Information asymmetry occurs when one party in a transaction possesses more or better information than the other, leading to imbalances that can affect decision-making and market outcomes. This disparity often results in adverse selection or moral hazard, impacting both buyers and sellers across various industries. Explore the rest of this article to understand how information asymmetry influences markets and strategies you can use to counteract its effects.

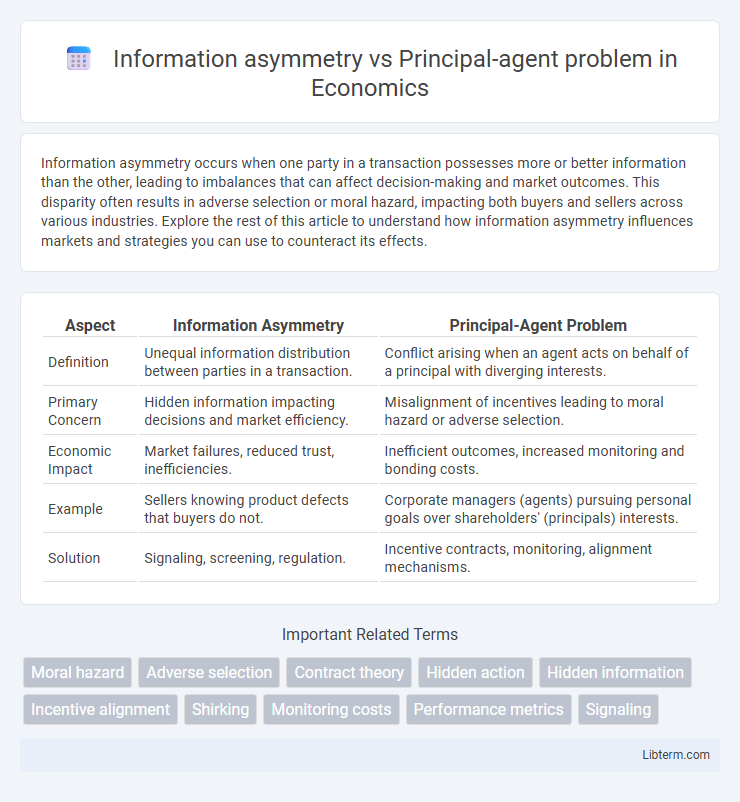

Table of Comparison

| Aspect | Information Asymmetry | Principal-Agent Problem |

|---|---|---|

| Definition | Unequal information distribution between parties in a transaction. | Conflict arising when an agent acts on behalf of a principal with diverging interests. |

| Primary Concern | Hidden information impacting decisions and market efficiency. | Misalignment of incentives leading to moral hazard or adverse selection. |

| Economic Impact | Market failures, reduced trust, inefficiencies. | Inefficient outcomes, increased monitoring and bonding costs. |

| Example | Sellers knowing product defects that buyers do not. | Corporate managers (agents) pursuing personal goals over shareholders' (principals) interests. |

| Solution | Signaling, screening, regulation. | Incentive contracts, monitoring, alignment mechanisms. |

Introduction to Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, leading to imbalances in decision-making and potential market inefficiencies. This phenomenon often underpins the principal-agent problem, where agents may exploit their informational advantage over principals to act in their own interest. Understanding the dynamics of information asymmetry is crucial in designing contracts and mechanisms that align incentives and reduce opportunities for opportunistic behavior.

Defining the Principal-Agent Problem

The principal-agent problem arises when one party (the agent) is tasked with making decisions or performing actions on behalf of another party (the principal), but their interests are not perfectly aligned, leading to potential conflicts and inefficiencies. This issue is deeply rooted in information asymmetry, as the agent typically possesses more information about their actions or intentions than the principal, creating challenges in monitoring and enforcing contracts. Effective mechanisms to mitigate the principal-agent problem often involve designing incentive-compatible contracts and implementing monitoring systems to reduce information gaps.

Key Differences Between Information Asymmetry and Principal-Agent Issues

Information asymmetry occurs when one party has more or better information than the other, affecting decision-making and market efficiency, while the principal-agent problem arises specifically from conflicts of interest between a principal and an agent who has decision-making authority. Key differences include that information asymmetry focuses broadly on uneven information distribution in economic transactions, whereas the principal-agent problem emphasizes misaligned incentives and actions within hierarchical relationships. Resolution strategies for information asymmetry often involve improving transparency and disclosure, while principal-agent issues require mechanisms like contracts, monitoring, and incentive alignment.

Causes of Information Asymmetry

Information asymmetry arises primarily from uneven distribution of information between parties, often due to factors such as hidden actions, hidden characteristics, and hidden information. It occurs when one party in a transaction has more or better information than the other, leading to adverse selection or moral hazard, which are central causes in economic theories. These disparities fuel principal-agent problems where agents possess more information than principals, causing misaligned incentives and inefficiencies.

How Principal-Agent Problems Arise

Principal-agent problems arise when there is a divergence of interests between a principal who delegates authority and an agent who performs tasks on the principal's behalf, combined with information asymmetry where the agent holds more information about their actions or intentions. This imbalance prevents the principal from effectively monitoring the agent's behavior, leading to potential moral hazard, adverse selection, or shirking. The core issue stems from incomplete contracts and the difficulty in aligning incentives to ensure the agent acts in the principal's best interest.

Real-World Examples of Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, exemplified by used car sales where sellers know more about vehicle defects than buyers. The principal-agent problem arises from this asymmetry when agents make decisions on behalf of principals, such as CEOs pursuing personal goals over shareholder interests. Real-world examples include financial markets where investors lack full insight into company risks, and healthcare systems where patients depend on physicians' expertise, highlighting challenges in trust and decision-making.

Real-World Cases of Principal-Agent Problems

Real-world cases of principal-agent problems commonly occur in corporate governance, where shareholders (principals) rely on executives (agents) to manage company resources, often facing challenges due to information asymmetry. Examples include CEOs engaging in self-serving behaviors like excessive risk-taking or overcompensation, which shareholders cannot easily monitor or control. These issues highlight the importance of aligning incentives and implementing transparent reporting mechanisms to mitigate conflicts arising from imbalanced information.

Strategies for Mitigating Information Asymmetry

Mitigating information asymmetry involves employing mechanisms such as signaling, screening, and incentive alignment to reduce knowledge gaps between parties. Employers implement performance-based contracts and monitoring systems to address the principal-agent problem by aligning agent actions with principal goals. Transparent communication channels and third-party verification also play crucial roles in minimizing adverse selection and moral hazard risks.

Solutions to Principal-Agent Problems

To address Principal-Agent problems arising from information asymmetry, organizations implement incentive alignment mechanisms such as performance-based compensation and profit sharing. Monitoring and reporting systems enhance transparency, reducing the agent's opportunity to act contrary to the principal's interests. Contractual agreements with clearly defined responsibilities and penalties further mitigate risks associated with hidden actions or information.

Impact on Markets and Organizational Performance

Information asymmetry leads to market inefficiencies by causing adverse selection and moral hazard, which reduce trust and increase transaction costs in financial and insurance markets. The principal-agent problem exacerbates these inefficiencies by creating conflicts of interest between owners and managers, resulting in suboptimal organizational performance and misaligned incentives. Both phenomena impair resource allocation and governance mechanisms, ultimately hindering market liquidity and corporate profitability.

Information asymmetry Infographic

libterm.com

libterm.com