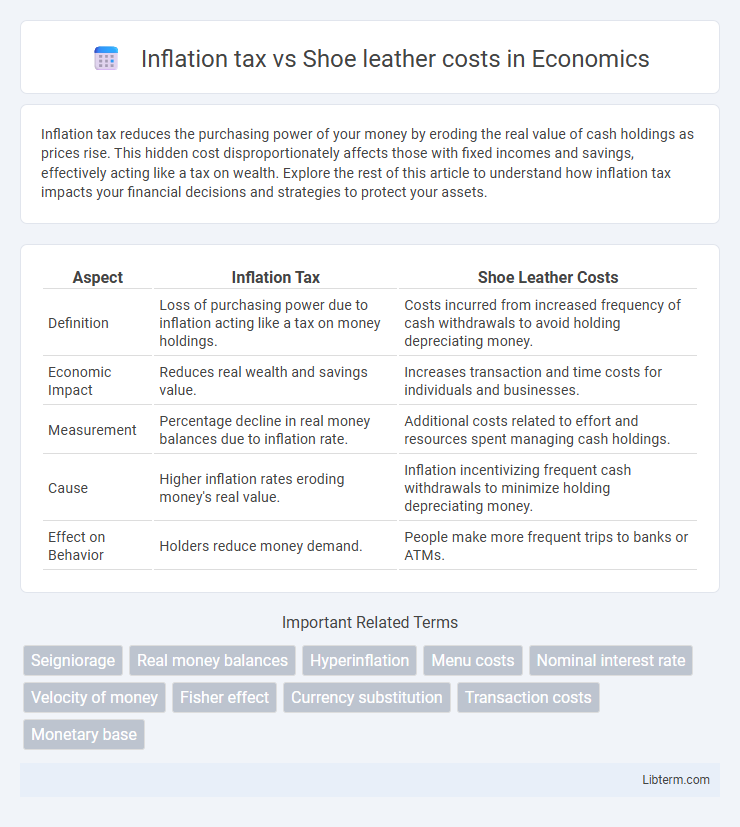

Inflation tax reduces the purchasing power of your money by eroding the real value of cash holdings as prices rise. This hidden cost disproportionately affects those with fixed incomes and savings, effectively acting like a tax on wealth. Explore the rest of this article to understand how inflation tax impacts your financial decisions and strategies to protect your assets.

Table of Comparison

| Aspect | Inflation Tax | Shoe Leather Costs |

|---|---|---|

| Definition | Loss of purchasing power due to inflation acting like a tax on money holdings. | Costs incurred from increased frequency of cash withdrawals to avoid holding depreciating money. |

| Economic Impact | Reduces real wealth and savings value. | Increases transaction and time costs for individuals and businesses. |

| Measurement | Percentage decline in real money balances due to inflation rate. | Additional costs related to effort and resources spent managing cash holdings. |

| Cause | Higher inflation rates eroding money's real value. | Inflation incentivizing frequent cash withdrawals to minimize holding depreciating money. |

| Effect on Behavior | Holders reduce money demand. | People make more frequent trips to banks or ATMs. |

Understanding Inflation Tax: Definition and Mechanisms

Inflation tax refers to the reduction in the purchasing power of money held by the public due to rising price levels, effectively acting as a hidden tax on cash balances. It occurs because as inflation increases, the real value of money decreases, forcing individuals and businesses to spend money faster or switch to alternative assets to avoid losses. This mechanism redistributes wealth from money holders to borrowers, particularly governments that can pay debts back with devalued currency.

The Concept of Shoe Leather Costs Explained

Shoe leather costs refer to the increased time and effort individuals spend reducing cash holdings to minimize losses from inflation, effectively representing the opportunity cost of holding money when prices rise. Unlike the inflation tax, which erodes purchasing power by increasing the general price level, shoe leather costs manifest in more frequent trips to banks or ATMs and higher transaction costs. This concept highlights the behavioral response to inflation, where individuals alter their cash management strategies to avoid holding devalued currency.

How Inflation Tax Impacts Consumer Purchasing Power

Inflation tax reduces consumer purchasing power by eroding the real value of money held in cash, effectively acting as a hidden tax on holding money. As prices rise, individuals must spend more money to buy the same goods and services, diminishing the utility of their income. This inflation-induced loss forces consumers to adjust spending or savings, highlighting the economic burden inflation tax imposes beyond explicit taxation.

The Economic Sources of Shoe Leather Costs

Shoe leather costs arise from the increased frequency of cash withdrawals and transactions due to high inflation, leading to time and effort spent managing cash holdings. These economic sources include reduced real money balances, increased opportunity costs of holding cash, and the need for more frequent trips to financial institutions. Inflation tax indirectly exacerbates shoe leather costs by eroding purchasing power, motivating individuals to minimize cash holdings and thereby incurring higher transaction-related expenses.

Comparative Effects: Inflation Tax vs Shoe Leather Costs

Inflation tax erodes the real value of money holdings, effectively reducing consumers' purchasing power and disproportionately impacting those with fixed incomes or cash savings. Shoe leather costs represent the increased effort and time spent minimizing cash holdings to avoid inflation losses, resulting in more frequent trips to the bank and decreased productivity. While inflation tax has a direct financial cost by reducing wealth, shoe leather costs impose indirect economic burdens through resource allocation inefficiencies and time consumption.

Behavioral Responses to Inflation Tax and Shoe Leather Costs

Inflation tax reduces the real value of money holdings, prompting individuals to minimize cash balances by increasing the frequency of transactions, which leads to higher shoe leather costs through additional time and effort spent managing cash. Behavioral responses to this tax include accelerated spending and shifts toward interest-bearing assets to avoid erosion of purchasing power, intensifying the economic burden beyond the nominal tax impact. These adjustments contribute to inefficiencies and resource misallocation, highlighting the hidden costs of inflation beyond its visible price increases.

Policy Implications and Economic Management

Inflation tax erodes real household wealth by reducing purchasing power, prompting governments to carefully balance money supply growth to avoid excessive inflation. Shoe leather costs increase as individuals make more frequent transactions to minimize cash holdings, leading to inefficiencies and reduced economic productivity. Policymakers must implement monetary strategies that stabilize inflation expectations and optimize interest rates to minimize both inflation tax burdens and shoe leather costs, fostering sustainable economic growth.

Long-Term Consequences for Savings and Investment

Inflation tax erodes the real value of savings by reducing purchasing power over time, which discourages long-term investment and wealth accumulation. Shoe leather costs represent the time and effort spent managing cash holdings to minimize inflation losses, indirectly decreasing productivity and economic efficiency. Over the long term, high inflation undermines capital formation by increasing uncertainty and reducing incentives to save, thereby hindering sustainable economic growth.

Case Studies: Countries Navigating Inflation Tax and Shoe Leather Costs

Countries like Zimbabwe and Venezuela illustrate the severe impact of inflation tax, where hyperinflation erodes real money value, forcing citizens to reduce cash holdings and incur significant shoe leather costs through frequent bank visits. In Argentina, persistent inflation has intensified shoe leather costs by compelling households and businesses to swiftly convert pesos into stable assets, highlighting economic inefficiencies and time lost. Case studies in Turkey reveal government attempts to balance inflation tax effects with monetary policy adjustments, demonstrating the complex interplay between inflation control and transaction cost burdens on the public.

Mitigation Strategies and Best Practices for Individuals and Governments

Mitigation strategies for inflation tax include indexing wages and pensions to inflation, implementing prudent monetary policies, and maintaining fiscal discipline to reduce excessive money supply growth. Shoe leather costs can be minimized by increasing the use of digital payments, improving banking infrastructure, and encouraging efficient cash management practices. Governments can adopt transparent inflation targeting frameworks while individuals should diversify assets to preserve purchasing power and reduce frequent cash withdrawals.

Inflation tax Infographic

libterm.com

libterm.com