and risk appetite.

Advantages and Limitations of Each Instrument

Industry loss warranties (ILWs) provide insurance coverage triggered by industry-wide loss events, offering straightforward protection with clear payout triggers based on predefined loss thresholds, making them efficient for risk transfer without complex modeling. However, ILWs can suffer from basis risk due to reliance on aggregate industry losses, potentially leading to payouts that do not fully align with the buyer's actual losses. Catastrophe bonds offer capital market access with risk diversification and custom-trigger options, reducing insurer exposure and enabling higher capacity, yet they are expensive to issue, involve lengthy structuring processes, and payouts depend on parametric or modeled loss triggers that may not perfectly match actual losses.

Choosing Between ILWs and Cat Bonds: Strategic Considerations

Choosing between Industry Loss Warranties (ILWs) and Catastrophe Bonds (Cat Bonds) hinges on factors such as risk retention preferences, capital market access, and payout triggers. ILWs offer tailored protection tied directly to industry losses with faster settlement times, making them suitable for companies seeking straightforward indemnity without complex bond structures. Cat Bonds provide diversified capital source and long-term risk transfer, ideal for entities aiming to leverage investor appetite in capital markets while managing higher issuance costs and basis risk.

Industry loss warranties Infographic

libterm.com

libterm.com