Crowding out occurs when increased government spending leads to a reduction in private sector investment by raising interest rates. This phenomenon can impact economic growth by limiting the resources available for businesses to expand. Explore the rest of the article to understand how crowding out affects your financial decisions.

Table of Comparison

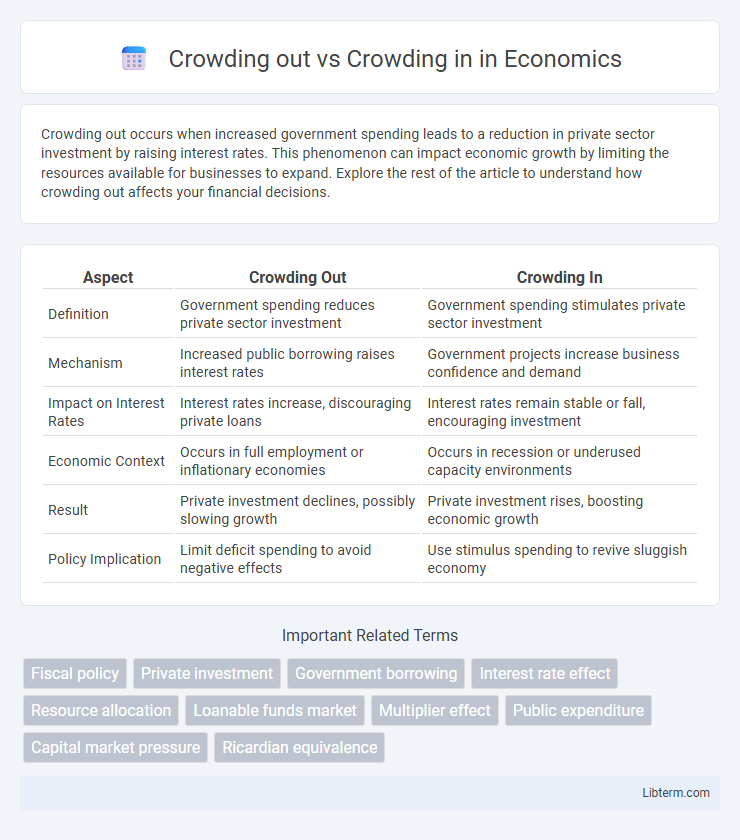

| Aspect | Crowding Out | Crowding In |

|---|---|---|

| Definition | Government spending reduces private sector investment | Government spending stimulates private sector investment |

| Mechanism | Increased public borrowing raises interest rates | Government projects increase business confidence and demand |

| Impact on Interest Rates | Interest rates increase, discouraging private loans | Interest rates remain stable or fall, encouraging investment |

| Economic Context | Occurs in full employment or inflationary economies | Occurs in recession or underused capacity environments |

| Result | Private investment declines, possibly slowing growth | Private investment rises, boosting economic growth |

| Policy Implication | Limit deficit spending to avoid negative effects | Use stimulus spending to revive sluggish economy |

Introduction to Crowding Out and Crowding In

Crowding out occurs when increased government spending leads to a reduction in private sector investment, often due to rising interest rates or resource competition. Crowding in refers to the scenario where public expenditure stimulates additional private investment by improving economic confidence or infrastructure. Understanding these dynamics is essential for evaluating fiscal policy impacts on overall economic growth and investment levels.

Defining Crowding Out: What Does It Mean?

Crowding out occurs when increased government spending reduces private sector investment by raising interest rates or redirecting resources, limiting economic growth potential. This phenomenon typically happens during deficit financing, where government borrowing competes with private borrowers. Understanding crowding out is crucial for evaluating fiscal policy impacts on overall investment and economic activity.

Defining Crowding In: The Opposite Effect

Crowding in refers to the phenomenon where increased government spending stimulates private sector investment, contrasting with crowding out, which occurs when public expenditure diminishes private investment. This effect often arises when government spending boosts economic confidence or improves infrastructure, creating favorable conditions for businesses to expand. Crowding in tends to happen in situations of economic slack or underutilized resources, where public investment complements rather than competes with private capital.

Key Differences Between Crowding Out and Crowding In

Crowding out occurs when increased government spending leads to a reduction in private sector investment due to higher interest rates or resource competition, whereas crowding in happens when government expenditure stimulates additional private investment by improving demand or infrastructure. Key differences include the impact on private investment levels--crowding out decreases while crowding in increases--and the economic context, with crowding out common in fully employed economies and crowding in more likely during recessions or underused capacity. The mechanisms also differ: crowding out primarily involves financial market constraints, while crowding in relates to positive demand externalities and business confidence.

Mechanisms Driving Crowding Out in the Economy

Crowding out occurs when increased government spending leads to a reduction in private sector investment by raising interest rates and absorbing available financial resources. This mechanism restricts capital availability for businesses, slowing economic growth and innovation. Higher public borrowing can exacerbate this effect by driving up borrowing costs, displacing private investment in critical sectors.

Factors Contributing to Crowding In

Crowding in occurs when increased government spending stimulates private sector investment, often driven by factors such as low-interest rates, improved business confidence, and complementary infrastructure projects. Fiscal policies that target productive sectors can enhance private capital formation by reducing uncertainties and increasing returns on private investments. Moreover, effective public investment in technology and human capital development creates positive spillovers that encourage private enterprises to expand.

Crowding Out in Fiscal Policy: Real-World Examples

Crowding out in fiscal policy occurs when increased government spending leads to a reduction in private sector investment due to higher interest rates or limited financial resources. For example, during the 1980s in the United States, large federal budget deficits caused by increased defense spending resulted in higher interest rates that discouraged private borrowing and slowed business investment. Similarly, Japan's extensive government borrowing in the 1990s contributed to crowding out by absorbing available credit, limiting funds for private enterprises despite low interest rates.

Crowding In and its Impact on Economic Growth

Crowding in occurs when increased government spending stimulates private sector investment by enhancing infrastructure, boosting demand, or reducing business risks, leading to higher overall economic growth. This phenomenon often results in improved capital formation and innovation, fostering productivity improvements and long-term development. Empirical studies show that crowding in can amplify the effectiveness of fiscal policy, especially in underdeveloped or recession-hit economies with idle resources.

Policy Implications: When Does Each Phenomenon Occur?

Crowding out occurs when increased government spending reduces private sector investment, typically during periods of full employment or high interest rates, leading to higher borrowing costs. Crowding in happens when government expenditure stimulates additional private investment, often in conditions of economic slack or low interest rates, by improving infrastructure or confidence. Policymakers must consider economic context and fiscal capacity to determine whether expansionary fiscal policy will trigger crowding in or crowding out effects.

Conclusion: Balancing Crowding Effects for Sustainable Development

Balancing crowding out and crowding in effects is crucial for sustainable development, as excessive public spending may displace private investment, hindering economic growth. Encouraging policies that stimulate private sector participation while efficiently allocating public resources can foster innovation and long-term prosperity. Achieving this balance ensures that government interventions complement rather than compete with market dynamics, promoting resilient and inclusive development outcomes.

Crowding out Infographic

libterm.com

libterm.com