The fiscal multiplier measures how government spending influences overall economic output, indicating the effectiveness of fiscal policy in stimulating growth. A higher multiplier means your government's investment can generate more economic activity, boosting employment and income levels. Explore this article to understand how different factors affect the fiscal multiplier and its importance in economic planning.

Table of Comparison

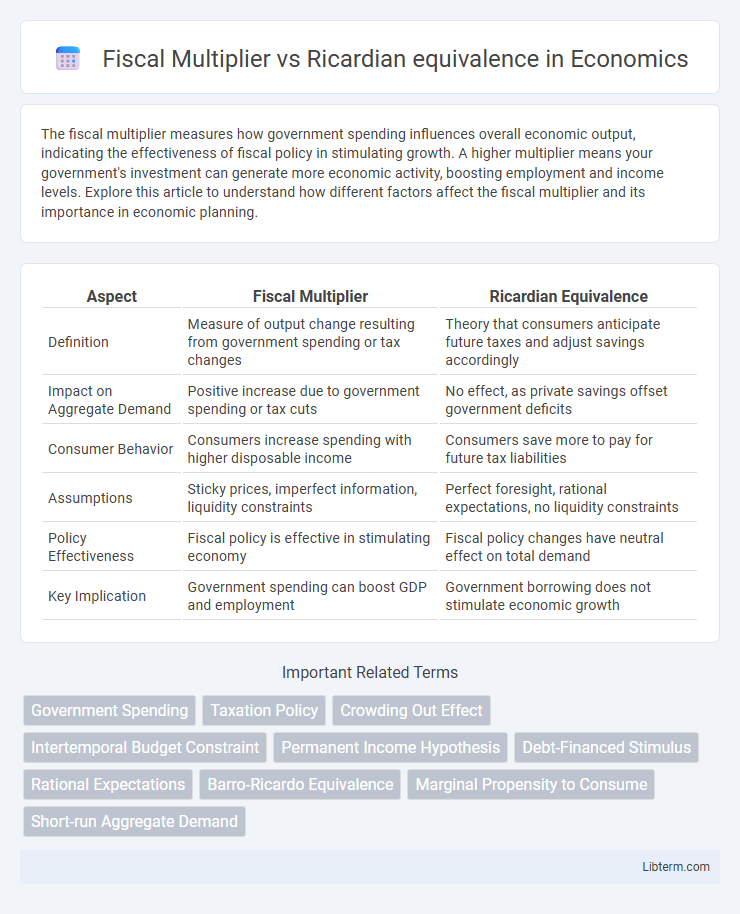

| Aspect | Fiscal Multiplier | Ricardian Equivalence |

|---|---|---|

| Definition | Measure of output change resulting from government spending or tax changes | Theory that consumers anticipate future taxes and adjust savings accordingly |

| Impact on Aggregate Demand | Positive increase due to government spending or tax cuts | No effect, as private savings offset government deficits |

| Consumer Behavior | Consumers increase spending with higher disposable income | Consumers save more to pay for future tax liabilities |

| Assumptions | Sticky prices, imperfect information, liquidity constraints | Perfect foresight, rational expectations, no liquidity constraints |

| Policy Effectiveness | Fiscal policy is effective in stimulating economy | Fiscal policy changes have neutral effect on total demand |

| Key Implication | Government spending can boost GDP and employment | Government borrowing does not stimulate economic growth |

Introduction to Fiscal Multiplier and Ricardian Equivalence

The fiscal multiplier measures the impact of government spending or tax changes on overall economic output, indicating how effectively fiscal policy stimulates growth. Ricardian equivalence suggests that consumers anticipate future taxes from government borrowing, thus offsetting the stimulative effects of fiscal deficits by increasing private saving. Understanding the interplay between fiscal multiplier magnitude and Ricardian equivalence assumptions is essential for designing effective fiscal policy.

Defining the Fiscal Multiplier

The fiscal multiplier measures the change in economic output resulting from a change in government spending or taxation, indicating the effectiveness of fiscal policy in stimulating growth. It quantifies the ratio of GDP increase to the initial government expenditure, with multipliers greater than one suggesting significant economic impact. Unlike Ricardian equivalence, which argues households anticipate future taxes and thus neutralize fiscal stimulus, the fiscal multiplier emphasizes the short-term boost to aggregate demand and employment.

Understanding Ricardian Equivalence Theory

Ricardian Equivalence Theory suggests that when a government increases debt to finance spending, rational consumers anticipate future tax hikes and thus increase their savings, offsetting the fiscal stimulus impact on aggregate demand. This theory contrasts with the Fiscal Multiplier concept, which posits that government spending boosts economic activity by increasing overall demand. Understanding Ricardian Equivalence is crucial for evaluating the effectiveness of fiscal policy and its long-term implications on national debt and consumer behavior.

Key Differences Between Fiscal Multiplier and Ricardian Equivalence

Fiscal multiplier measures the impact of government spending on aggregate demand and economic output, indicating how fiscal policy stimulates economic growth. Ricardian equivalence suggests that consumers anticipate future taxes resulting from government debt, leading them to save rather than spend, thereby neutralizing fiscal stimulus effects. The key difference lies in fiscal multiplier assuming increased government spending boosts demand, whereas Ricardian equivalence posits that rational consumers offset this by adjusting their behavior through increased savings.

Historical Context and Development of Both Concepts

The fiscal multiplier concept emerged during the Great Depression, reflecting Keynesian economics' emphasis on government spending to stimulate demand and economic growth. Ricardian equivalence, formulated by David Ricardo in the early 19th century and later formalized in the 1970s by Robert Barro, challenges this by suggesting that consumers anticipate future taxes from government debt and adjust their savings accordingly, negating fiscal stimulus effects. The historical evolution of these theories highlights contrasting views on government intervention's role in influencing aggregate demand and fiscal policy effectiveness.

Real-World Examples: Fiscal Multiplier in Action

Fiscal multipliers measure the change in economic output resulting from government spending or tax policies, with real-world examples such as the 2009 American Recovery and Reinvestment Act generating a fiscal multiplier estimated between 1.5 and 2.0, indicating a significant boost to GDP. In contrast, Ricardian equivalence suggests that consumers anticipate future taxes from government debt and adjust their savings accordingly, limiting the multiplier effect. Empirical evidence from countries like Japan and Germany shows varying fiscal multipliers influenced by factors like economic slack and consumer confidence, challenging the universal applicability of Ricardian equivalence in real economies.

Empirical Evidence on Ricardian Equivalence

Empirical evidence on Ricardian equivalence reveals mixed results, with many studies questioning its practical validity in real-world economies. Research often finds that fiscal multipliers are positive and significant, indicating that government spending impacts aggregate demand, contrary to the Ricardian hypothesis that consumers fully offset government debt by increasing savings. Data from diverse economies and periods, including Keynesian fiscal stimulus episodes, consistently show incomplete Ricardian offset, suggesting that household liquidity constraints, myopia, and heterogeneity limit the equivalence effect.

Policy Implications for Governments and Economies

The fiscal multiplier measures the impact of government spending or tax changes on overall economic output, indicating that increased public spending can stimulate growth and boost employment. Ricardian equivalence suggests that consumers anticipate future taxes to repay government debt, leading them to save rather than spend in response to fiscal stimulus, which can neutralize the intended economic impact. Policymakers must consider these contrasting theories when designing fiscal interventions, as the effectiveness of stimulus depends on factors like consumer expectations, debt sustainability, and the prevailing economic conditions.

Criticisms and Limitations of Both Concepts

Fiscal multiplier estimates often face criticism for overestimating government spending effects due to assumptions of liquidity constraints and neglect of crowding-out in open economies. Ricardian equivalence encounters limitations as it presupposes fully rational consumers with perfect foresight and intergenerational altruism, which empirical studies frequently challenge. Both concepts struggle with heterogeneous agent responses and dynamic economic environments, complicating accurate policy impact assessments.

Conclusion: Weighing Fiscal Multiplier Versus Ricardian Equivalence

The fiscal multiplier measures the impact of government spending on aggregate demand, often indicating that increased public expenditure boosts economic output. Ricardian equivalence argues that consumers anticipate future taxes from government debt, leading to unchanged consumption despite fiscal policy shifts. Analyzing both frameworks reveals that the effectiveness of fiscal policy depends on consumer behavior, timing of tax adjustments, and economic context, suggesting multipliers vary across economies and conditions.

Fiscal Multiplier Infographic

libterm.com

libterm.com