Interest rate parity is a fundamental concept in international finance that links the difference in interest rates between two countries to the differential in their exchange rates. This principle helps investors understand how currency values adjust to maintain equilibrium in the foreign exchange market. Dive deeper into how interest rate parity influences global investments and currency risk in the rest of this article.

Table of Comparison

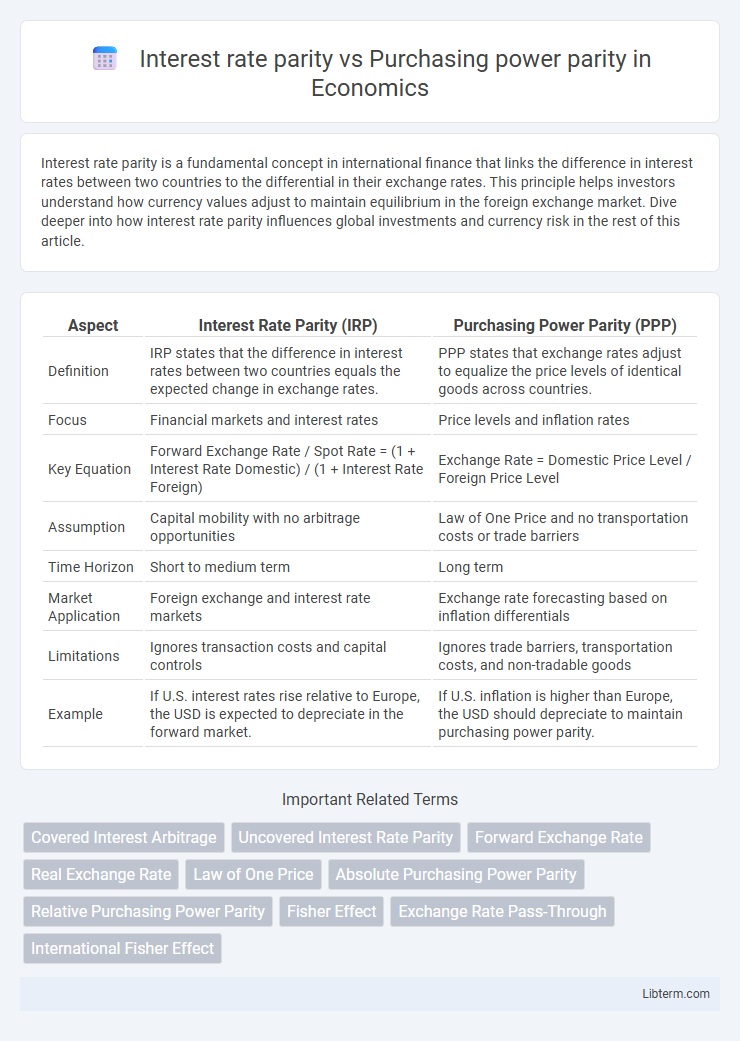

| Aspect | Interest Rate Parity (IRP) | Purchasing Power Parity (PPP) |

|---|---|---|

| Definition | IRP states that the difference in interest rates between two countries equals the expected change in exchange rates. | PPP states that exchange rates adjust to equalize the price levels of identical goods across countries. |

| Focus | Financial markets and interest rates | Price levels and inflation rates |

| Key Equation | Forward Exchange Rate / Spot Rate = (1 + Interest Rate Domestic) / (1 + Interest Rate Foreign) | Exchange Rate = Domestic Price Level / Foreign Price Level |

| Assumption | Capital mobility with no arbitrage opportunities | Law of One Price and no transportation costs or trade barriers |

| Time Horizon | Short to medium term | Long term |

| Market Application | Foreign exchange and interest rate markets | Exchange rate forecasting based on inflation differentials |

| Limitations | Ignores transaction costs and capital controls | Ignores trade barriers, transportation costs, and non-tradable goods |

| Example | If U.S. interest rates rise relative to Europe, the USD is expected to depreciate in the forward market. | If U.S. inflation is higher than Europe, the USD should depreciate to maintain purchasing power parity. |

Understanding Interest Rate Parity (IRP)

Interest Rate Parity (IRP) establishes a fundamental relationship between the spot exchange rate and the forward exchange rate based on interest rate differentials between two countries. It ensures no arbitrage opportunities exist by equating the returns on investments in different currencies when adjusted for exchange rate risk. Unlike Purchasing Power Parity (PPP), which focuses on price levels and inflation differences, IRP centers on capital market equilibrium and interest rates to predict currency movements.

Defining Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory that states the exchange rate between two currencies should equalize the price of a basket of goods and services in both countries. This concept helps determine the relative value of currencies by comparing cost of living and inflation rates. PPP is widely used to assess whether a currency is undervalued or overvalued against another currency in the long term.

Theoretical Foundations of IRP and PPP

Interest Rate Parity (IRP) is grounded in the theory that differences in nominal interest rates between two countries are equalized by changes in the exchange rate, ensuring no arbitrage opportunities in the foreign exchange markets. Purchasing Power Parity (PPP) is based on the law of one price, stating that identical goods should have the same price across countries when expressed in a common currency, linking exchange rates to relative price levels. While IRP emphasizes financial market equilibrium determined by interest rates and expected currency movements, PPP focuses on long-term equilibrium driven by price level adjustments and inflation differentials.

Key Assumptions Behind IRP and PPP

Interest Rate Parity (IRP) assumes no arbitrage opportunities exist in foreign exchange markets, implying that differences in interest rates between two countries are offset by expected changes in exchange rates. Purchasing Power Parity (PPP) is based on the assumption that identical goods should have the same price across countries when expressed in a common currency, reflecting long-term equilibrium in price levels. Both theories rely on frictionless markets but differ as IRP focuses on financial capital flows, while PPP emphasizes goods market integration and inflation rates.

Mathematical Formulas: IRP vs PPP

Interest Rate Parity (IRP) is mathematically expressed as \( \frac{F}{S} = \frac{1 + i_d}{1 + i_f} \), where \(F\) represents the forward exchange rate, \(S\) the spot exchange rate, \(i_d\) the domestic interest rate, and \(i_f\) the foreign interest rate. Purchasing Power Parity (PPP) is formulated as \( \frac{S_1}{S_0} = \frac{P_1}{P_0} \), with \(S_1\) and \(S_0\) being the future and current exchange rates, and \(P_1\) and \(P_0\) the price levels in respective countries. These formulas highlight IRP's emphasis on interest rate differentials affecting forward rates and PPP's focus on price level changes influencing currency values.

Practical Applications in Foreign Exchange Markets

Interest rate parity (IRP) is crucial for arbitrage strategies in foreign exchange markets, ensuring no risk-free profits by aligning spot and forward exchange rates with interest rate differentials between countries. Purchasing power parity (PPP) guides long-term currency valuation by comparing price levels across nations, helping investors assess if a currency is overvalued or undervalued relative to another. Traders and multinational corporations utilize IRP for short-term hedging and forward contracts, while PPP informs long-term investment decisions and economic forecasts based on inflation-adjusted exchange rates.

Factors Causing Deviations from IRP and PPP

Interest rate parity (IRP) deviations occur due to transaction costs, capital controls, and differences in risk perceptions affecting arbitrage activities in foreign exchange markets. Purchasing power parity (PPP) deviations arise from factors such as transportation costs, trade barriers, and differences in consumption patterns influencing relative price level adjustments between countries. Both IRP and PPP are impacted by market imperfections and short-term shocks that prevent equilibrium from being instantly established.

Implications for International Investors

Interest rate parity (IRP) and purchasing power parity (PPP) provide crucial frameworks for international investors assessing currency risks and returns on foreign investments. IRP suggests that the difference in interest rates between two countries equals the expected change in exchange rates, guiding investors in making arbitrage decisions to avoid risk-free profits. PPP emphasizes that exchange rates adjust to equalize price levels across countries, impacting long-term investment strategies by forecasting currency value shifts that influence real returns on international assets.

Real-World Examples: IRP and PPP in Action

Interest rate parity (IRP) is exemplified by the arbitrage opportunities in forex markets, such as when U.S. and European interest rate differentials influence EUR/USD forward exchange rates, ensuring no risk-free profits from interest rate differences. Purchasing power parity (PPP) is illustrated by comparing prices of identical goods like the Big Mac Index, highlighting currency valuation disparities and long-term exchange rate adjustments, such as the undervaluation of the Indian Rupee versus the U.S. Dollar. Both IRP and PPP provide critical frameworks for understanding exchange rate movements in global finance, with IRP focusing on financial arbitrage and PPP emphasizing goods price equilibrium.

Comparing Limitations: IRP vs PPP

Interest Rate Parity (IRP) assumes no transaction costs and perfect capital mobility, which often fails in real-world markets due to capital controls and liquidity constraints, limiting its accuracy in predicting exchange rates. Purchasing Power Parity (PPP) relies on the Law of One Price and assumes identical goods and services baskets across countries, but differences in consumption patterns, tariffs, and non-tradable goods introduce significant deviations. Both IRP and PPP face empirical challenges, with IRP more accurate in short-term financial markets and PPP better suited for long-term exchange rate trends.

Interest rate parity Infographic

libterm.com

libterm.com