Willingness to pay measures the maximum amount a consumer is prepared to spend on a product or service, reflecting its perceived value and importance. Understanding your willingness to pay helps businesses set optimal prices and tailor marketing strategies to meet customer expectations. Discover how this concept can influence your purchasing decisions and pricing models throughout the article.

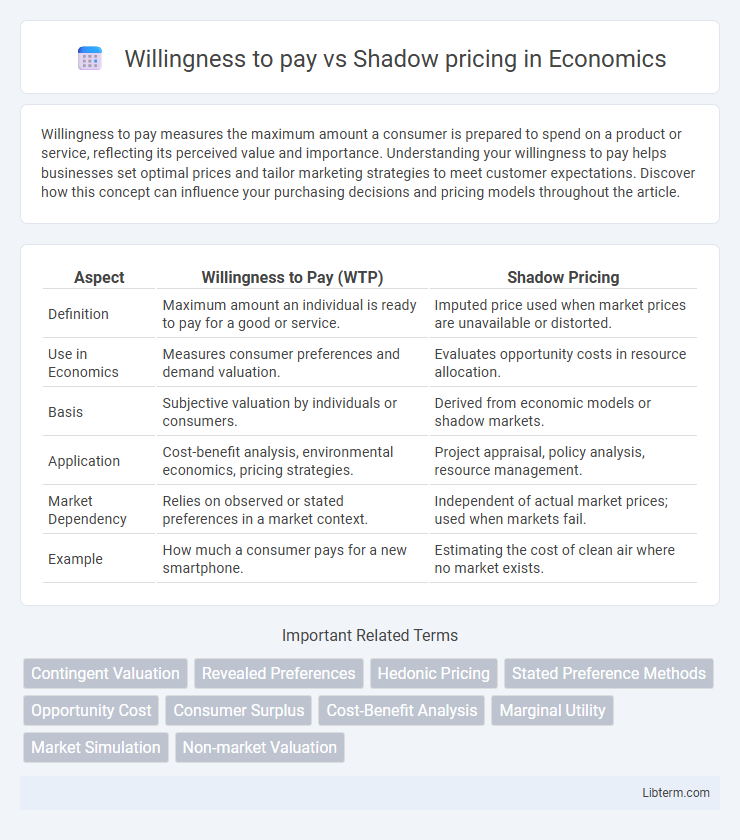

Table of Comparison

| Aspect | Willingness to Pay (WTP) | Shadow Pricing |

|---|---|---|

| Definition | Maximum amount an individual is ready to pay for a good or service. | Imputed price used when market prices are unavailable or distorted. |

| Use in Economics | Measures consumer preferences and demand valuation. | Evaluates opportunity costs in resource allocation. |

| Basis | Subjective valuation by individuals or consumers. | Derived from economic models or shadow markets. |

| Application | Cost-benefit analysis, environmental economics, pricing strategies. | Project appraisal, policy analysis, resource management. |

| Market Dependency | Relies on observed or stated preferences in a market context. | Independent of actual market prices; used when markets fail. |

| Example | How much a consumer pays for a new smartphone. | Estimating the cost of clean air where no market exists. |

Understanding Willingness to Pay: Definition and Significance

Willingness to pay (WTP) represents the maximum amount an individual is ready to spend for a good or service, reflecting their perceived value and personal utility. It plays a crucial role in market analysis, helping businesses and policymakers gauge consumer preferences and set optimal pricing strategies. Understanding WTP aids in resource allocation decisions and economic evaluations by capturing consumer surplus and demand intensity accurately.

What is Shadow Pricing? Core Concepts Explored

Shadow pricing refers to the monetary valuation assigned to intangible or non-market goods, used to guide decision-making where market prices are unavailable or distorted. It reflects the true economic cost or benefit of resources, incorporating externalities and opportunity costs to optimize resource allocation. This concept is fundamental in cost-benefit analysis and environmental economics, allowing policymakers to evaluate public projects and natural resource use more accurately.

Comparing Willingness to Pay and Shadow Pricing: Key Differences

Willingness to pay (WTP) measures the maximum amount an individual is ready to spend for a good or service, reflecting subjective valuation based on preferences and budget constraints. Shadow pricing assigns monetary values to non-market goods or externalities by estimating their opportunity costs or social costs, often used in cost-benefit analysis for public projects. Key differences include WTP's basis in individual preferences versus shadow pricing's reliance on inferred or calculated values to capture true economic costs beyond market prices.

Methodologies for Measuring Willingness to Pay

Measuring willingness to pay (WTP) involves methodologies such as contingent valuation, where individuals state their maximum payment for goods or services in hypothetical scenarios, and choice modeling, which analyzes preferences through discrete choice experiments. Shadow pricing derives implicit prices from revealed preferences or opportunity costs in markets lacking explicit prices, often using econometric techniques to infer WTP indirectly from observed behaviors. These methodologies provide complementary approaches for economic valuation in cost-benefit analysis and environmental economics, enhancing accuracy in estimating consumer surplus and policy impacts.

Techniques for Calculating Shadow Prices

Techniques for calculating shadow prices include the use of linear programming, which determines the optimal allocation of resources by assigning implicit values to constraints reflecting their marginal worth. Another common method is the input-output analysis, assessing interdependencies between sectors to estimate opportunity costs of resource usage. Econometric models also play a role, using statistical methods to infer shadow prices from observed market behavior where direct pricing is unavailable.

Applications in Policy and Market Analysis

Willingness to pay (WTP) measures the maximum amount individuals are ready to spend for a good or service, guiding demand estimation and consumer surplus calculation in market analysis. Shadow pricing assigns values to goods or services not traded in markets, enabling cost-benefit analysis in public policy decisions by reflecting opportunity costs and social value. Both tools are essential in evaluating environmental regulations, public goods, and infrastructure projects, ensuring resource allocation aligns with societal preferences and economic efficiency.

Advantages and Limitations of Willingness to Pay

Willingness to pay (WTP) captures the maximum amount individuals are prepared to spend for a good or service, reflecting personal value and demand, which is particularly advantageous for estimating consumer surplus and guiding market-based policy decisions. However, WTP is limited by potential biases such as hypothetical bias, income effects, and strategic misrepresentation, making it sometimes less reliable for public goods valuation. In contrast, shadow pricing assigns value based on opportunity costs in the absence of market prices, offering objective economic estimates but often lacking the direct consumer preference insight provided by WTP measures.

Pros and Cons of Using Shadow Pricing

Shadow pricing offers an effective tool for valuing non-market goods by assigning monetary values based on opportunity costs, enhancing decision-making in cost-benefit analysis. It provides a practical approach when direct willingness to pay data is unavailable, but its accuracy depends heavily on the assumptions and estimation methods used, potentially leading to biased or imprecise valuations. However, shadow pricing may overlook individual preferences and subjective values, limiting its representation of actual consumer surplus compared to willingness to pay measures.

Real-World Case Studies: Willingness to Pay vs Shadow Pricing

Real-world case studies reveal that willingness to pay (WTP) reflects individuals' true valuation of goods or services in market-driven contexts, while shadow pricing assigns implicit costs to non-market assets or externalities, such as environmental damage or social impacts. For instance, the valuation of clean air through WTP surveys contrasts with government-implemented shadow prices used in cost-benefit analyses to regulate pollution. Studies in urban transportation projects demonstrate how shadow pricing helps quantify social costs that WTP alone might underestimate, ensuring comprehensive policy evaluation.

Implications for Decision-Making and Future Research

Willingness to pay (WTP) measures individual valuation based on personal preference and income constraints, while shadow pricing assigns monetary values to non-market goods using opportunity cost, influencing economic efficiency in resource allocation. Decision-making benefits from integrating WTP to capture consumer surplus with shadow pricing for environmental and social externalities, promoting balanced policy outcomes. Future research should explore hybrid models combining revealed preferences and shadow pricing to enhance accuracy in cost-benefit analyses and inform sustainable development strategies.

Willingness to pay Infographic

libterm.com

libterm.com