Interest rate smoothing rule refers to a monetary policy approach where central banks adjust interest rates gradually to avoid sudden economic disruptions and maintain market stability. This technique helps in managing inflation expectations and supports steady economic growth by preventing sharp fluctuations in borrowing costs. Explore the rest of the article to understand how this rule impacts your financial decisions and the broader economy.

Table of Comparison

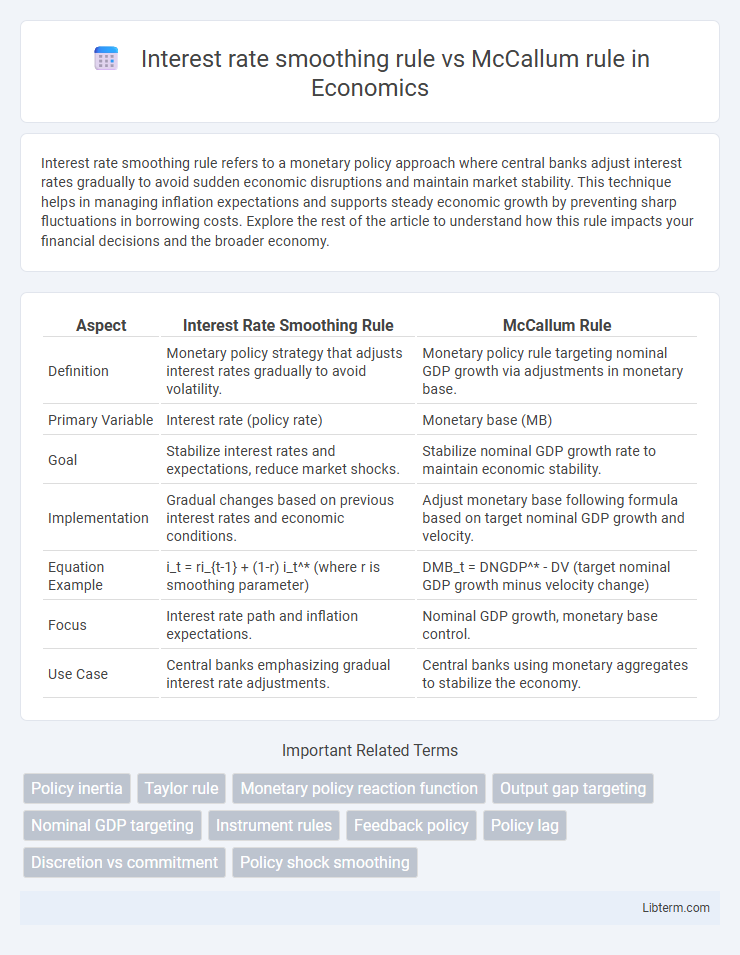

| Aspect | Interest Rate Smoothing Rule | McCallum Rule |

|---|---|---|

| Definition | Monetary policy strategy that adjusts interest rates gradually to avoid volatility. | Monetary policy rule targeting nominal GDP growth via adjustments in monetary base. |

| Primary Variable | Interest rate (policy rate) | Monetary base (MB) |

| Goal | Stabilize interest rates and expectations, reduce market shocks. | Stabilize nominal GDP growth rate to maintain economic stability. |

| Implementation | Gradual changes based on previous interest rates and economic conditions. | Adjust monetary base following formula based on target nominal GDP growth and velocity. |

| Equation Example | i_t = ri_{t-1} + (1-r) i_t^* (where r is smoothing parameter) | DMB_t = DNGDP^* - DV (target nominal GDP growth minus velocity change) |

| Focus | Interest rate path and inflation expectations. | Nominal GDP growth, monetary base control. |

| Use Case | Central banks emphasizing gradual interest rate adjustments. | Central banks using monetary aggregates to stabilize the economy. |

Introduction to Monetary Policy Rules

The Interest Rate Smoothing Rule emphasizes gradual adjustments to the nominal interest rate, stabilizing economic fluctuations by avoiding abrupt changes. The McCallum Rule targets monetary aggregates, setting growth rates that align with long-term nominal GDP trends to control inflation and output. Both rules serve as systematic frameworks in monetary policy, guiding central banks to balance inflation control with economic growth stabilization.

Understanding Interest Rate Smoothing Rule

Interest rate smoothing rule emphasizes gradual adjustments in policy rates to avoid market volatility and foster economic stability, contrasting with the McCallum rule that targets monetary aggregates for inflation control. This rule incorporates lagged interest rates in the policy equation to reduce abrupt changes, promoting predictable central bank behavior. Empirical evidence suggests smoothing enhances credibility and reduces output fluctuations by anchoring expectations.

Overview of the McCallum Rule

The McCallum rule is a monetary policy guideline that targets the growth rate of the nominal monetary base to stabilize the economy and control inflation. It adjusts money supply growth based on deviations of nominal GDP from its target level, aiming to anchor expectations without frequent interest rate changes. Unlike the interest rate smoothing rule, which emphasizes gradual adjustments to interest rates to avoid market volatility, the McCallum rule focuses on monetary aggregates, providing a systematic approach to managing liquidity in the economy.

Key Differences Between the Two Rules

The Interest Rate Smoothing Rule emphasizes gradual adjustments to the nominal interest rate to avoid abrupt changes and maintain economic stability, prioritizing policy inertia. In contrast, the McCallum Rule targets the growth rate of the nominal money supply, linking monetary policy directly to money supply targets rather than interest rate adjustments. Key differences include the former's focus on interest rate path smoothness versus the latter's emphasis on controlling nominal GDP through monetary aggregates.

Theoretical Foundations and Assumptions

The Interest Rate Smoothing Rule is grounded in the assumption that central banks adjust interest rates gradually to avoid excessive volatility and maintain policy credibility, reflecting a forward-looking approach with partial adjustment. In contrast, the McCallum Rule derives from monetary aggregate targeting embedded in quantity theory, assuming a stable velocity of money and emphasizing feedback from nominal GDP to control the monetary base. The theoretical foundation of interest rate smoothing highlights inertia and expectations management in policy interest rates, whereas the McCallum Rule relies on monetary policy's ability to influence nominal income via money supply adjustments under stable demand conditions.

Implications for Inflation and Output Stability

The Interest Rate Smoothing Rule emphasizes gradual adjustments in policy rates, enhancing output stability by reducing volatility in economic activity but may delay responses to inflationary pressures, potentially causing short-term inflation fluctuations. The McCallum Rule targets monetary base growth aligned with nominal GDP trends, promoting price stability and anchoring inflation expectations more effectively, thus supporting long-term inflation targeting. Empirical studies suggest the Interest Rate Smoothing Rule provides smoother output paths, while the McCallum Rule better controls inflation variability, indicating a trade-off between inflation stability and output volatility in monetary policy design.

Practical Implementation by Central Banks

Central banks often favor the Interest Rate Smoothing Rule for its ability to reduce volatility in policy rates, promoting gradual adjustments that enhance market stability and predictability. The McCallum Rule, anchored in targeting nominal GDP growth, offers a systematic approach to monetary policy but requires precise real-time data and robust statistical infrastructure, which can complicate its practical implementation. In practice, the choice between these rules hinges on a central bank's data availability, institutional framework, and the trade-off between policy responsiveness and stability.

Criticisms and Limitations of Each Rule

The Interest Rate Smoothing Rule faces criticism for its potential to delay policy responses, which can exacerbate economic fluctuations due to its gradual adjustment approach. The McCallum Rule, while emphasizing money growth targeting, is limited by its reliance on stable velocity and accurate output gap estimates, which are often difficult to obtain in real time. Both rules may suffer from model specification errors and may not adequately account for unexpected shocks, reducing their effectiveness under diverse economic conditions.

Empirical Evidence and Real-World Performance

Empirical evidence indicates that the Interest Rate Smoothing Rule provides gradual adjustments in policy rates, promoting economic stability by reducing volatility in inflation and output fluctuations. The McCallum Rule, based on targeting nominal GDP growth, has demonstrated strong theoretical appeal but mixed real-world performance due to measurement challenges and data revisions affecting timely policy responses. Comparative studies reveal that while the smoothing rule enhances predictability in central bank behavior, the McCallum Rule's effectiveness depends heavily on accurate nominal GDP data and may exhibit slower adjustment to economic shocks.

Policy Implications and Future Perspectives

Interest rate smoothing rule emphasizes gradual adjustments in nominal interest rates to stabilize the economy and reduce volatility, supporting steady economic growth and inflation control. The McCallum rule targets nominal GDP growth directly, promoting more responsive monetary policy that can better accommodate supply shocks and demand fluctuations. Future perspectives suggest integrating data-driven approaches and real-time economic indicators to enhance the effectiveness and adaptability of both rules in dynamic macroeconomic environments.

Interest rate smoothing rule Infographic

libterm.com

libterm.com