A floating exchange rate fluctuates based on market forces of supply and demand without direct government or central bank intervention. This system allows currencies to adjust naturally, reflecting economic conditions such as inflation, interest rates, and trade balances. Explore the rest of the article to understand how floating exchange rates impact global trade and your financial decisions.

Table of Comparison

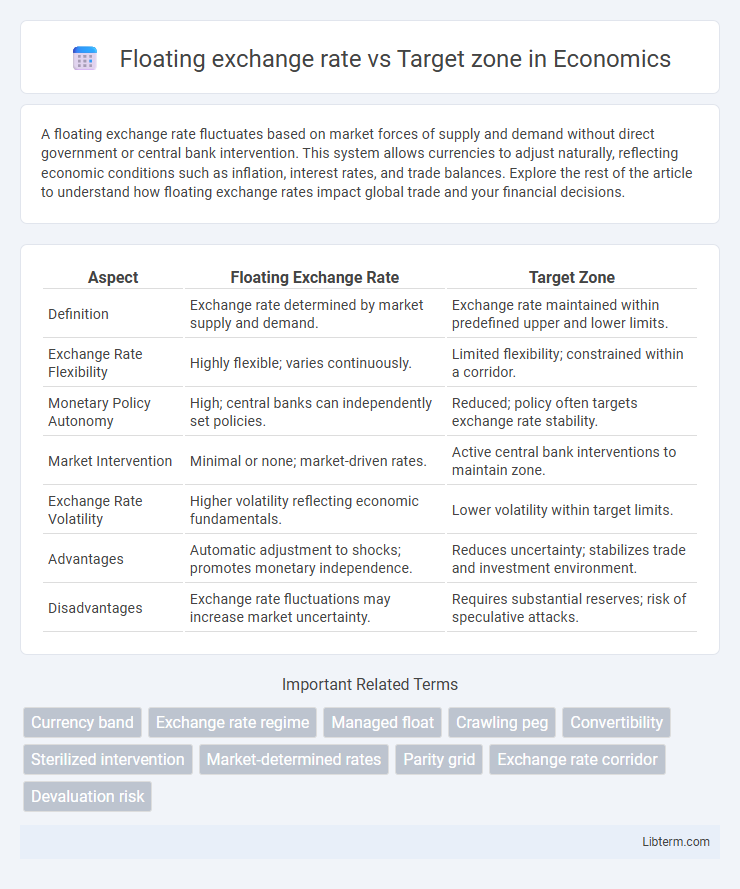

| Aspect | Floating Exchange Rate | Target Zone |

|---|---|---|

| Definition | Exchange rate determined by market supply and demand. | Exchange rate maintained within predefined upper and lower limits. |

| Exchange Rate Flexibility | Highly flexible; varies continuously. | Limited flexibility; constrained within a corridor. |

| Monetary Policy Autonomy | High; central banks can independently set policies. | Reduced; policy often targets exchange rate stability. |

| Market Intervention | Minimal or none; market-driven rates. | Active central bank interventions to maintain zone. |

| Exchange Rate Volatility | Higher volatility reflecting economic fundamentals. | Lower volatility within target limits. |

| Advantages | Automatic adjustment to shocks; promotes monetary independence. | Reduces uncertainty; stabilizes trade and investment environment. |

| Disadvantages | Exchange rate fluctuations may increase market uncertainty. | Requires substantial reserves; risk of speculative attacks. |

Introduction to Exchange Rate Regimes

Floating exchange rate regimes allow currency values to fluctuate freely based on market demand and supply, reflecting real-time economic conditions. Target zone systems intervene to keep exchange rates within a predetermined band, stabilizing the currency while allowing limited flexibility. These regimes influence trade balances, inflation control, and monetary policy effectiveness depending on the degree of exchange rate stability desired by a country.

What is a Floating Exchange Rate?

A floating exchange rate is a currency valuation system where the currency's value fluctuates freely according to foreign exchange market supply and demand without direct government or central bank intervention. This system contrasts with a target zone, where authorities maintain the currency within a predetermined range by buying or selling currency reserves. Floating exchange rates offer automatic adjustment to economic conditions but can result in higher volatility compared to target zones.

Defining the Target Zone System

The Target Zone System is a currency exchange rate regime where governments or central banks maintain a currency's value within a specified range or band against another currency or a basket of currencies. Unlike the Floating Exchange Rate system, where currency values fluctuate freely based on market forces, the Target Zone involves intervention mechanisms such as buying or selling currencies to prevent the exchange rate from moving outside the set boundaries. This system aims to combine exchange rate stability with flexibility, reducing excessive volatility while allowing adjustments to economic fundamentals.

Key Differences: Floating Rate vs Target Zone

Floating exchange rates fluctuate freely based on market supply and demand, allowing currency values to adjust continuously without direct government intervention. Target zones involve a fixed exchange rate band where authorities intervene to maintain the currency within predetermined upper and lower limits, stabilizing volatility. The key difference lies in flexibility: floating rates offer automatic adjustment to economic conditions, whereas target zones impose controlled boundaries to reduce exchange rate uncertainty.

Advantages of Floating Exchange Rates

Floating exchange rates offer greater flexibility by allowing currency values to adjust according to market forces, which helps absorb external economic shocks and maintain competitiveness. This system reduces the need for large foreign exchange reserves since central banks do not have to intervene constantly to stabilize the currency. Moreover, floating exchange rates support independent monetary policy, enabling central banks to focus on domestic objectives like controlling inflation and promoting growth.

Benefits of Target Zone Systems

Target zone systems stabilize exchange rates within predetermined bands, reducing volatility and providing a predictable environment for international trade and investment. By limiting excessive currency fluctuations, target zones enhance market confidence and lower the risks associated with sudden devaluations or appreciations. This stability supports economic planning and fosters competitiveness by balancing flexibility with exchange rate stability.

Challenges and Drawbacks of Floating Rates

Floating exchange rates face significant challenges including high volatility that creates uncertainty for importers, exporters, and investors, potentially disrupting trade and investment decisions. The lack of intervention in the forex market can lead to sharp currency fluctuations influenced by speculative attacks or market sentiment rather than economic fundamentals. Additionally, floating rates offer limited control to policymakers over exchange rate stability, complicating inflation targeting and economic planning.

Limitations of Target Zone Regimes

Target zone exchange rate regimes face limitations such as frequent speculative attacks when market participants doubt the central bank's ability to maintain the band. Maintaining the exchange rate within a predetermined margin requires substantial foreign reserves and often leads to higher interest rates, which can negatively impact economic growth. Additionally, target zones reduce monetary policy autonomy and can create market distortions, making them less flexible compared to floating exchange rate systems.

Historical Examples and Case Studies

The floating exchange rate system, exemplified by the US dollar following the breakdown of the Bretton Woods system in 1971, allows currency values to fluctuate based on market forces, leading to volatility but greater flexibility. In contrast, the target zone regime, as seen in the European Exchange Rate Mechanism (ERM) from 1979 to 1999, involves maintaining currency values within predetermined bands, stabilizing exchange rates to facilitate trade and economic integration. Historical case studies highlight the 1992 ERM crisis where speculative attacks on the British pound forced its exit from the target zone, illustrating the challenges of maintaining fixed exchange rate bands amid divergent economic pressures.

Choosing the Right Exchange Rate System

Choosing the right exchange rate system depends on a country's economic stability, inflation control, and trade openness. Floating exchange rates allow currencies to fluctuate based on market forces, providing automatic adjustment to external shocks but can lead to volatility. Target zones offer a compromise by limiting fluctuations within a set range, promoting stability while maintaining some flexibility for monetary policy adjustments.

Floating exchange rate Infographic

libterm.com

libterm.com