Foreign bias often shapes perceptions and policymaking by favoring one country's interests over another's, which can lead to skewed international relations and unfair economic practices. Recognizing and addressing your own potential biases helps promote more balanced viewpoints and fairer dialogues on global issues. Explore the rest of the article to discover practical strategies for identifying and mitigating foreign bias in everyday contexts.

Table of Comparison

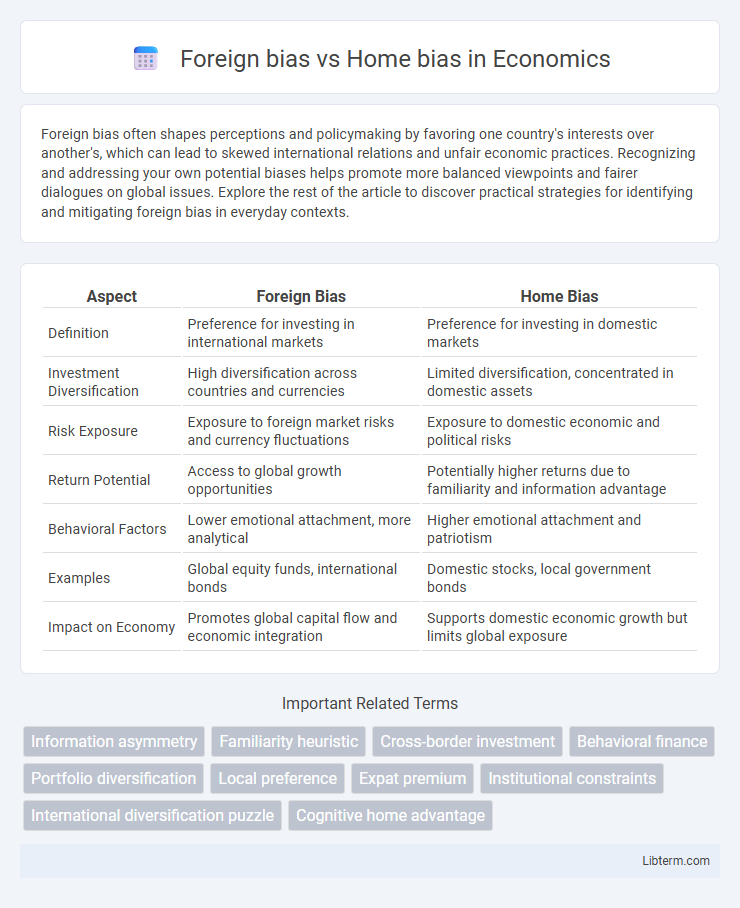

| Aspect | Foreign Bias | Home Bias |

|---|---|---|

| Definition | Preference for investing in international markets | Preference for investing in domestic markets |

| Investment Diversification | High diversification across countries and currencies | Limited diversification, concentrated in domestic assets |

| Risk Exposure | Exposure to foreign market risks and currency fluctuations | Exposure to domestic economic and political risks |

| Return Potential | Access to global growth opportunities | Potentially higher returns due to familiarity and information advantage |

| Behavioral Factors | Lower emotional attachment, more analytical | Higher emotional attachment and patriotism |

| Examples | Global equity funds, international bonds | Domestic stocks, local government bonds |

| Impact on Economy | Promotes global capital flow and economic integration | Supports domestic economic growth but limits global exposure |

Understanding Foreign Bias and Home Bias

Foreign bias refers to investors' tendency to favor assets from international markets, often driven by perceptions of higher returns or diversification benefits. Home bias describes the preference for domestic investments, rooted in familiarity, regulatory comfort, and perceived lower risk. Understanding these biases helps investors balance global portfolio diversification against the psychological and informational advantages of local assets.

Origins of Home Bias in Investment

Home bias in investment originates from psychological comfort and familiarity with domestic markets, leading investors to prefer local assets despite diversification benefits abroad. Factors such as information asymmetry, national loyalty, and regulatory familiarity reinforce this bias, limiting exposure to foreign securities. Empirical studies indicate that cognitive constraints and perceived higher risk in foreign markets contribute significantly to persistent home bias.

Causes of Foreign Bias in Decision-Making

Foreign bias in decision-making arises primarily from limited local knowledge, which hinders accurate evaluation of domestic options and inflates the perceived value of foreign alternatives. Cultural differences and cognitive biases, such as the unfamiliarity or exoticism effect, skew preferences toward foreign entities perceived as novel or superior. Furthermore, global media influence and historical prestige associated with foreign brands amplify this bias, often overshadowing objectively better homegrown choices.

Psychological Factors Behind Investment Biases

Psychological factors driving foreign bias versus home bias in investments include familiarity and cognitive ease, where investors prefer local assets due to better understanding and perceived lower risk. Home bias is reinforced by emotional attachment and nationalistic sentiments, leading to under-diversification and portfolio inefficiencies. Conversely, foreign bias can stem from overconfidence in international markets and the allure of potential higher returns despite unfamiliarity.

Economic Impacts of Home Bias

Home bias in investment portfolios leads to reduced international diversification, increasing exposure to domestic economic shocks and limiting potential gains from global growth opportunities. This behavior can result in suboptimal risk-return profiles and slower capital allocation efficiency across countries. Economies with strong home bias may experience restricted foreign capital inflows, which can hinder market development and innovation.

Risks Associated with Foreign Bias

Foreign bias in investment portfolios carries significant risks, including currency fluctuations that can erode returns and geopolitical uncertainties that may disrupt markets. Exposure to unfamiliar regulatory environments increases the likelihood of compliance issues and legal challenges. Moreover, limited access to timely information and cultural differences can lead to suboptimal decision-making and increased volatility.

Strategies to Overcome Home Bias

To overcome home bias, investors can diversify their portfolios by increasing international asset allocation, thereby reducing country-specific risks and capturing growth opportunities in emerging markets. Utilizing global index funds, exchange-traded funds (ETFs), and multinational mutual funds facilitates efficient access to foreign equities and bonds, balancing exposure beyond domestic markets. Employing currency hedging strategies and leveraging financial advisors skilled in global markets can further mitigate risks associated with foreign investments, enhancing overall portfolio performance.

Balancing Global and Domestic Investments

Balancing global and domestic investments requires addressing foreign bias and home bias, which influence portfolio diversification and risk management strategies. Foreign bias occurs when investors overallocate to international markets, potentially increasing exposure to currency and geopolitical risks, while home bias reflects a preference for domestic assets, limiting opportunities for global growth and diversification. Effective investment strategies incorporate a calibrated mix of foreign and domestic equities to optimize returns and mitigate systemic market fluctuations.

Case Studies: Home Bias vs. Foreign Bias

Case studies reveal that investors in countries like the U.S. often exhibit home bias by disproportionately allocating portfolios to domestic equities, limiting exposure to foreign markets despite potential diversification benefits. Contrastingly, foreign bias can occur when investors favor foreign securities, as seen in markets such as Japan, where historical experiences and currency factors promote overseas investment preferences. Empirical research highlights how factors including information asymmetry, transaction costs, and behavioral tendencies influence these biases, impacting international asset allocation and portfolio performance.

Future Trends in Global Investment Biases

Future trends in global investment biases indicate a gradual reduction of home bias as investors increasingly diversify across foreign markets to capitalize on growth opportunities and mitigate risks. Technological advancements and improved access to international financial information promote foreign bias by enabling more informed cross-border investment decisions. Shifts in geopolitical dynamics and evolving regulatory frameworks further encourage investors to balance home and foreign asset allocation, fostering a more globally integrated investment approach.

Foreign bias Infographic

libterm.com

libterm.com