A callable bond allows the issuer to redeem the bond before its maturity date, typically at a premium, providing flexibility to refinance debt if interest rates decline. This feature often results in a higher yield to compensate investors for the call risk, which can impact your investment strategy. Explore the rest of this article to understand how callable bonds work and their implications for your portfolio.

Table of Comparison

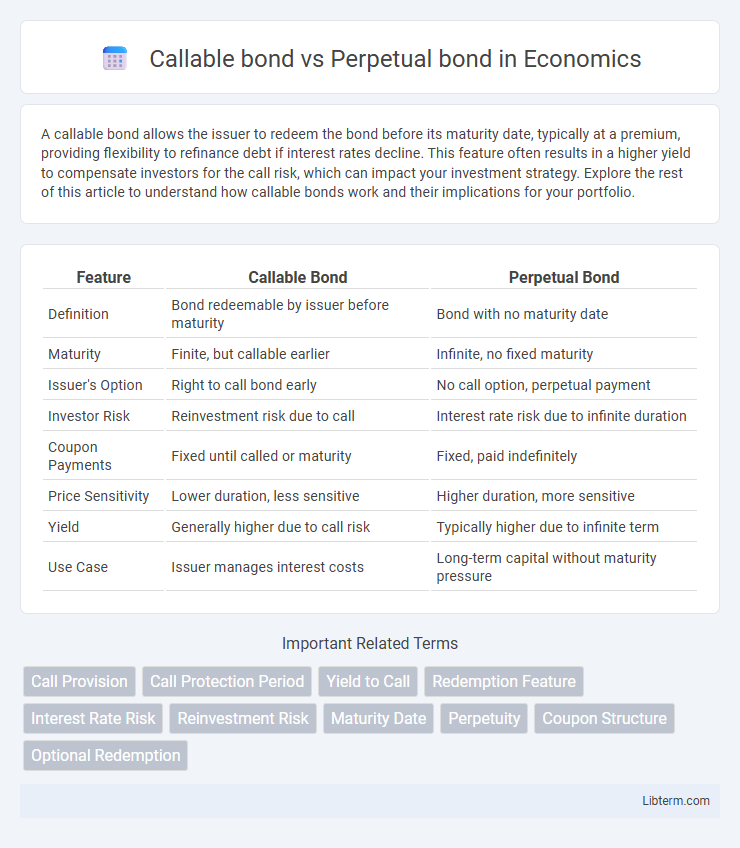

| Feature | Callable Bond | Perpetual Bond |

|---|---|---|

| Definition | Bond redeemable by issuer before maturity | Bond with no maturity date |

| Maturity | Finite, but callable earlier | Infinite, no fixed maturity |

| Issuer's Option | Right to call bond early | No call option, perpetual payment |

| Investor Risk | Reinvestment risk due to call | Interest rate risk due to infinite duration |

| Coupon Payments | Fixed until called or maturity | Fixed, paid indefinitely |

| Price Sensitivity | Lower duration, less sensitive | Higher duration, more sensitive |

| Yield | Generally higher due to call risk | Typically higher due to infinite term |

| Use Case | Issuer manages interest costs | Long-term capital without maturity pressure |

Introduction to Callable and Perpetual Bonds

Callable bonds grant issuers the right to redeem the bond before its maturity date, usually at a premium, allowing flexibility to refinance debt if interest rates decline. Perpetual bonds, also known as consol bonds, have no maturity date and pay interest indefinitely, making them similar to equity instruments. Investors in callable bonds face reinvestment risk due to early redemption, while perpetual bonds offer steady income but carry higher interest rate risk.

Key Features of Callable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, typically at a predetermined call price, providing flexibility to refinance debt if interest rates decline. These bonds often feature a call protection period during which the bond cannot be redeemed, balancing investor risk and issuer advantage. The callable feature usually results in higher yields compared to non-callable bonds to compensate investors for the reinvestment risk.

Key Features of Perpetual Bonds

Perpetual bonds are fixed-income securities with no maturity date, offering investors indefinite interest payments often at higher coupon rates to compensate for their perpetual nature. Unlike callable bonds, which allow issuers to redeem the bond before maturity, perpetual bonds provide continuous income without principal repayment obligations. These bonds are particularly attractive to investors seeking steady, long-term income streams, but they carry higher interest rate risk due to their endless duration.

Callable Bonds: How They Work

Callable bonds grant the issuer the right to redeem the bond before its maturity date, usually at a specified call price, allowing the issuer to refinance debt when interest rates decline. These bonds typically offer higher yields to compensate investors for the call risk, which includes reinvestment risk and the uncertainty of cash flow timing. Investors should carefully analyze the bond's call schedule, call premium, and the issuer's creditworthiness to accurately assess the bond's potential risks and rewards.

Perpetual Bonds: How They Work

Perpetual bonds are fixed-income securities with no maturity date, providing investors with indefinite coupon payments. They function as a hybrid between equity and debt, offering steady income while the principal remains outstanding. Issuers benefit from flexibility, as these bonds do not require repayment of principal, making them a long-term financing tool.

Risk Factors: Callable vs Perpetual Bonds

Callable bonds expose investors to reinvestment risk since issuers may redeem the bond early when interest rates decline, leading to lower returns. Perpetual bonds carry infinite duration risk and sensitivity to interest rate fluctuations, causing price volatility and potential capital loss. Credit risk affects both, but callable bonds also face call risk, whereas perpetual bonds lack maturity, heightening duration-related uncertainties.

Yield and Return Potential Compared

Callable bonds typically offer higher yields compared to perpetual bonds to compensate investors for the call risk, which limits their price appreciation potential. Perpetual bonds provide steady income with fixed coupons indefinitely, but their return potential is lower due to sensitivity to interest rate fluctuations and absence of maturity. The yield on callable bonds can increase upon call, whereas perpetual bonds' return depends entirely on coupon payments and market interest rates, making callable bonds more attractive for higher short- to medium-term returns.

Impact of Interest Rate Changes

Callable bonds expose issuers to the risk of redemption when interest rates decline, leading to reinvestment at lower yields and limited price appreciation for investors. Perpetual bonds, lacking maturity, are highly sensitive to interest rate fluctuations, with price inversely affected by changing rates due to the infinite duration of cash flows. Interest rate increases cause callable bond prices to drop moderately, while perpetual bond prices experience more significant declines, reflecting the heightened duration risk.

Suitability for Different Investors

Callable bonds suit investors seeking higher yields with some risk tolerance, as issuers may redeem the bond early, affecting income predictability. Perpetual bonds appeal to income-focused investors aiming for long-term, steady coupon payments without maturity date concerns, but they face higher interest rate sensitivity and credit risk. Choice depends on investor priorities: yield enhancement and flexibility with callable bonds, or income stability and duration exposure with perpetual bonds.

Summary: Choosing Between Callable and Perpetual Bonds

Callable bonds offer issuers the flexibility to redeem the bond before maturity, allowing them to manage interest rate risk and refinance at lower rates, which may result in higher yields but increased reinvestment risk for investors. Perpetual bonds provide investors with indefinite interest payments without a maturity date, making them suitable for those seeking long-term income, though they carry higher interest rate risk due to the absence of principal repayment. The choice between callable and perpetual bonds depends on investment goals, risk tolerance, and market conditions, with callable bonds favoring issuer flexibility and perpetual bonds favoring steady, long-term income streams.

Callable bond Infographic

libterm.com

libterm.com