Fiscal federalism explores the division of governmental functions and financial relations among different levels of government, enhancing efficiency and accountability. It plays a crucial role in balancing local autonomy with national interests to optimize public service delivery and economic stability. Discover how fiscal federalism impacts your community and economy by reading the full article.

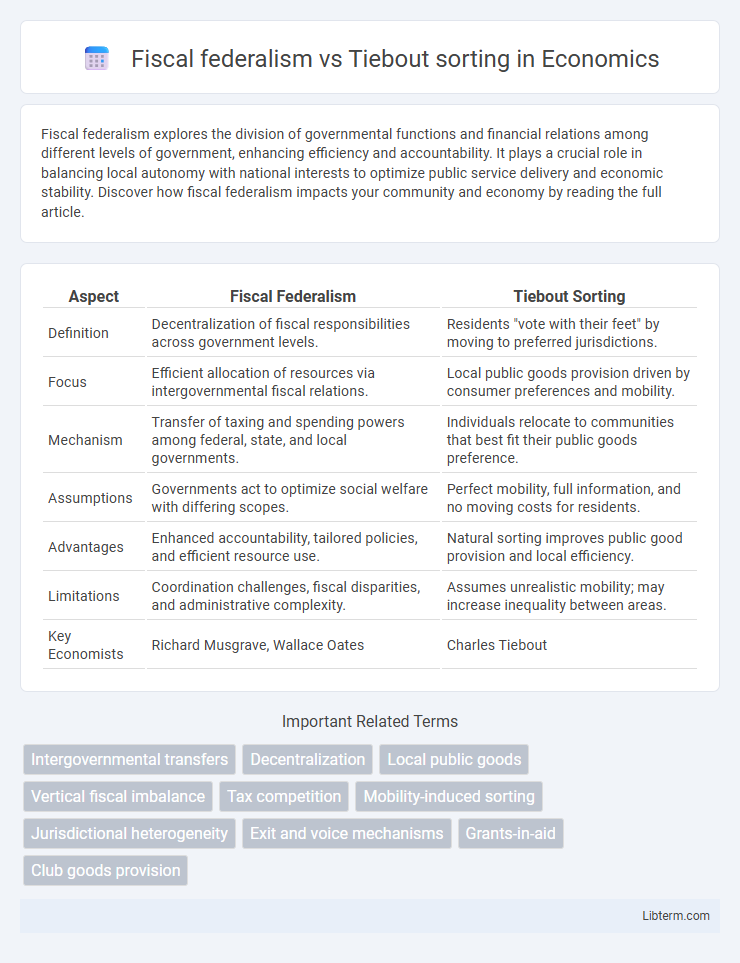

Table of Comparison

| Aspect | Fiscal Federalism | Tiebout Sorting |

|---|---|---|

| Definition | Decentralization of fiscal responsibilities across government levels. | Residents "vote with their feet" by moving to preferred jurisdictions. |

| Focus | Efficient allocation of resources via intergovernmental fiscal relations. | Local public goods provision driven by consumer preferences and mobility. |

| Mechanism | Transfer of taxing and spending powers among federal, state, and local governments. | Individuals relocate to communities that best fit their public goods preference. |

| Assumptions | Governments act to optimize social welfare with differing scopes. | Perfect mobility, full information, and no moving costs for residents. |

| Advantages | Enhanced accountability, tailored policies, and efficient resource use. | Natural sorting improves public good provision and local efficiency. |

| Limitations | Coordination challenges, fiscal disparities, and administrative complexity. | Assumes unrealistic mobility; may increase inequality between areas. |

| Key Economists | Richard Musgrave, Wallace Oates | Charles Tiebout |

Introduction to Fiscal Federalism and Tiebout Sorting

Fiscal federalism examines the allocation of financial responsibilities and decision-making authority across different government levels to enhance public service efficiency and address local preferences. Tiebout sorting proposes that individuals "vote with their feet" by choosing jurisdictions that best match their preferences for public goods and taxation, creating competitive local governments. Together, these frameworks explore how decentralized governance and mobility influence the optimal provision of public services.

Theoretical Foundations of Fiscal Federalism

Fiscal federalism is grounded in the theory that decentralized government structures allocate resources more efficiently by matching public service provision to local preferences and conditions, minimizing information asymmetry and externalities. The theoretical foundations emphasize the role of multiple layers of government in optimizing fiscal responsibilities, balancing redistribution with efficiency through tax and expenditure assignments. Contrastingly, Tiebout sorting theory explains how individuals "vote with their feet" by migrating to jurisdictions that offer their preferred mix of taxation and public goods, highlighting mobility as a mechanism for achieving efficient local public service allocation.

Key Principles of Tiebout Sorting

Tiebout sorting centers on the principle that individuals "vote with their feet" by moving to communities that best match their preferences for public goods and taxation levels, leading to efficient local public service provision. It assumes a competitive environment where multiple jurisdictions offer diverse bundles of taxes and services, enabling residents to select the community that maximizes their utility. This mechanism encourages local governments to tailor policies to resident demands, fostering efficient resource allocation and minimizing free-rider problems inherent in fiscal federalism.

Mechanisms of Resource Allocation in Fiscal Federalism

Fiscal federalism allocates resources through a hierarchical system where central and subnational governments have distinct expenditures and revenue-raising responsibilities, enabling tailored public service provision. Resource allocation mechanisms include intergovernmental transfers, local taxation autonomy, and expenditure assignments designed to optimize efficiency and equity across jurisdictions. These mechanisms balance economies of scale with local preferences, contrasting with Tiebout sorting that relies on individuals "voting with their feet" by moving to jurisdictions matching their service-tax trade-offs.

Local Government Competition and Tiebout Sorting

Local government competition drives municipalities to improve public service quality and tax policies to attract residents and businesses, aligning closely with the principles of Tiebout sorting where individuals "vote with their feet" by moving to communities that best match their preference for public goods and tax levels. Fiscal federalism emphasizes the efficient allocation of resources across different government layers, whereas Tiebout sorting highlights the role of residential mobility in achieving an optimal match between citizen preferences and local government provisions. Both concepts underscore the importance of decentralized decision-making and inter-jurisdictional competition in enhancing public service delivery and economic efficiency.

Public Goods Provision: Fiscal Federalism vs Tiebout Model

Fiscal federalism emphasizes government layers allocating resources to match local preferences for public goods, leveraging tax and expenditure assignments to optimize efficiency. The Tiebout model highlights individual mobility across jurisdictions, enabling residents to "vote with their feet" for communities that best align with their public goods preferences and tax burdens. Both frameworks address public goods provision by balancing centralized coordination and localized choice, but fiscal federalism relies more on institutional design while Tiebout sorting depends on population mobility and preference heterogeneity.

Efficiency and Equity Outcomes Compared

Fiscal federalism emphasizes decentralized governance with local governments tailoring public goods to regional preferences, promoting allocative efficiency but sometimes causing fiscal disparities. Tiebout sorting theorizes that individuals "vote with their feet" by moving to jurisdictions matching their preference for public goods and tax levels, enhancing efficiency through competitive local governments but potentially exacerbating equity issues as low-income households face limited mobility. Both models improve efficiency by aligning public service provision with residents' preferences, yet fiscal federalism relies more on government intervention to address equity, whereas Tiebout sorting risks increasing inequality due to selective migration patterns.

Challenges and Critiques of Each Model

Fiscal federalism faces challenges in aligning local government incentives with efficient allocation of resources, often leading to issues of fiscal externalities and unequal service provision across regions. Tiebout sorting, while promoting consumer preferences through mobility, is critiqued for assumptions of perfect information, costless movement, and homogeneous preferences, limiting its real-world applicability. Both models struggle with addressing disparities in income distribution and public goods provision, raising concerns about equity and the feasibility of decentralized governance in diverse populations.

Real-World Applications and Empirical Evidence

Fiscal federalism allocates governmental functions and financial resources among multiple layers of government, facilitating tailored public service provision based on regional needs and preferences. Tiebout sorting theorizes that individuals "vote with their feet" by moving to jurisdictions that best match their preferred public goods and tax levels, enhancing efficiency through competition among local governments. Empirical studies reveal mixed evidence: fiscal federalism supports diverse service delivery and local accountability, while Tiebout sorting is limited by mobility constraints, informational asymmetries, and housing market rigidities affecting practical implementation.

Policy Implications and Future Directions

Fiscal federalism emphasizes the allocation of taxing and spending powers across government levels to enhance efficiency and equity, guiding policies on intergovernmental grants and fiscal decentralization. Tiebout sorting highlights individuals' mobility based on local public goods preferences, suggesting policies that promote diverse municipal offerings and competition among jurisdictions to optimize public service delivery. Future directions involve integrating digital governance to improve fiscal transparency and refining models to address socioeconomic disparities and regional externalities within both frameworks.

Fiscal federalism Infographic

libterm.com

libterm.com