Nominal rigidities refer to the slow adjustment of prices and wages despite changes in the overall economy, which can lead to market inefficiencies and affect monetary policy effectiveness. These rigidities influence inflation dynamics and unemployment rates, making it crucial for economists to incorporate them into macroeconomic models. Explore the article to understand how nominal rigidities impact economic stability and policy decisions.

Table of Comparison

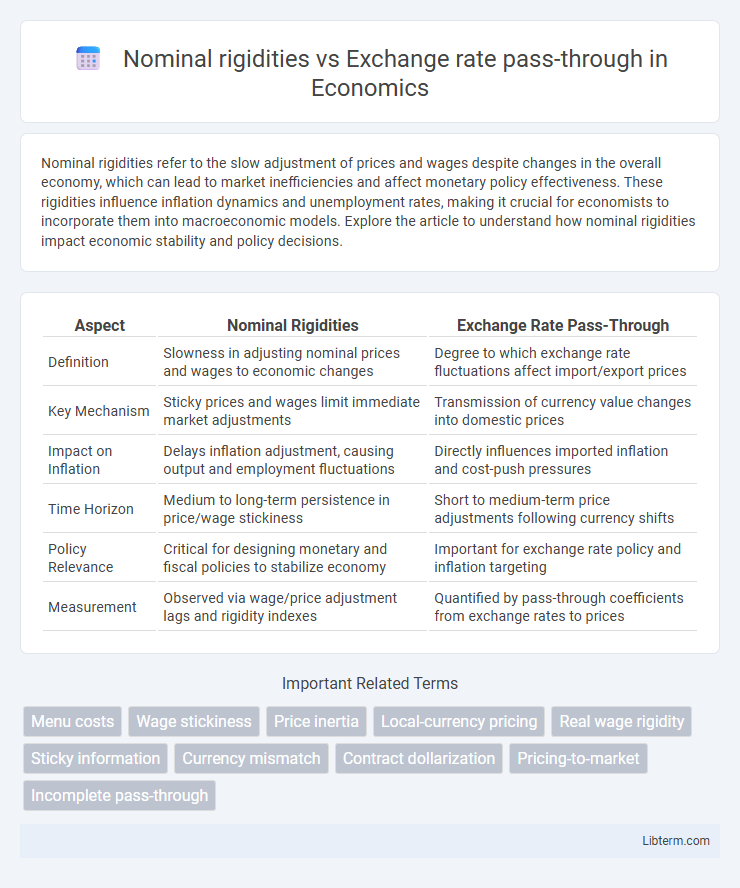

| Aspect | Nominal Rigidities | Exchange Rate Pass-Through |

|---|---|---|

| Definition | Slowness in adjusting nominal prices and wages to economic changes | Degree to which exchange rate fluctuations affect import/export prices |

| Key Mechanism | Sticky prices and wages limit immediate market adjustments | Transmission of currency value changes into domestic prices |

| Impact on Inflation | Delays inflation adjustment, causing output and employment fluctuations | Directly influences imported inflation and cost-push pressures |

| Time Horizon | Medium to long-term persistence in price/wage stickiness | Short to medium-term price adjustments following currency shifts |

| Policy Relevance | Critical for designing monetary and fiscal policies to stabilize economy | Important for exchange rate policy and inflation targeting |

| Measurement | Observed via wage/price adjustment lags and rigidity indexes | Quantified by pass-through coefficients from exchange rates to prices |

Understanding Nominal Rigidities: A Primer

Nominal rigidities refer to the slow adjustment of prices and wages in response to economic shocks, which significantly influence the degree of exchange rate pass-through to domestic prices. Understanding nominal rigidities involves examining menu costs, contracts, and price-setting behaviors that cause sluggish price adjustments, limiting the immediate impact of exchange rate fluctuations on inflation. These rigidities create a partial and delayed exchange rate pass-through, crucial for monetary policy effectiveness and inflation targeting in open economies.

What is Exchange Rate Pass-Through?

Exchange rate pass-through (ERPT) refers to the extent to which changes in the exchange rate affect domestic prices of imported goods and services. Nominal rigidities, such as price stickiness and menu costs, can limit the speed and magnitude of this pass-through, causing delayed or incomplete adjustment of prices to exchange rate fluctuations. Understanding the interaction between ERPT and nominal rigidities is crucial for assessing inflation dynamics and the effectiveness of monetary policy in an open economy.

Theoretical Foundations: Linking Rigidities and Pass-Through

Nominal rigidities, such as sticky prices and wages, fundamentally influence the degree of exchange rate pass-through by limiting the speed and extent to which firms adjust prices in response to currency fluctuations. Theoretical models, including New Keynesian frameworks, demonstrate how these rigidities create price stickiness that dampens immediate pass-through effects, leading to more gradual adjustments in import and export prices. Empirical observations support that economies with stronger nominal rigidities exhibit lower short-term exchange rate pass-through, resulting in muted inflationary impacts from exchange rate volatility.

How Price Stickiness Affects Currency Movements

Price stickiness, a key aspect of nominal rigidities, impedes immediate adjustments in domestic prices following exchange rate fluctuations, causing exchange rate pass-through to be incomplete and gradual. This partial pass-through modifies currency movements by dampening the direct impact of exchange rate changes on import and export prices, leading firms to adjust markups and output instead of prices. Consequently, price rigidity influences trade balances and monetary policy effectiveness by buffering the economy from volatile currency shocks and altering the transmission of exchange rate changes to inflation and real economic activity.

Empirical Evidence on Exchange Rate Pass-Through

Empirical evidence on exchange rate pass-through demonstrates that nominal rigidities, such as price stickiness in domestic markets, significantly dampen the extent to which exchange rate fluctuations affect import and consumer prices. Studies utilizing micro-level import price data reveal incomplete and delayed pass-through, with higher pass-through observed in economies exhibiting lower inflation and more flexible price adjustment mechanisms. Cross-country analyses confirm that nominal rigidities, including wage contracts and menu costs, are critical determinants of the heterogeneity in exchange rate pass-through rates across different economic environments.

Sectoral Differences in Nominal Rigidities

Sectoral differences in nominal rigidities significantly influence exchange rate pass-through, as industries with high price stickiness exhibit lower responsiveness to currency fluctuations. Manufacturing sectors often display more rigid nominal prices due to long-term contracts and input costs, resulting in muted pass-through effects compared to service sectors where prices adjust more frequently. Understanding these variations is crucial for policymakers assessing the inflationary impact of exchange rate movements across different economic sectors.

Policy Implications for Inflation Targeting

Nominal rigidities, such as sticky wages and prices, limit the immediate adjustment of domestic prices to exchange rate fluctuations, thereby affecting the degree of exchange rate pass-through to inflation. Central banks pursuing inflation targeting must consider that high nominal rigidities can delay the transmission of exchange rate changes to consumer prices, complicating the control of inflation expectations. Effective policy requires integrating real-time monitoring of pass-through dynamics and nominal rigidities to adjust interest rates and communication strategies, ensuring price stability amid exchange rate volatility.

Globalization and the Evolution of Pass-Through

Nominal rigidities, such as sticky prices and wages, limit the speed at which exchange rate fluctuations influence domestic prices, thereby moderating exchange rate pass-through (ERPT). Globalization has intensified international trade linkages and competitive pressures, leading to lower ERPT as firms absorb exchange rate changes to maintain market share. Over time, evolving global supply chains and increased cross-border sourcing have contributed to a structural decline in passthrough, reflecting the combined effects of nominal rigidities and global economic integration.

Case Studies: Advanced vs. Emerging Economies

Nominal rigidities significantly influence exchange rate pass-through (ERPT) differently in advanced and emerging economies, with advanced economies generally exhibiting lower ERPT due to more flexible price adjustments and well-developed financial markets. Case studies reveal that emerging economies experience higher ERPT as nominal rigidities such as wage stickiness and price menu costs hinder price flexibility, amplifying the transmission of exchange rate fluctuations into domestic prices. Empirical evidence from countries like the United States and Germany contrasts with Brazil and Turkey, highlighting how institutional factors and market structures mediate the interaction between nominal rigidities and exchange rate pass-through in various economic contexts.

Key Challenges and Future Research Directions

Nominal rigidities hinder the immediate adjustment of prices and wages, complicating the accurate measurement of exchange rate pass-through (ERPT) and affecting monetary policy effectiveness. Key challenges include disentangling the impacts of menu costs, wage contracts, and pricing-to-market strategies on incomplete ERPT across different sectors and economies. Future research should explore dynamic models integrating micro-level price stickiness with macroeconomic shocks and investigate heterogeneity in ERPT across firms and currencies to better inform policy responses in volatile exchange rate environments.

Nominal rigidities Infographic

libterm.com

libterm.com