The capital adequacy ratio (CAR) measures a bank's financial strength by comparing its capital to its risk-weighted assets, ensuring stability and protecting depositors. Maintaining a healthy CAR is crucial for regulatory compliance and mitigating potential losses during economic downturns. Discover how understanding CAR can empower your decisions in the banking sector by exploring the full article.

Table of Comparison

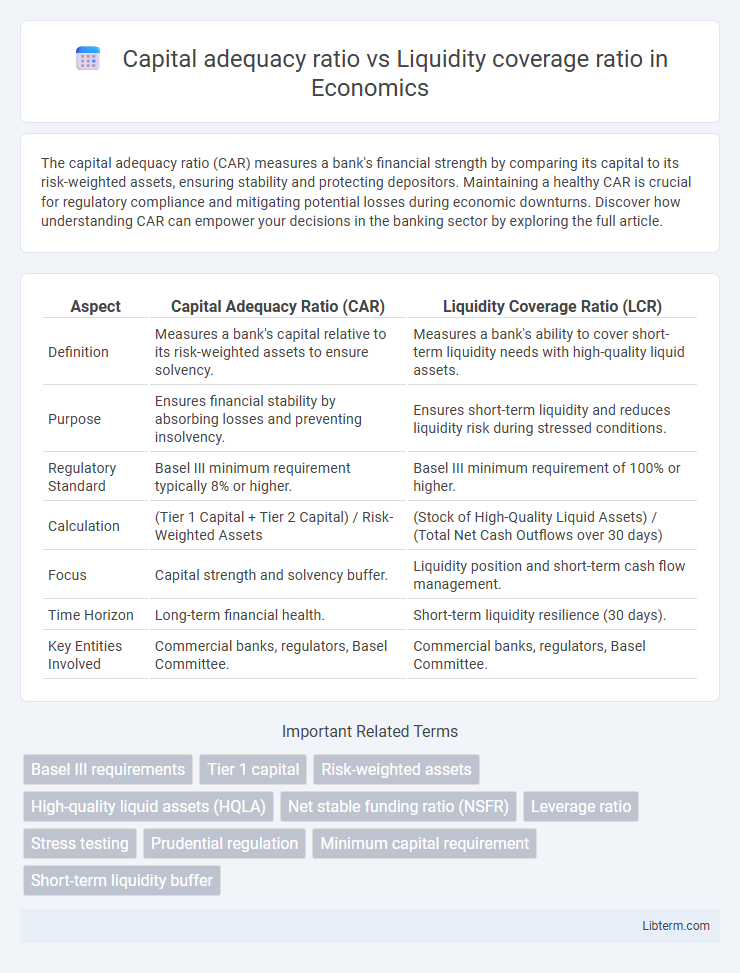

| Aspect | Capital Adequacy Ratio (CAR) | Liquidity Coverage Ratio (LCR) |

|---|---|---|

| Definition | Measures a bank's capital relative to its risk-weighted assets to ensure solvency. | Measures a bank's ability to cover short-term liquidity needs with high-quality liquid assets. |

| Purpose | Ensures financial stability by absorbing losses and preventing insolvency. | Ensures short-term liquidity and reduces liquidity risk during stressed conditions. |

| Regulatory Standard | Basel III minimum requirement typically 8% or higher. | Basel III minimum requirement of 100% or higher. |

| Calculation | (Tier 1 Capital + Tier 2 Capital) / Risk-Weighted Assets | (Stock of High-Quality Liquid Assets) / (Total Net Cash Outflows over 30 days) |

| Focus | Capital strength and solvency buffer. | Liquidity position and short-term cash flow management. |

| Time Horizon | Long-term financial health. | Short-term liquidity resilience (30 days). |

| Key Entities Involved | Commercial banks, regulators, Basel Committee. | Commercial banks, regulators, Basel Committee. |

Introduction to Capital Adequacy Ratio and Liquidity Coverage Ratio

Capital Adequacy Ratio (CAR) measures a bank's available capital expressed as a percentage of its risk-weighted assets, ensuring the institution can absorb potential losses and maintain stability. Liquidity Coverage Ratio (LCR) evaluates a bank's ability to meet short-term liquidity needs by holding sufficient high-quality liquid assets to cover net cash outflows over 30 days. Both ratios are regulatory tools designed to enhance financial resilience and prevent systemic risks in the banking sector.

Defining Capital Adequacy Ratio (CAR)

Capital Adequacy Ratio (CAR) measures a bank's capital in relation to its risk-weighted assets, ensuring sufficient buffers to absorb potential losses and protect depositors. It is a crucial regulatory metric used by financial authorities to maintain overall banking system stability and reduce insolvency risk. Unlike the Liquidity Coverage Ratio (LCR), which focuses on short-term liquidity resilience, CAR evaluates long-term financial strength and capital sufficiency.

Understanding Liquidity Coverage Ratio (LCR)

Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand a 30-day liquidity stress scenario by maintaining an adequate stock of high-quality liquid assets (HQLA) that can be easily converted to cash. This regulatory metric ensures that financial institutions hold enough liquid assets to meet short-term obligations, enhancing stability and reducing the risk of a liquidity crisis. LCR complements the Capital Adequacy Ratio (CAR), which assesses capital strength by requiring banks to maintain sufficient capital buffers against credit, market, and operational risks.

Regulatory Framework: Basel III and Beyond

The Capital Adequacy Ratio (CAR) under Basel III ensures banks maintain sufficient capital to absorb losses and protect depositors, focusing on risk-weighted assets. The Liquidity Coverage Ratio (LCR) mandates banks hold high-quality liquid assets to cover net cash outflows for 30 days, enhancing short-term resilience. Both ratios embody Basel III's comprehensive regulatory framework designed to strengthen bank stability and address vulnerabilities exposed during the 2008 financial crisis.

Key Components of CAR vs LCR

The Capital Adequacy Ratio (CAR) primarily measures a bank's core capital relative to its risk-weighted assets, focusing on Tier 1 capital, Tier 2 capital, and risk-weighted assets to ensure solvency and absorb losses. In contrast, the Liquidity Coverage Ratio (LCR) emphasizes a bank's ability to withstand short-term liquidity shocks by comparing High-Quality Liquid Assets (HQLA) against total net cash outflows over a 30-day stress period. While CAR assesses long-term financial stability through capital buffers, LCR targets short-term liquidity resilience using liquid asset holdings.

Importance of CAR in Banking Stability

The Capital Adequacy Ratio (CAR) is crucial for banking stability as it measures a bank's capital relative to its risk-weighted assets, ensuring the institution can absorb potential losses and protect depositors. Unlike the Liquidity Coverage Ratio (LCR), which focuses on short-term liquidity to meet cash outflows, CAR provides a long-term buffer against credit, market, and operational risks. Regulatory authorities mandate minimum CAR levels to maintain financial system resilience and prevent bank insolvencies during economic downturns.

Role of LCR in Managing Short-term Liquidity

The Liquidity Coverage Ratio (LCR) is crucial in managing a bank's short-term liquidity by ensuring it holds sufficient high-quality liquid assets to cover net cash outflows for 30 days under stress scenarios. Unlike the Capital Adequacy Ratio (CAR), which measures a bank's capital strength to absorb losses, LCR focuses specifically on maintaining immediate cash flow resilience. Regulators use LCR to mitigate liquidity risk and enhance financial stability, particularly during periods of market stress.

Comparative Analysis: CAR vs LCR

The Capital Adequacy Ratio (CAR) measures a bank's core capital relative to its risk-weighted assets, ensuring overall financial stability and solvency, while the Liquidity Coverage Ratio (LCR) evaluates a bank's ability to meet short-term obligations using high-quality liquid assets during a 30-day stress scenario. CAR focuses on long-term risk absorption capacity, primarily addressing credit, market, and operational risks, whereas LCR targets short-term liquidity risks by maintaining sufficient liquid assets to survive immediate cash outflows. Banks must balance CAR and LCR requirements to optimize both solvency and liquidity, managing capital reserves without compromising the availability of liquid assets needed for operational resilience.

Challenges in Meeting CAR and LCR Requirements

Meeting Capital Adequacy Ratio (CAR) requirements poses challenges due to the need for banks to maintain sufficient high-quality capital against risk-weighted assets, which can strain profitability and limit lending capacity. Liquidity Coverage Ratio (LCR) compliance demands holding a buffer of highly liquid assets to cover net cash outflows for 30 days, creating constraints on asset utilization and potentially reducing interest income. Balancing these regulatory standards requires banks to optimize capital structure while ensuring robust liquidity, often complicating risk management and strategic planning.

Impact on Banking Sector Performance and Risk Management

Capital adequacy ratio (CAR) measures a bank's capital in relation to its risk-weighted assets, ensuring sufficient buffer to absorb potential losses and supporting stability and confidence in the banking sector. Liquidity coverage ratio (LCR) evaluates a bank's ability to meet short-term obligations with high-quality liquid assets, crucial for maintaining operational resilience during financial stress. Both ratios play a vital role in risk management by enhancing financial soundness, reducing insolvency risk, and improving overall banking sector performance through better capital and liquidity planning.

Capital adequacy ratio Infographic

libterm.com

libterm.com